Browsing Tag

Jeremy Grantham

62 posts

Avoiding Shortsightedness: Looking at Returns for the Next 10 Years

Avoiding Shortsightedness: Looking at Returns for the Next 10 Years by Brad McMillan Commonwealth Financial Network I shared…

December 29, 2015

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Jeremy Grantham: 10 Quick Topics to Ruin Your Summer

by Jeremy Grantham, Chief Investment Officer, GMO LLC 10 Quick Topics to Ruin Your Summer Introduction I have…

August 5, 2015

Jeremy Grantham: Investment Outlook 1Q 2015

GMO Quarterly Letter 1Q 2015 Breaking Out of Bondage The Impossible Math Behind Future Bond Returns by Ben…

May 4, 2015

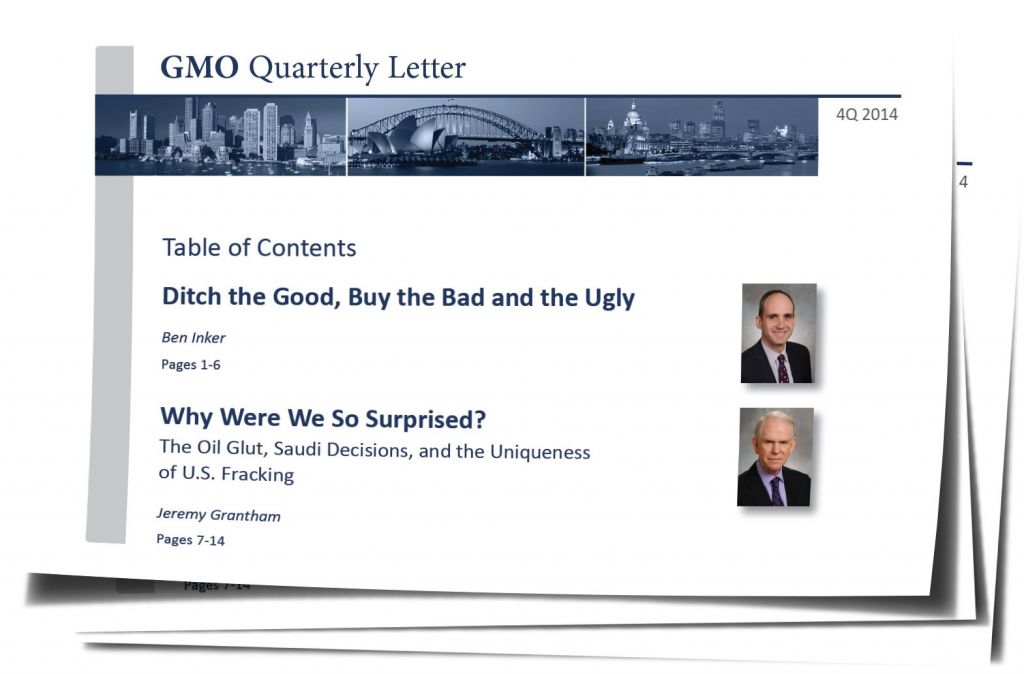

Jeremy Grantham: Investment Outlook (Q4/2014)

Why Were We So Surprised? The Oil Glut, Saudi Decisions, and the Uniqueness of U.S. Fracking by Jeremy…

February 6, 2015

Are We Witnessing a Melt-Up In Long-Term Bonds?

by Ben Carlson, A Wealth of Common Sense Since the financial crisis, investors are constantly on edge that…

December 18, 2014

Jeremy Grantham: Investment Outlook (Q3 2014)

Jeremy Grantham's GMO has recently released its Letter to Investors, presented below without comment: Grantham's advice to a…

November 19, 2014

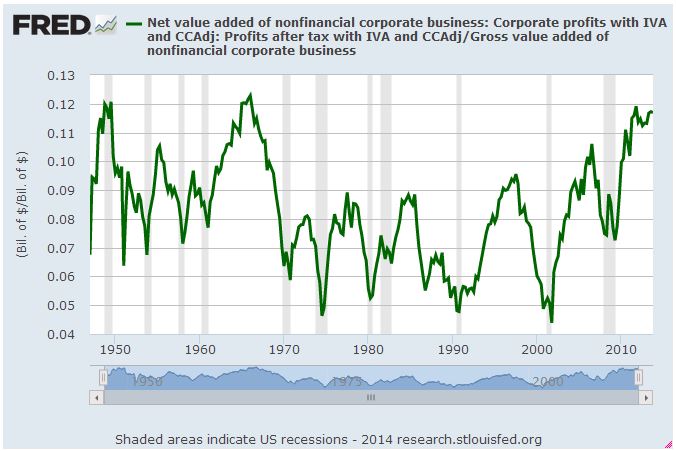

Three Things to Think About

by Lance Roberts of STA Wealth Management, Mean Reverting Profits Earlier this week I discussed the growing detachment…

November 14, 2014

Enduring Lessons from the Financial Crisis

by Ben Carlson, A Wealth of Common Sense When asked what people would learn from the financial crisis,…

September 19, 2014

GMO: "There Is No Safe Place To Hide"

From Jeremy Grantham's GMO: We have been writing quite a bit about why asset allocation today is in…

August 21, 2014

Valuation Based Equity Market Forecasts: Q2 2014

by Adam Butler, http://gestaltu.com Any analysis that relies on the past to offer guidance about the future makes…

July 19, 2014

6 Things To Ponder: Bulls, Bears, Valuations & Stupidity

Submitted by Lance Roberts of STA Wealth Management, With just a tad more than three weeks left in the year it…

December 9, 2013

Jeremy Grantham: U.S. Market "Will Head 20-30% Higher in the Next Year or, More Likely Two Years"

by Jeremy Grantham of GMO Timing Bear Markets My personal view is that the Greenspan-Bernanke regime of excessive…

November 20, 2013

Screaming “Bear Market Rally” (Smead)

by William Smead, Smead Capital Management In the summer of 2009, I was a regular guest on CNBC…

May 10, 2013