by Daniel J. Loewy, AllianceBernstein

Daniel J. Loewy and Brian T. Brugman

The odds of the market staying in risk-on, risk-off mode are lower than they were a few months ago, in our view—but still too high to take a highly aggressive stance.

Market volatility has plunged over the last two weeks, as concerns over a European breakup have abated, China’s economy showed signs of recovery, and an eleventh-hour agreement kept the US from going over the fiscal cliff. Is this just another phase of the risk-on, risk-off (RORO) market that has whipsawed investors for three years—or the beginning of a more lasting positive market environment?

In a RORO environment, markets repeatedly shift between fear and euphoric relief, typically in response to news regarding the dominant issue of the day. Unusually high variability in perceived risk leads to unusually high variability in levels of market volatility.

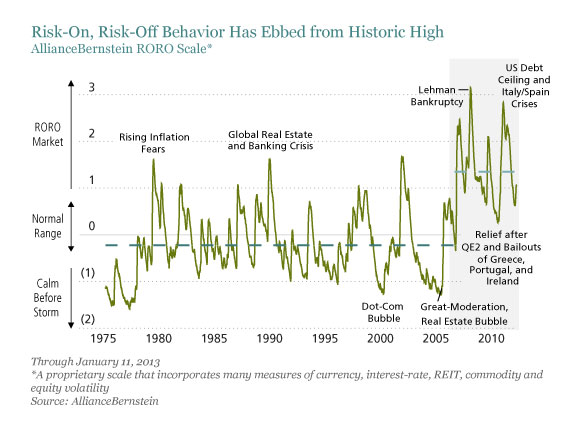

RORO behavior reached historic high levels in recent years, driven by concerns about subpar macroeconomic growth, deleveraging, and political gridlock over key policy issues, as shown by the display below. This behavior is not unprecedented: in the early 1980s, concerns about inflation spiraling out of control drove similar, albeit lower, RORO behavior. The display is based on a proprietary RORO metric that we developed; it incorporates many market volatility measures.

RORO environments tend to persist: the current RORO environment began with the financial crisis five years ago. But by our metric, RORO behavior has declined steadily over the last year, which suggests that we may be on the cusp of a prolonged period of stability. In a more stable environment, we’d expect investor concerns about growth and deflation to abate, and take a back seat to industry and company fundamentals.

We would also expect risk aversion to ebb in periods of stabilization. As a result, risk assets such as equities (particularly high-beta segments such as emerging-market and smaller-cap equities) would deliver strong returns. We’d also expect real assets, such as commodities, to do well as accelerating economic growth generally leads investors to anticipate a pick-up in inflation.

But our metric also shows that RORO behavior remains well above average and recently registered a small up-tick, which raises the possibility that this latest risk-on phase will be short-lived.

Clearly, there are fundamental risks that could drive volatility up. Europe is likely to adopt more painful austerity measures. The US has yet to deal with its deficit and faces the near-term specter of automatic spending cuts and political deadlock over the debt ceiling. And both Japan’s and China’s new leaders may make big policy shifts.

Given these mixed signals, we think it may make sense to add to equities and real assets, but to hedge those bets. Here are three tools to consider:

- Adding income-generating strategies such as credit, which tend to do well in a low-growth RORO world;

- More frequent rebalancing after market rallies or dips; and

- Opportunistic purchases of equity put options as a hedge against a spike in volatility.

The recent drop in market volatility has made options a relatively cheap form of insurance. That may not last.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Daniel J. Loewy is Co-Chief Investment Officer and Brian T. Brugman is Portfolio Manager of Dynamic Asset Allocation services at AllianceBernstein.

Copyright © AllianceBernstein