by Brooke Thackray, Horizons ETFs, Alphamountain Investments

Play: Hamptons, By: A Central Banker

A parody of Shakespeare’s Hamlet

The ultimate question is not whether the stock market will “V,” but whether the economy will “V.” For if the economy does not “V,” the stock market will surely attempt a “W” (sarcasm).

There is a lot of talk about the S&P 500 producing a “V” shaped recovery, with a steep correction from February 19. Like a miracle, the stock market has bounced without a significant pullback (so far). The steepness of the decline that started in February in the stock market was unprecedented. Likewise, the subsequent rally has been unprecedented.

In late March, many pundits were calling for the stock market to trace out the letter “L,” a drop and then a flat recovery. Other pundits were calling for the stock market to trace out the letter “U,” a drop, a slow recovery and then a sharp recovery. Recently, I have heard someone call for the stock market to trace out a “W,” a decline, a rally, a decline and then a rally again. Ok, enough.

There are only twenty-six letters in the alphabet and only five capital letters are possible for the stock market to trace out, using direction and positive time. In case you are wondering, an “O” is not possible as you cannot move backwards in time.

It is the economy that matters

I am a seasonal investor, because seasonal trends help to provide historical probability frameworks for superior risk-adjusted returns over the long-term. But, I will acknowledge the importance of fundamentals, because strong companies produce earnings, which is what drives the stock market. There is one caveat on measuring fundamentals, they are generally not a good tool to time investment decisions.

Ultimately, it is the economy that has to be sound for companies to produce earnings, which drive the stock market higher. Economic growth in the latest bull market has been rather tepid in the years following the Great Financial Crisis (GFC). The stock market has largely been driven higher because of multiple expansion caused by the Federal Reserve loose monetary policy and financial engineering with companies buying back their own stock with cheap loans.

There is no question that the Federal Reserve is extremely active supporting the stock market econo- my and will continue to be active for the foreseeable future. I would hazard a guess that the number of companies buying back their own stock is going to drop precipitously in the future. In an ironic twist of fate, the US airlines over the last decade have bought back $50 billion of their own stock to make their P/E look healthier and to reward their top executives, and in the Covid-19 pandemic the airlines have asked the government for $50 billion in bailouts.

The problem is that the economy was not super healthy before this crisis started and is going to be a disaster for the next while. I don’t care what letter of the alphabet the stock market is tracing out, the likelihood of the economy of producing a sharp “full V” is small. In the last bull market from 2009 to 2020, the economy (Real GDP) grew at an average of 1.9% per year (BEA).

This is “okay” growth, but nothing spectacular. In fact, the best growth rate in the period was 2.9% in 2018, on the back of the tax cuts. Coming off a recession, it is typical to get a couple of years of 4% or even 5% growth. This has not occurred since the last financial crisis. The main reason for the stock market rally has been lower interest rates forcing investors into the markets, not economic growth.

There are two bets in the stock market right now, not much else matters

Unemployment, earnings, PMIs and other economic reports do not matter much at the current mo- ment. They will one day, but not right now. Investors are focused on two things right now. First, that central banks and governments will keep providing stimulus and not let “anything” bad happen. Second, that the path of the economy opening back up is steep and will open rapidly.

Investors are betting that the Federal Reserve will have their backs and rush to the rescue when the stock market economy stumbles worse than expected. Counting on the Federal Reserve to take action is not a bad bet. They will keep taking action, with new programs that have acronyms that cover the span of the alphabet. Action does not equal effectiveness. Over the last eleven years the Federal Reserve has been very active. Initially, their programs were effective for the economy as they provided liquidity into the markets. In the later years, their stimulus became less effective.

Can the stock market keep performing well? Absolutely. The current narrative about the pace of re- opening the economy is helping to drive the stock market higher. Investors are buoyed by the positive outlook. Many government officials are putting plans in place to slowly start to reopen the economy. People sitting in their homes are getting mixed messages and it is confusing. Stay at home. Don’t go out. Stay away from people. But we are going to open the economy soon.

Of course, this time is different. No really, we have not had a global pandemic in modern times. So, what is driving the stock market is truly unique. It is not earnings. It is not economic reports. It is the belief that central bankers are willing and able to flood the world with liquidity to overcome any economic “hiccup” caused by Covid-19.

I think that it is safe to say that the economy is not going to “open big” as Trump has tweeted out. All governments are planning on having gradual staged openings. Even if businesses open up, it is doubtful that people will flock to stores and start travelling. Various models from different broker- age houses have different rates of growth in the economy and many of the models have the economy back on track in Q4 of this year. No one denies that GDP growth will take a hit overall in 2020, but there is a strong sense of optimism that is dependent on a rapid ramp up of growth, even without the consideration of a possible second wave of Covid-19 in autumn. Given the amount of unknowns, it is extremely difficult to build a reliable case for the economy to get back to previous levels in the near future.

Putting the “Half-V” in perspective

As the S&P 500 has climbed half way back up the “V,” investors are getting excited that maybe the S&P 500 can reach its February high in the near future.

To understand where we are now, the starting point matters. Most investors keep focusing on the high of 3,386 set on February 19 for the S&P 500, but is that really the right benchmark? In mid-February, it would be hard to argue that the S&P 500 was substantially undervalued. If you do believe that the stock market was undervalued at its high in February, then a rapidly expanding economy back to previous levels with record low unemployment would justify the S&P 500 marching past its all-time high in the not-so-distant future.

On the other hand, most investors would accept that at its high in February, the S&P 500 was either overvalued or close to fully valued on a variety of metrics. If this is the case, there may be limited up- side for the S&P 500. The S&P 500 started 2019 the year at a low value of 2,510 and ended at 3,231. Overall, the average value for the S&P 500 was 2913, which is just above the current level of the S&P 500 on April 27, 2020. In addition, the value of the S&P 500 on April 29, 2019 (approximately one year ago from writing this report) was 2,943, which is very close to where it is today. In other words, the stock market is really just back to its 2019 average level. In the bull market from 2009 to 2020, there were numerous times where the S&P 500 was at the same level that it was one year previously, just like it is today.

If the stock market was not undervalued in 2019, then given that we are currently just below the aver- age value for the S&P 500 in 2019 of 2913, then the stock market is not really a great bargain.

It is a bit ironic that the current value of the S&P 500 is very close to the level it was one year ago and the economy is showing signs of substantial weakness. As of the writing of this report, the GDP report produced by the BEA for Q1 has not been published. Even when it is published on April 29, 2020, it will only give a glimpse of the effect of the shut-downs and quarantines caused by Covid-19 as regu- lations were only put into place in late March. Nevertheless, the economy is showing signs of being in worse shape than it was one year ago and over the same time period the S&P 500 is basically “flat.”

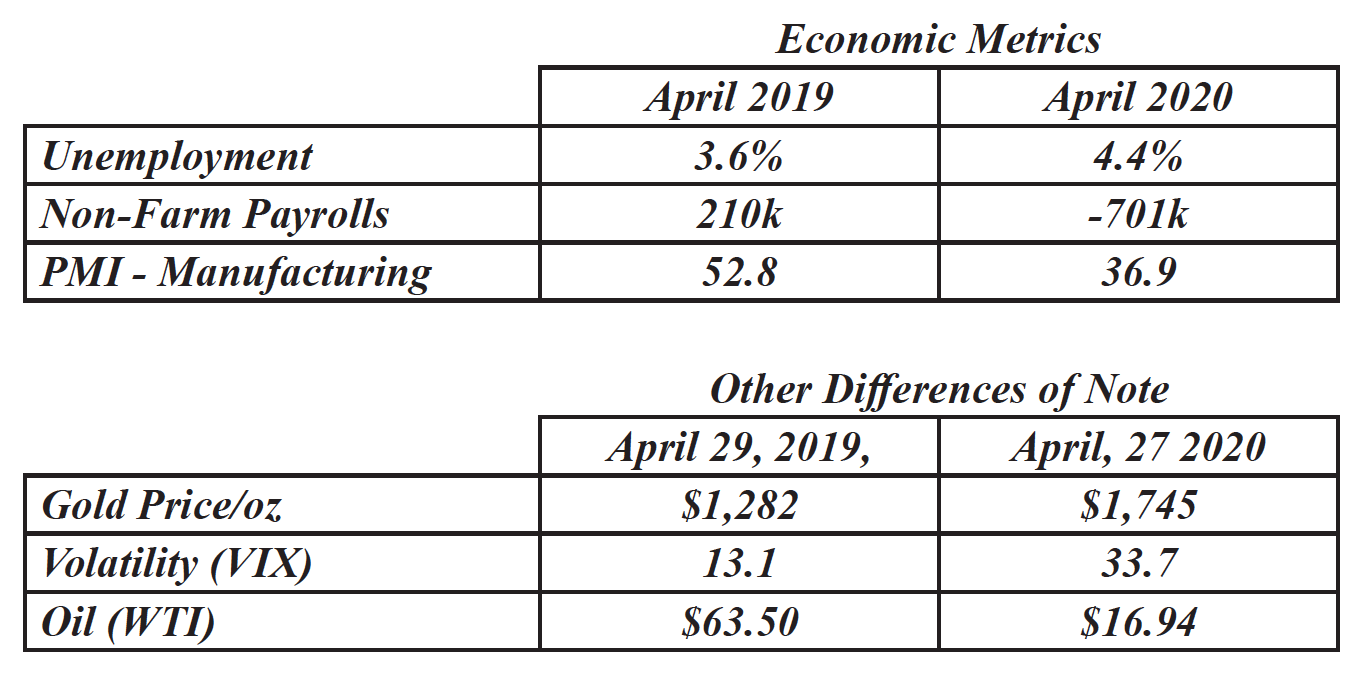

The above “Economic Metrics” table shows some of the economic metrics illustrating the slow down in the economy. The “Other Differences of Note” table illustrate just how much our world has changed over the last year.

Seasonality is not on the side of a sustained “V” rally in the stock market

On a seasonal basis, on average over the long-term, the next six months (May 6 to October 27) tend to be weaker than the current six month period. It does not mean that the stock market cannot be positive over the next six months, but the seasonal probability of a large return is much less than in the favor- able six-month period. On a risk-adjusted basis, the next six months presents a much less attractive scenario for the stock market.

There are still seasonal opportunities in the stock and bond markets during the six-month unfavor- able period for stocks. There are many sectors of the stock market that tend to perform well at some point in the six-month unfavorable period for stocks, such as utilities, consumer staples, health care, biotech, gold and other sectors.

*****