by Richard Bernstein, Richard Bernstein Advisors

The market generally proves the consensus wrong, and 2011 certainly adhered to that historical precedent because the consensus “must owns” at the beginning of 2011 generally underperformed during the year. What is somewhat startling to us, however, is that conviction has yet to be shaken. The consensus continues to favor commodities, emerging markets, and “any-bond-but-treasuries”.

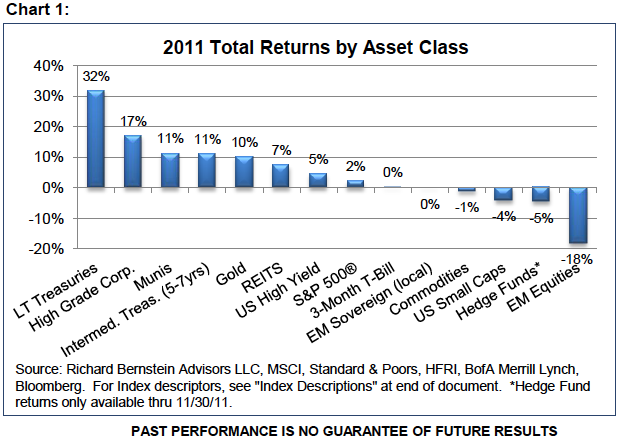

Our view continues to be that the US markets are in the early stages of a decade of outperformance. US stocks have now outperformed BRIC (Brazil, Russia, India, and China) for more than four years, and the US dollar (as measured by the DXY) troughed in 2008. Long-term US treasury bonds were 2011’s best performing major asset class, and they continued to exhibit our three defining characteristics of an alternative asset class. Unlike when investing in typical alternative investments, however, investing in treasuries doesn’t require the investor to accept high fees and illiquidity.

It’s déjà vu all over again. Investors during the early-2000s were waiting for technology shares to rebound, and ignored the asset classes that were outperforming, such as emerging markets, commodities, gold and REITs. Today, investors are waiting for emerging markets and commodities to rebound, and are generally ignoring the asset classes that are outperforming, such as US stocks and bonds.

We continue to favor US assets as the core of our strategies.

Long-term treasuries

Long-term US treasuries have been perhaps the most hated asset class for several years, yet their performance has been outstanding. During 2011, long-term US treasuries were the best performing major asset class in the world (see Chart 1). This should not be too surprising because quality investments generally outperformed around the world, and US t-bonds are the world’s highest quality asset.