by MicroFundy

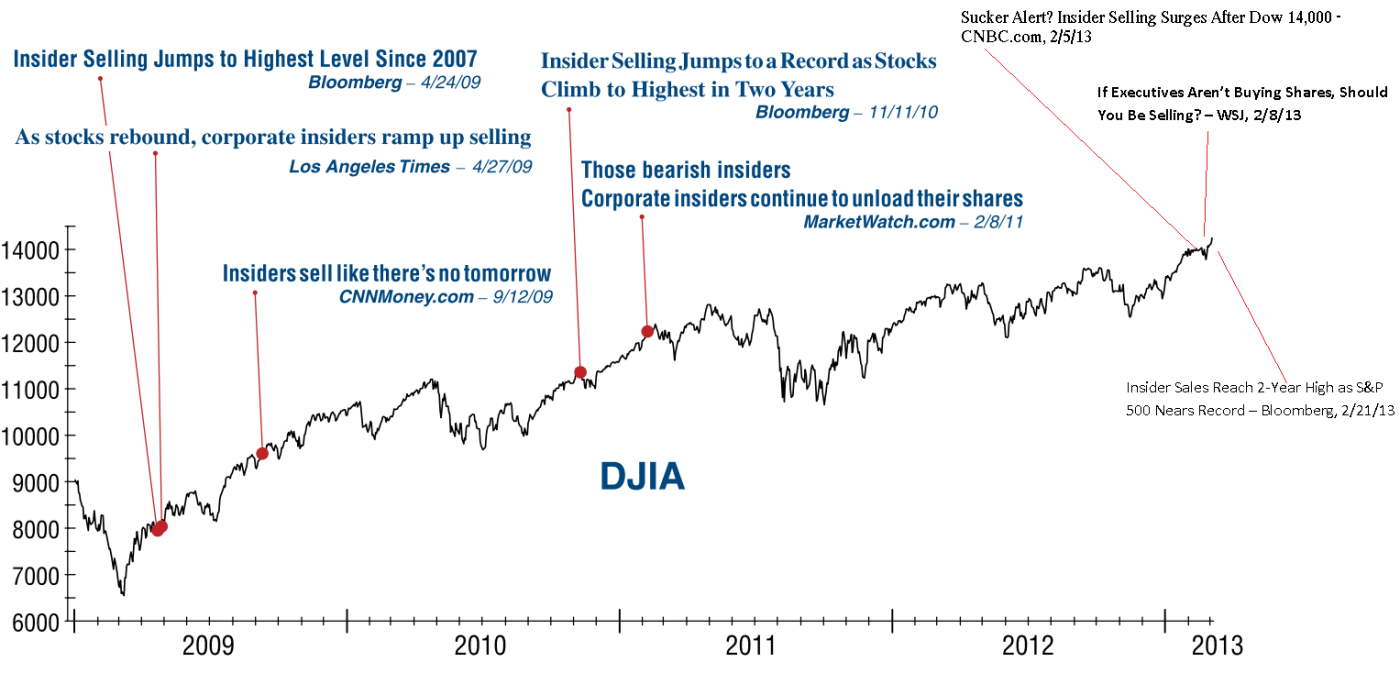

Source: Investech Research with a h/t to @ritholtz who posted it earlier today in his post: “Is Insider Selling A Concern? (No)“

As you can see from the chart and linked post above, insider sales are not really as good as an indicator as most people are led to believe. Also, (importantly,) there is absolutely nothing wrong with them.

Of course there are many exceptions (such as excessive sales, especially during a time where execs are leading investors to believe things are fine but they really are not etc.) – but for the most part, enough of the “if the company is doing well, why are the insiders selling?” comments!

For close to a dozen years I’ve been professionally advising high net-worth individuals on how to invest their money. I have never not recommended an executive to diversify and sell as much of their company stock as they can.

It is typically the case that most of these executives have almost their entire human capital and almost all of their financial capital tied to this one company. I don’t care how good the company is doing or how much other money they have, that should not be the focus.

Human capital is the future earnings from one’s employment. Of course most executives at established companies can find other work if “shit hits the fan”, but currently almost all of their future compensation is expected to come from their current employer.

Most of these executives earn a high enough salary or have already sold enough stock to live a nice life style and most have other assets as well, so they do have other financial capital. But most of the focus on insider selling is typically on the huge sales – the millions, tens of millions, or even hundreds of millions of dollars. These executives typically don’t have other money like this sitting around in other stocks, real estate, cash etc. This is their “real” money and it’s all tied to one company’s stock price.

It would be irresponsible not to sell and diversify. (think Enron)

So if you’re bearish on $KORS or $CRM et al… say the company is overpriced, write about slowing growth, the GAAP vs non-GAAP numbers, or some accounting issues etc. I’m sure there are plenty of (valid) reasons to be short, but don’t blame Michael Kors or Marc Benioff for selling stock, I (and you) would have and should have done the same.

- MicroFundy