I continue to believe that longer dated Spanish and Italian bonds are poised for a significant sell-off. At this stage everyone knows the problems the two countries are facing. Spain’s economy seems to be doing worse than Italy, but Italy has a heavier debt burden.

Over the past few weeks, more and more investors are coming to the conclusion that either debt restructuring or a currency conversion or both are real possibilities. The short lived success of LTRO is very concerning. It demonstrates that liquidity has its limits when solvency is the real risk.

So my first premise is that the risk of restructuring or currency conversion is real. It is not imminent as politicians and central bankers continue to do what they can to avoid that outcome, but virtually everyone now believes that this is a potential, if not inevitable outcome. That has changed in the past few weeks and has not been fully digested.

The other key premise is that the ECB is unlikely to intervene in a meaningful way anytime soon. That seems to have been confirmed yesterday by Mr. Draghi himself. From conversations I had, the unintended consequence of the ECB’s tough stance during the Greek debt negotiations has meant that countries no longer welcome ECB intervention with open arms. If restructuring is on the table, having a party that is unwilling to take a loss yet holds all the cards when it comes to future financing of the banks, it is an awful situation. Greek post-PSI bonds trade poorly at least in part because of the ECB’s stance on its position. The ECB’s secondary market purchases of Greek debt turned out to be disastrous for Greece in their attempt to restructure and create a workable debt load. This has not been lost on Spain and Italy. The desire to retain flexibility in any future negotiations is incompatible with inviting the ECB to buy more bonds. That is one reason that the EFSF and ESM are supposed to assume that role. Though in typical EU fashion, rather getting those entities ready to assume secondary market purchases when the markets were calm, they dragged their feet and aren’t quite ready. The EFSF will eventually be ready to buy bonds. They will be the preferred buyer because they can be made to take a loss. That may become an issue as countries providing the guarantees that let EFSF function may decide it isn’t in their best interests to be the patsy at the negotiating tables.

So in my world, there is real risk of restructuring and currency conversion. It’s not going to happen tomorrow, and even I admit there is a chance it never happens, but the key is that this risk is real and is being acknowledged (at least privately) by virtually everyone involved in the market. Then, there is my view that the ECB will be slow to do anything. There “help” is not as universally viewed as good thing by those receiving it, and the political will within Europe to risk money for other countries is diminishing.

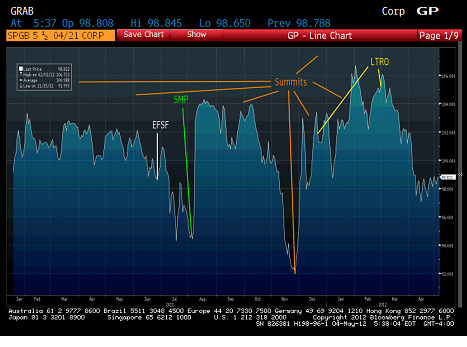

Before analyzing where we might get to, it is worthwhile seeing where we have been. This is the “off the run” 10 year Spanish bond. It was issued at the start of 2011, so the price runs through the time of the big EFSF expansion, the first time the ECB intervened in the secondary market for Spanish debt, the never ending series of summits, and the 2 LTRO programs.

This is the price of that bond. I have chosen price rather than yield, because that in the end is the key metric. When people worry about positions it is about how much money they might lose (or gain) and that is always in price terms. The bonds were issued just under par. They traded up (like any good new issue should) and bounced around between 100 and 102 until the crisis in Greece, Portugal, and Ireland got worse in the summer. At that time, “contagion” really hadn’t spread to Spain and Italy. After the market briefly rejoiced at the new and improved EFSF announcement, the market lost confidence that it was big enough, and for the first time, Spain and Italy faced real fear, rather than just the fear of fear. Bonds slid to 94. Bounced on some announcement, sold off again to 94, finally rallying all the way back to 104 after the ECB decided to intervene in the secondary market. That spike is worth watching. The bond went from 94 to 104 in a matter of days. That is how illiquid credit markets can be. Clearly nothing was solved, but the ECB intervention caused an incredibly sharp and immediate rally. This lost steam and then from mid October until late November the bonds slid in price virtually every day, until hitting a low of 92. Even during this period, there were a couple of strong days, but the final decent happened very quickly. There are periods of time in fixed income where liquidity vanishes.

A combination of summits and plans drove bonds quickly from 92 to 102. Then the dance of fear and greed played out, with some volatile trading in the 98 to 104 range, until, finally the LTRO in particular was enough to push bonds as high as 106, and that is really where this story begins.

Since the LTRO closed on February 29th and the bonds were at 106, they have dropped to 99. Anyone who bought the bonds on that day on the assumption the banks would have a lot of demand for Spanish bonds has been horribly wrong. With only a 5.5% coupon, you have not yet accrued even 1 point of interest, but you have lost 7 points. You have lost more than the entire year’s interest. Carry sounds great, but mark to market always trumps carry.

So, here we are sitting at a price of 99 in Spain, and similar prices and yields in Italy. Who is going to buy these bonds? If selling pressure starts, who will actually step up and buy these bonds.

Big Domestic Banks

The big domestic banks would be the main hope. The markets would love to see the BBVA’s of the world step up and buy these bonds here. But they won’t. They have already stated that they are getting full on these bonds and they aren’t lying. The big banks are global and should be able to survive the crisis, even if the sovereign debt is restructured. The key to surviving and possibly thriving in the aftermath will be to retain some semblance of prudent risk management. These banks need to behave as ongoing concerns. They need to ensure that exposure to any single issuer isn’t so large that it can bring them down. As much as the countries want them to load up on their own sovereign debt, these banks are too big, and the senior people have too much wealth tied up in the banks, to do anything too drastic. They have done their part, but will not be a puppet of the state. If they buy more, it will be in t-bills which seem to have their own special niche in the world as even Greece never defaulted on their t-bills. So if selling pressure mounts and Spain has trouble issuing debt, these banks will increase their exposure only minimally, and it will be almost exclusively at the very short end of the curve.

Big Foreign Banks

It is one thing to lose money, it is totally a different thing to lose money on something that everyone said was bad. Big banks who rely on the ECB might “do their part”, but they will do as little as possible. Anything they buy so they can tell the regulators how helpful they are will be pre-hedged in the CDS market, or they too will focus on the very short end. They aren’t about to buy 10 year bonds, with big duration risk, especially when they trade so close to par. I find it hard to imagine any CEO at an American bank wants to have to answer a question about exposure to PIIGS and be forced to admit that he has increased the bank’s exposure. Even if the bank thought it was good risk/reward, they would not want to do it because of the almost certainly negative consequences that admission would have on their stock price. Big foreign banks will do even less than big domestic banks.

Small Domestic Banks

A lot of these banks are already “all-in”. One part of the bank is busy buying sovereign debt and supporting the nation. Another part of the bank is already negotiating on what the terms of its own bailout package need to be. They might add more but these banks are in many cases in real trouble. They have balance sheets full of “toxic” assets and have stuffed themselves silly on their own country’s debt. They might not quite be at that “it’s only wafer thin mint” point, but more purchases from this group will be small and focused on the short dated bonds. They need LTRO to exist in some cases, and will not buy bonds longer than the LTRO funding.

Small Foreign Banks

You might as well jump up and down and start screaming “short me, short me” at the top of your lungs if you are a small foreign bank and are considering buying longer dated bonds from Spain or Italy. If you are weak, you are hiding in your corner of the world and hoping no one notices you, and being seen as a bank desperate enough to buy 10 year Spanish or Italian bonds is unlikely to help your share price. Maybe the market will reward you for being so smart and seeing value where others don’t dare to tread, but more likely, the market would wonder why you are so desperate for yield that you are willing to take such risk. Those that really want the exposure may sell CDS as they get more leverage (still) and it is a bit further off the radar screen. If you are a strong small bank, why bother? You probably didn’t get strong by investing on a whim and there should be a lot of domestic opportunities to lend and make money. As a whole this group might buy some debt and might even go out in maturity as far as 5 years, but it won’t be an aggressive bid in the market.

Domestic Insurance Companies and Pension Funds

These are the right buyers. They have long dated liabilities and need assets to fund those. They are less concerned about currency conversion so long as their liabilities will also be converted. In the end, this will be the group that will need to step up and buy bonds and are in the best position to do it. Except for the fact that they have already done it. The insurance companies have already bought a lot of longer dated sovereign debt. They will buy more, but they too will want to get a better sense of the range of possible outcomes before adding more. They don’t care as much about currency risk if their policies would also be converted, but they do care about restructuring risk. If their assets are restructured, but they cannot reduce their obligations, then they have a real problem. Public pension funds might have the greatest ability to add bonds while we are still in a period of uncertainty as they may see their obligations decreased as pension benefit reductions would likely be a part of any overall restructuring effort. This group is the most likely source of real buying power, and I will be trying to monitor their activity closely, but I suspect right now that they too will be only tentative buyers.

Foreign Insurance Companies and Pension Funds

I cannot imagine these entities adding significantly to their exposure. They would be hurt by restructuring and buy currency conversion. Many of these funds are more focused on not losing money than by outperforming. They often have ratings based guidelines that will be more difficult for them to overrule than for their domestic equivalents. Finally, why take the risk. Outperforming your peers by a bit by being over-allocated to these bonds hardly seems worth the risk of being “that person”. The “idiot” who bent the rules to own more Spanish and Italian debt that eventually defaulted, which everyone will say should have been obvious to everyone. Career preservation will overwhelm any attempt to be aggressive and foreign insurance companies and banks will avoid adding exposure and are more likely to under-weight exposure so they don’t have to potentially sell if further downgrades occur.

Market Making Desks

Whether or not the Volcker rule is in place or would even apply, banks will have a self imposed Volcker rule on these bonds. No one is going to build up an inventory of bonds in anticipation of a wave of buying. Small trading positions (both long and short) will be a natural part of the operations, but the desks are running incredibly tight on the risk side, and at this stage, it is still probably easier to explain how you took a small short position and lost money, than taking a small long position and losing money. On the bright side, even if the flows are skewed to selling, the dealers are far less likely to lean on the market than in the past because they just don’t want to take much risk. I think these desks will be fairly neutral, with a slight bias to be short here, but a willingness to go long for a trade, particularly if we get above 6% again.

Mutual Funds/Retail Investors

I don’t see retail investors flocking to funds dedicated to investing in bonds of these countries, and I think most mutual funds will behave a bit like foreign insurance companies. They will have some holdings so they don’t underperform their benchmark (or peers) if the situation improves, but while rating downgrades remain a real possibility (and many funds have ratings based rules), they are going to be wary about having too much exposure. The risk of underperforming a bit in a rebound is lower and the fund can always try to catch up by chasing yield once the turnaround occurs. The risk of being caught long in a big down move and having to explain how you didn’t see it coming when it was on the front page of every paper is just so much worse. I don’t see selling pressure coming from here, but I also don’t see them providing a big source of fresh money, at least not until the ratings risk stabilizes, and the daily news flow is less horrific.

Hedge Funds and Prop Desks (not that they exist still)

This is the key group. This is the group that caused the recent sell-off. Funds had gotten excited and bought into the LTRO saves the world theory. They owned these bonds, and because the yields were so low, and the potential price gains were getting less obvious (at 106), they had to use some leverage in an effort to get to 10% returns after fees. They got caught long and are the ones who got stopped out of trades and turned small daily selling pressure into a quick, but serious downward move. I think the hedge funds are now skewed slightly to the short side. The weak longs got pushed out and the bear crew has moved in. The funds are short the market both in bonds and in CDS. They generally prefer CDS but there is some concern that the CDS settlement on Greece was pure dumb luck and that the documentation needs to be amended for sovereign CDS to be truly effective. CDS has never recovered as much as the bonds did. CDS remains closer to the wides and didn’t participate as much in the LTRO rally. This is in part because German bunds have done so well, but it is also because the government programs – LTRO, SMP, etc., have focused on manipulating bond prices and have been less effective at manipulating CDS prices.

After the ECB giving a signal that intervention isn’t likely to occur any time soon, the people who think Spain and Italy are still yielding too little will be more comfortable pushing in the bond market. Until now, the CDS bid (buyers of protection) haven’t had much of an impact on bonds. But if the bears now decide that the ECB won’t step up, and I’m correct on my assessment of other potential risk takers, then they will start leaning on bonds, and we can see a quick sell-off as at first bonds move to catch up with CDS and then they take turns driving each other wider/lower.

That is my expectation of what will happen and think Spain breaking 6% will trigger a fast and furious move to 6.5% for itself and although Italy is currently trading tighter than Spain, I think it would get to 6.5% as well as the sheer size of the market would overwhelm what liquidity there is and the better fundamentals in Italy would be ignored, at least temporarily.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts