by Jesse Felder, The Felder Report

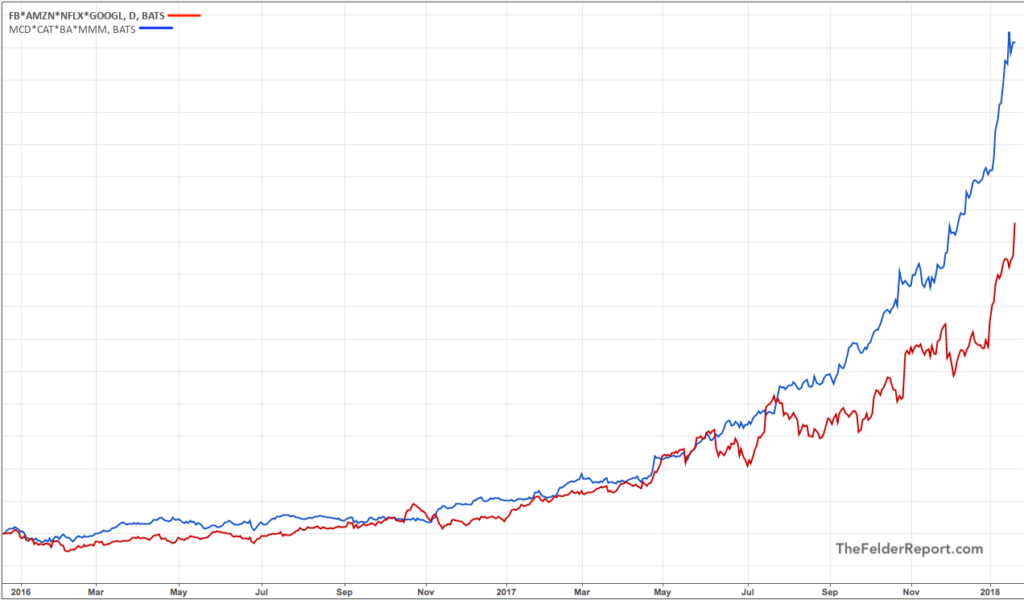

The FANG stocks (Facebook, Amazon, Netflix and Google, now known as Alphabet) have become the face of the current bull market in equities. But there is another fantastic foursome, typically the province of far less intrepid investors, that has outperformed even this notable group over the past two years and more accurately epitomizes what has been behind the current blowoff.

These are: McDonald’s, Caterpillar, Boeing and 3M.

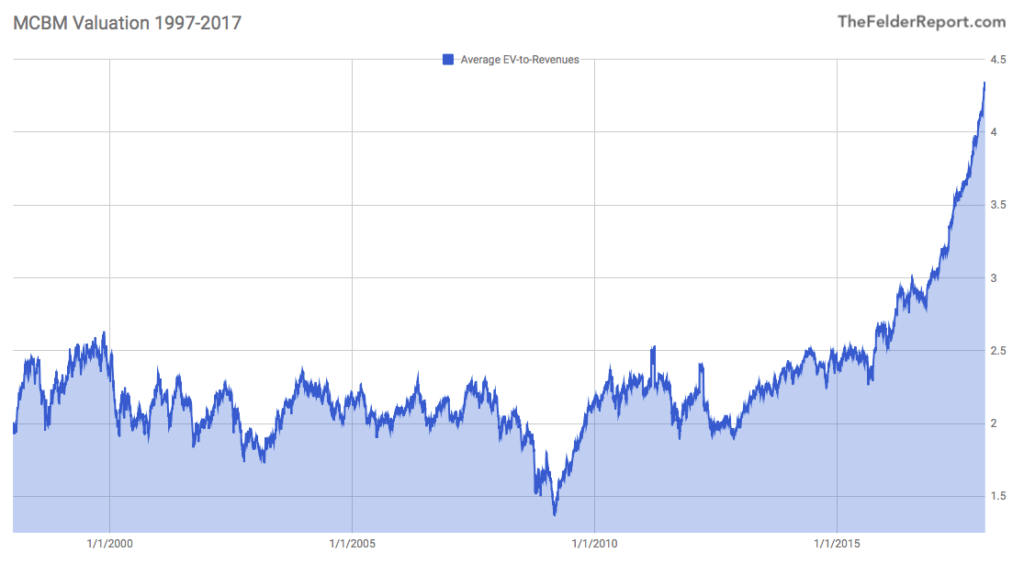

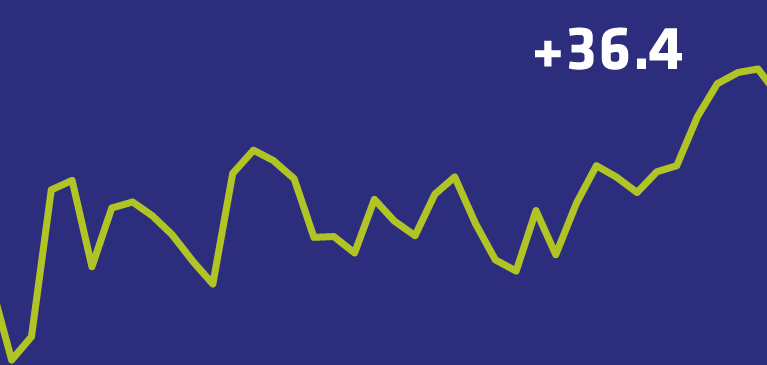

Looking at the valuation history of MCBM over the past twenty years, it’s clear that as a group they traded within a range of 1.5-to-2.5 times enterprise value-to-revenues. This period includes both the dotcom mania and the housing bubble. Then, in 2016 they broke out of this range and today they trade at more than twice their average valuation of the past two decades.

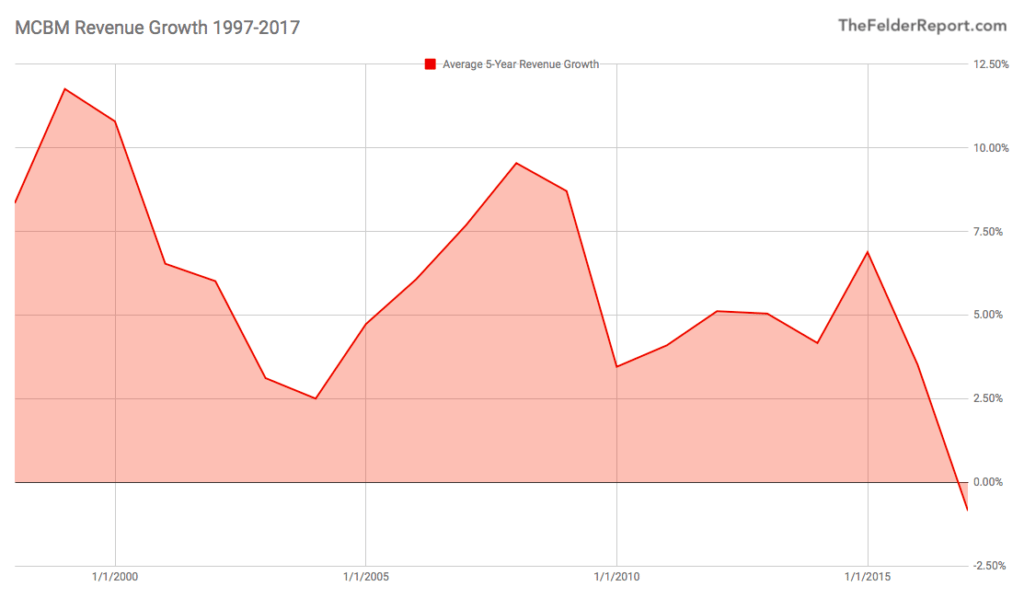

You might rationally presume that, because the stock market is known as a discounting mechanism, this surge to unprecedented valuations reflects a surge in their respective businesses. In that case, you would presume wrong. The average revenue growth for these four companies over the past five years has done just the opposite.

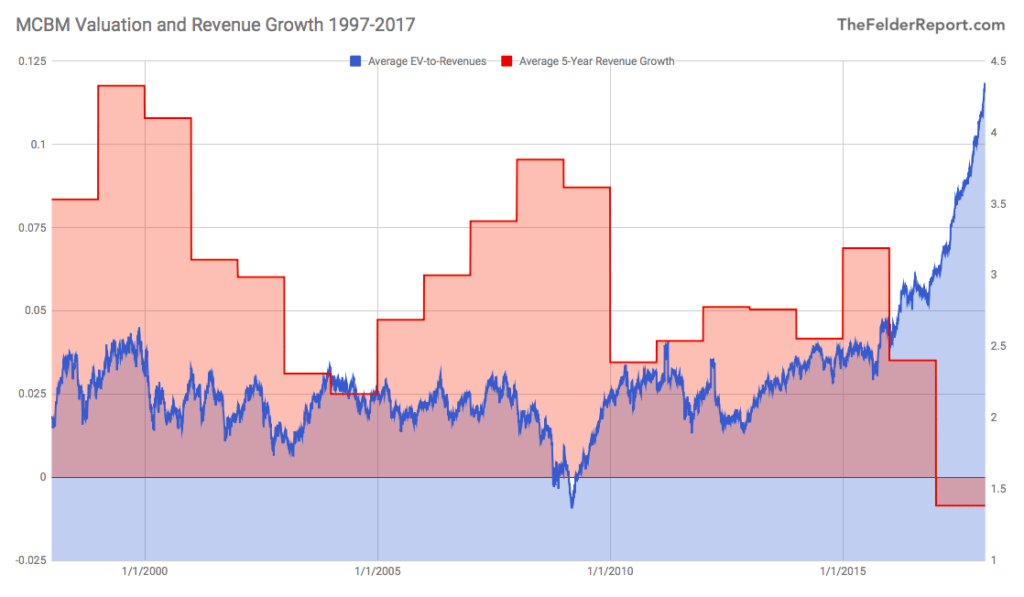

Put these two charts together and you get a result that is almost inexplicable. How can valuations scream to highs never seen before even as revenue growth stagnates or even goes negative?

The answer is twofold: stock buybacks and an epic reach for yield on the part of investors. These popular “blue chip” stocks have become “one decision” stocks like the “Nifty Fifty” were back in the late-1960’s and early 1970’s, for both investors and for their top executives.

It’s probably not that investors are buying them directly as “one decision” stocks but that dividend-focused ETFs have become the new “one decision” stocks. 32 ETFs count McDonald’s among their top 15 holdings. 25 ETFs count Caterpillar among their top 15. 83 ETFs overweight Boeing to this degree and 44 overweight 3M. They also count themselves among the top 10 holdings in the Dow Jones Industrial Average despite the fact that none of these four stocks can be found among the top 20 within the S&P 500.

How many investors in these “one decision” ETFs would be willing to buy these shares directly after understanding that means paying the highest valuation in history for the worst revenue growth? At least the top brass at the company can ensure they will get their bonus stock awards via buyback programs… and ensure they have someone to sell them to. Investors reaching for yield in these things today can hardly say the same.

Copyright © The Felder Report