Section

portfolio management

301 posts

Discovering The Genius Du Jour

by James Picerno, Capital Spectator Selection bias is everywhere in financial journalism, and for obvious reasons (obvious if…

March 27, 2014

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

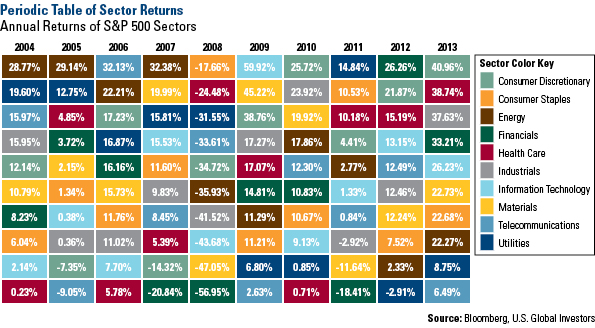

What Makes a Slam-Dunk Portfolio?

What Makes a Slam-Dunk Portfolio? By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors March 21,…

March 24, 2014

Your Very Own Black Swan Strategy

by A Wealth of Common Sense “In the world of finance, the only black swans are the history…

March 20, 2014

What Areas of the Market Will Remain in the Limelight?

What Areas of the Market Will Remain in the Limelight? By Frank Holmes., CEO and Chief Investment Officer,…

March 3, 2014

Can Investors Make Meaningful Decisions Using Track Records? (GestaltU)

NFL Parity, Sample Size and Manager Selection by Adam Butler, GestaltU We’ve been discussing issues around statistical significance…

February 25, 2014

Faber’s Ivy Portfolio: As Simple as Possible, But No Simpler (GestaltU)

by Adam Butler, GestaltU We’ve been discussing sources of performance decay, degrees of freedom, and the implied statistical…

February 20, 2014

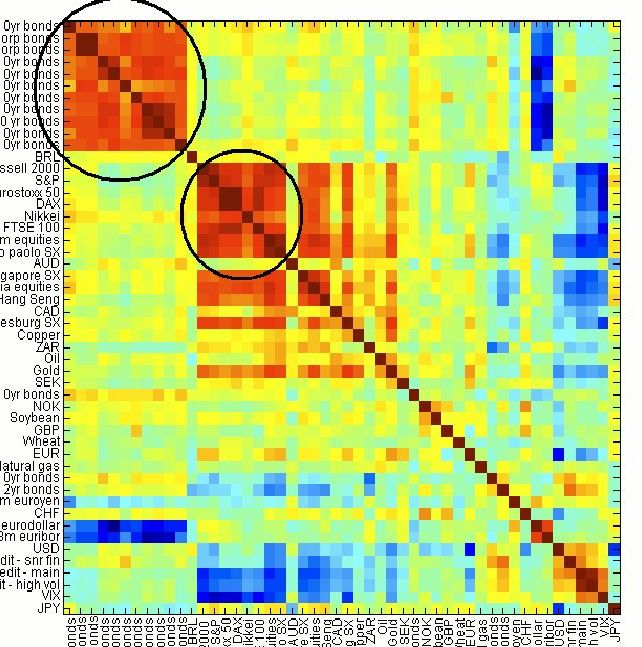

Rick Ferri: Why Correlation Doesn't Matter Much

by Rick Ferri Correlation analysis in portfolio management design is overrated. There isn’t much benefit derived from relying…

January 27, 2014

Why Rebalancing Has Become Even More Important for Investors

REITs, Asset Allocation, & The Correlation Headwind by Capital Spectator Morningstar’s Samuel Lee warns “that REITs' diversification powers…

January 9, 2014

Stay Out of the Bottom Quartile – Look for Fund Managers with Large Active Share (David Merkel)

by David Merkel, Aleph Blog If you are a money manager, you would like to be in the…

December 16, 2013

Portfolio Rebalancing is Not One-Size Fits All (Capital Spectator)

Rebalancing "Mistakes" by Capital Spectator Paul Merriman concludes that “rebalancing could be a huge mistake.” Perhaps, although it…

November 21, 2013

Many Investors Are Still Under-Diversified

by Capital Spectator The Crucial Connection: Asset Allocation & Rebalancing The link between asset allocation and rebalancing is…

October 25, 2013

Better Beta is No Monkey Business

by Patrick Rudden, AllianceBernstein The infinite monkey theorem states that a monkey hitting keys at random on a typewriter…

October 10, 2013

Why Investors So Focus on Down Market Performance (SSRN)

Fund Flows in Rational Markets by Francesco A. Franzoni, University of Lugano; Swiss Finance Institute and Martin C.…

September 18, 2013

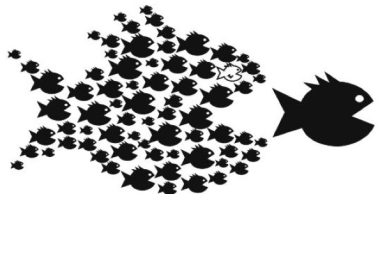

The Secret to Fishing (Visscher)

by Steven Visscher, Mawer Investment Management I recently went fishing for the first time. My expectations were pretty…

August 13, 2013

Why More is Less

by Tom Brakke, Research Puzzle Published in early 2004, The Paradox of Choice by Barry Schwartz carried the…

August 13, 2013