This cycle has been no different. 2008’s bear market was a signal to investors that the economic environment was moving away from the credit-driven growth of the prior decade. As we pointed out last month in our “2012” report, the result has been that nearly all credit-related investments (i.e., such things as housing, commodities, emerging markets, financial stocks, etc.) have been underperforming since 2008. The biggest beneficiaries of the credit bubble are now largely the biggest underperformers.

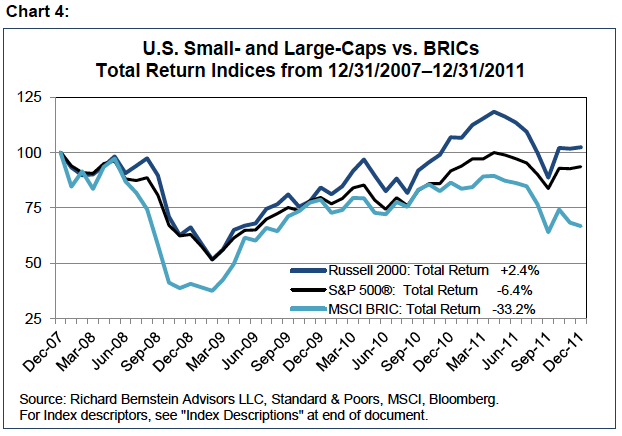

Perhaps the most striking example is that US stocks have now outperformed BRIC stocks since late-2007, i.e., for more than four years (see Chart 4). Even European stocks outperformed BRIC stocks during 2011 despite Europe’s myriad of financial problems. The world’s stock markets seem to be sensing that the global credit bubble’s deflation is worse for the emerging markets than it is for developed regions.

Munis outperformed gold and EM debt!

Going into 2011, the consensus was that the US municipalities were in dire straits. Investors were worried that many municipal defaults were looming. At the same time the growing consensus was that gold should be a core holding. The markets again surprised investors, and municipal bonds actually outperformed gold during 2011 (11.2% versus 10.1%). Despite the thought that US credit conditions were deteriorating whereas those in the emerging markets were improving, Munis also outperformed local-currency emerging market debt (11.2% versus 7.7%).

The US’s year. More to come?

Whether one looks at the stock markets, the government bond markets, or even the municipal market, 2011 was certainly the US’s year. Interestingly, though, investors still seem mesmerized by non-US markets despite that the economic and financial fundamentals associated with the deflation of the global credit bubble increasingly seem to favor investing in the US.

As we discussed in detail in our “2012” report, we continue to believe that the greatest opportunities for investment are mainly in the United States.

****

© Copyright 2012 Richard Bernstein Advisors LLC. All rights reserved.

The views expressed are those of Richard Bernstein Advisors LLC, not necessarily those of UBS or any of its affiliates, and may in some cases be different from, or inconsistent with, views expressed or taken by UBS. Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in, any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. Specifically, and without limiting the generality of the foregoing, before acquiring the shares of any mutual fund, it is your responsibility to read the fund’s prospectus. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor's investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment's value. Investing is an inherently risky activity, and investors must always be prepared to potentially lose some or all of an investment's value. Past performance is, of course, no guarantee of future results.