Section

value investing

244 posts

Tom Brakke: The Nature of Value

by Tom Brakke, Research Puzzle When I travel, I try to meet with people and organizations from…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Made in Detroit: Seeing Value Where Others Do Not

by Kara Lilly, Mawer Investment Management A scrappy, twenty-something-year old from Detroit, Andy Didorosi does not fit into…

Joseph Paul: Alarm Clock Goes Off on Dream Stocks

by Joseph G. Paul, Chief Investment Officer, U.S. Value Equities, AllianceBernstein Investors have recently woken up to the reality…

Eddy Elfenbein: There's No Such Thing as Value

by Eddy Elfenbein, Crossing Wall Street One of the foundations of investment analysis is the dichotomy between a…

Why It Matters That Value Stocks are Outperforming Growth Stocks

by David Templeton, Horan Capital Advisors Quite a bit of discussion has occurred over the past several days…

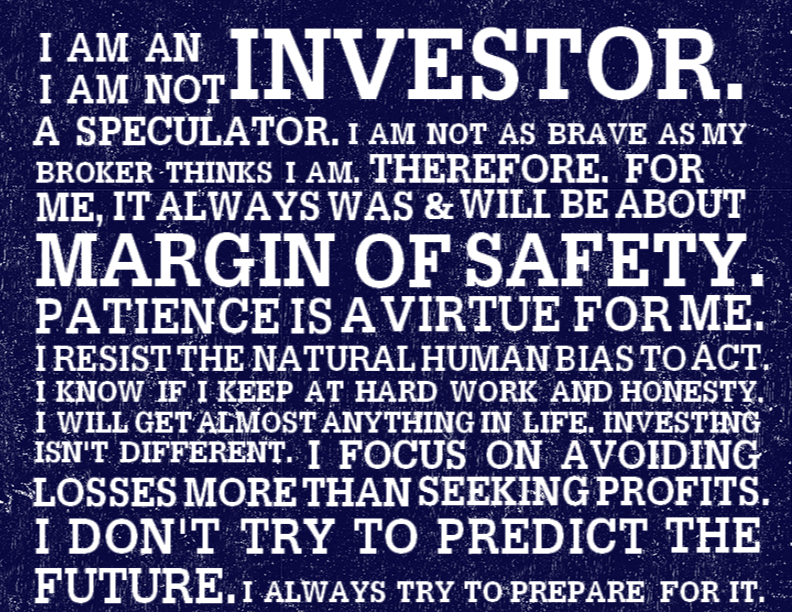

Some Very Different Investment Strategies Masquerade as 'Value' These Days

by 25iq Ben Graham and his disciples like Warren Buffett, Howard Marks and Seth Klarman have developed a…

Ben Graham’s Value Investing ≠ Fama/French’s Factor Investing

by 25iq Ben Graham and his disciples like Warren Buffett, Howard Marks and Seth Klarman have developed a…

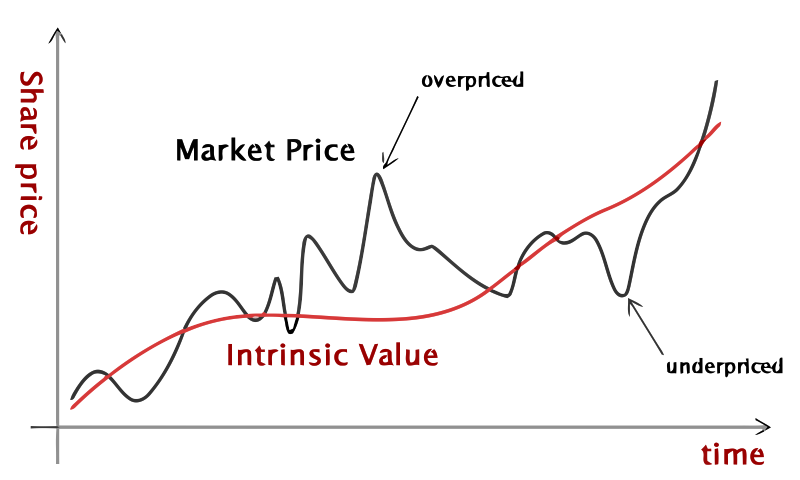

David Merkel: On Intrinsic Value

by David Merkel, Aleph Blog In his annual report, though not his more well-known letter, Buffett talked about…

Wallflower Value Stocks Are Ready to Dance

by Chris Marx, AllianceBernstein Global equities are notching new highs, valuations are elevated and talk of market bubbles…

Value Stocks Beckon in Emerging Markets

by Henry S. D'Auria and Morgan Harting, AllianceBernstein Years of playing defense have left many emerging-market (EM) equity…

David Kass: 16 Questions for Warren Buffett

(Notes taken by Professor David Kass, Department of Finance, Robert H. Smith School of Business, University of Maryland…

"The More Comfortable You are in Valuing a Company, the Less Point There is to Doing that Valuation"

One of the responses to my last post on valuing young companies was that even if you can…

The Underperformance Culprit: Active Management or Active Managers?

by Tony Scherrer, CFA, Director of Research & Portfolio Manager, Smead Capital Management Each year we are reminded…

Looking For Value... In Price Signals?

by Capital Spectator Recognizing value as a risk factor of significance is firmly established in the academic literature…

William Smead: Investment Outlook (September 4, 2013)

"Exponential Business Success" by William Smead, Smead Capital Management At a major conference in November of 2012, the…