Browsing Tag

Rodrigo Gordillo

33 posts

Time to get comfortable being uncomfortable

Rodrigo Gordillo and Mike Philbrick, quantitative investing authorities and co-founders of Resolve Asset Management contend that it’s time…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Life of a Thanksgiving Turkey: An Investment Fable

by Adam Butler, Resolve Asset Management From the perspective of a (free-range) turkey, life is pretty good. The…

Risk Parity and the Four Faces of Risk

by Adam Butler, GestaltU Benjamin Graham famously said that “In the short run, the market is a voting…

The Bull Giveth, The Bear Taketh & You’re Not Passive

by Lance Roberts, Clarity Financial Over the last several months, in particular, the number of articles discussing the…

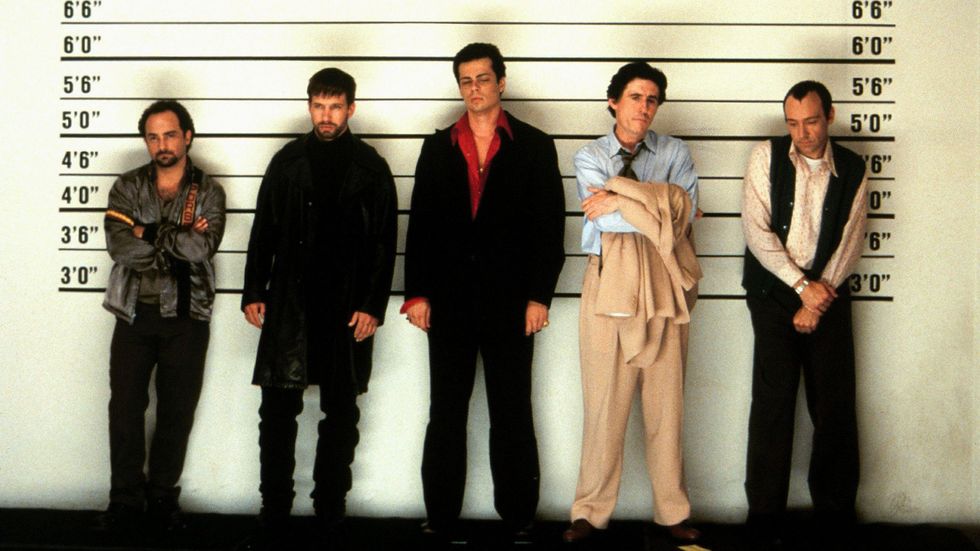

Tactical Asset Allocation Alpha and The Greatest Trick the Devil Ever Pulled

by Adam Butler, Resolve Asset Management, via GestaltU.com “The greatest trick the Devil ever pulled was convincing the…

Lessons From Canada's Top Pension Managers

by Adam Butler, Resolve Asset Management, via S&P Dow Jones Indices Summary Many studies have documented the fact…

Risk Parity isn’t the Problem, it’s the Solution

by Adam Butler, GestaltU Bank of America Merrill Lynch recently released a research note suggesting that Risk Parity…

Bold, Confident & WRONG: Why You Should Ignore Expert Forecasts

Bold, Confident & WRONG: Why You Should Ignore Expert Forecasts by Adam Butler, Michael Philbrick, Rodrigo Gordillo, ReSolve…

On Backtesting: An All-New Chapter from our Adaptive Asset Allocation Book

On Backtesting: An All-New Chapter from our Adaptive Asset Allocation Book by Adam Butler, ReSolve Asset Management, via…

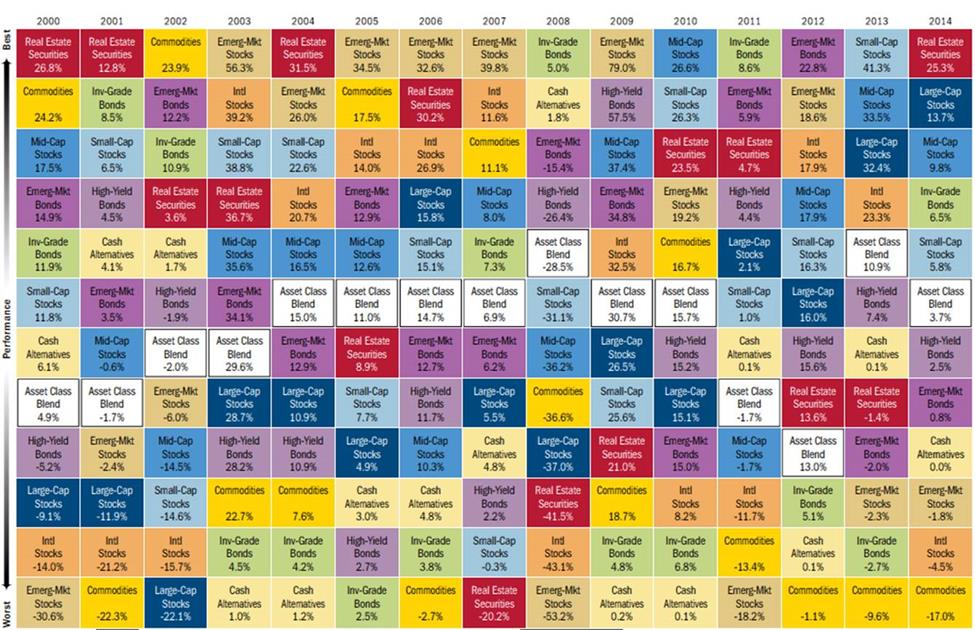

Asset Allocation, Asset Allocation, Asset Allocation!

Tactical Alpha Part III: Asset Allocation vs. Security Selection by Adam Butler, GestaltU.com Asset Allocation, Asset Allocation, Asset…

Apples and Oranges: A Random Portfolio Case Study

Apples and Oranges: A Random Portfolio Case Study by Adam Butler, Resolve Asset Management This article was motivated…

Forget “Active vs. Passive”: It’s All About Factors

Forget “Active vs. Passive”: It’s All About Factors by Adam Butler, Michael Philbrick, Rodrigo Gordillo, ReSolve Asset Management,…

All Strategies "Blow Up"

by Adam Butler, GestaltU We are a quantitative finance shop, right down to the ground. All of our…

Think Modern Portfolio Theory Doesn't Work? Clearing Up Some Misconceptions

by David Varadi, CSS Analytics A note to readers: I have posted some interesting material the last few…

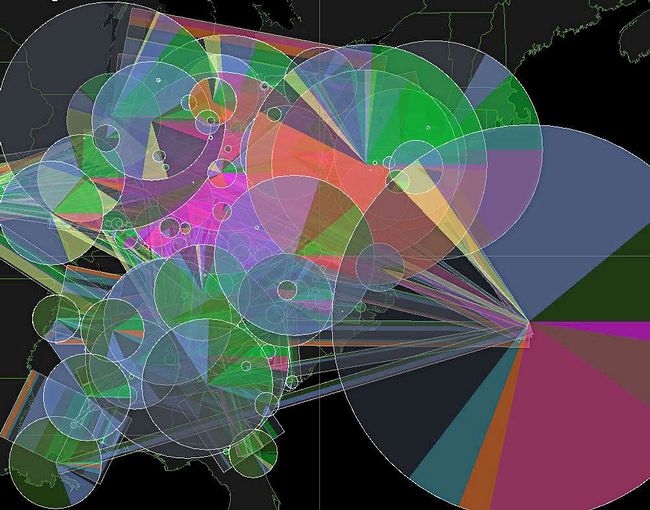

Global Tactical Asset Allocation: Just the Facts

by Adam Butler, GestaltU Rob Seawright of Above the Market recently posted an article broadly skewering tactical asset allocation (TAA)…