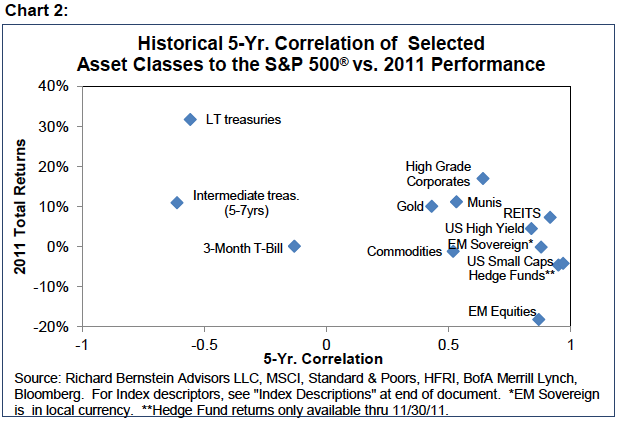

We continue to believe that investors’ portfolios are severely under-diversified because they generally refuse to hold treasuries. It is nearly impossible today to form a diversified portfolio without including treasuries because most other asset classes are so highly correlated. Chart 2 shows the 2011 performance of selected asset classes versus those asset classes’ correlations to the S&P 500. Treasuries stand out both in terms of 2011 performance and in terms of diversification potential.

Again, our favoring treasuries is not a directional belief that long-term interest rates must fall. Rather, we favor holding treasuries for diversification purposes. We remain very surprised that investors have not gravitated to treasuries despite their outperformance AND their currently unique diversification properties.

Treasuries may be the new “alternative” investment

In a Financial Times article in 2009 we first outlined our view that treasuries are the new “alternative” investment. (You can read the article here: http://www.ft.com/intl/cms/s/0/a8ad8980-d481-11de-a935-00144feabdc0.html#axzz1iWdiAAnN) Alternative investments tend to have several characteristics: 1) they provide superior returns; 2) they are uncorrelated or negatively correlated to other asset classes and, in particular, to equities; and 3) they are generally considered overly risky by investors because they are the “alternative” to the generally accepted investment strategy. Treasuries appeared to have these three characteristics, whereas traditional alternative investments (hedge funds, private equity, commodities, etc.) no longer did. Traditional alternatives were underperforming, alternatives’ correlations had risen substantially, and risk premiums were low because investors were flooding the asset sub-classes with funds. Our observations in 2009 still seem appropriate today.