Section

Strategy

2450 posts

Sources of Performance Decay (GestaltU)

by Adam Butler, GestaltU Above all, the greatest fear in empirical finance is that the out of sample…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Toward a Simpler Palate (GestaltU)

by Adam Butler, GestaltU My palate is simpler than it used to be. A young chef adds and…

Jeffrey Gundlach: Investment Outlook (March 2014)

What Hath QE Wrought? Jeffrey Gundlach Answers by Sam Ro, Business Insider DoubleLine Funds' Jeff Gundlach doesn't expect…

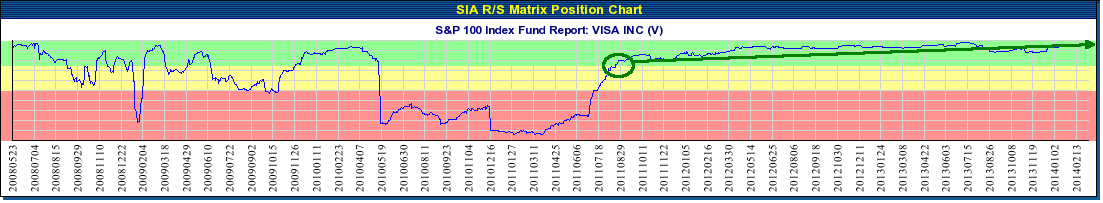

VISA INC (V) NYSE - Mar 12, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

The Black Box: Eyewitness Testimony and Investment Models (GestaltU)

by Adam Butler, GestaltU We’ve been spending a lot of time recently discussing the quality of investment modeling,…

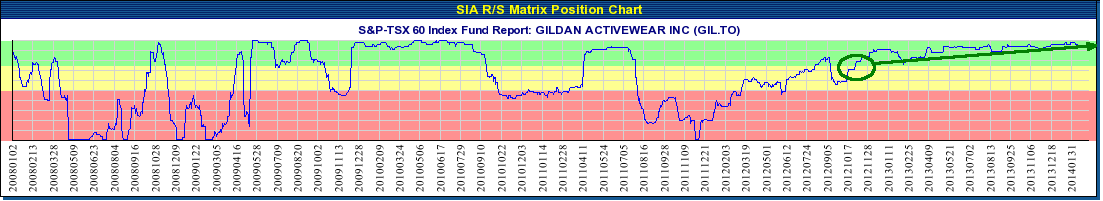

GILDAN ACTIVEWEAR INC (GIL.TO) TSX - Mar 11, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

Four Things Learned From George Soros

by Ivaylo Ivanhoff, Ivanhoff Capital When asked about the most important lessons that Stan Druckenmiller learned from George…

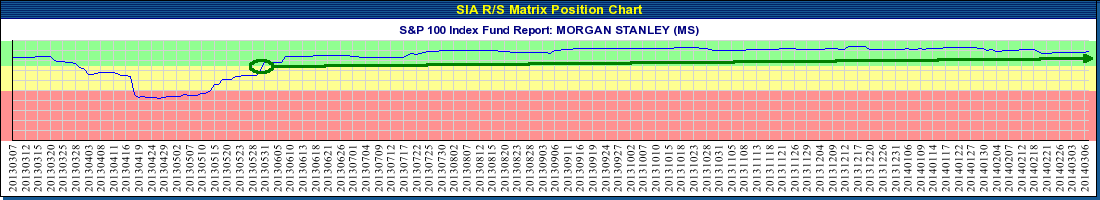

MORGAN STANLEY (MS) NYSE - Mar 10, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

Making Green from Gold, Palladium and Pollution

Making Green from Gold, Palladium and Pollution By Frank Holmes CEO and Chief Investment Officer U.S. Global Investors…

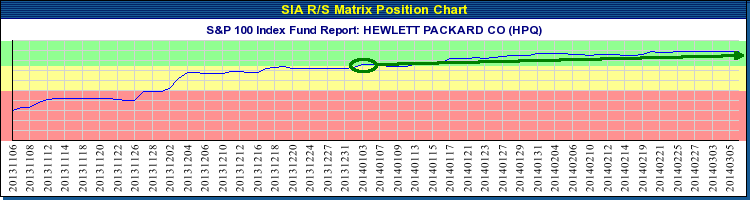

HEWLETT PACKARD CO (HPQ) NYSE - Mar 07, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

There's Always a Risk Factor at Work – Pick Your Poison

The Illusion Of “Investing” by James Picerno, Capital Spectator The term “investing” is a misnomer when it comes…

Not All Emerging Markets Are Created Equal

by JC Parets, All Star Charts As bad as the Emerging Market space has been, not all of…

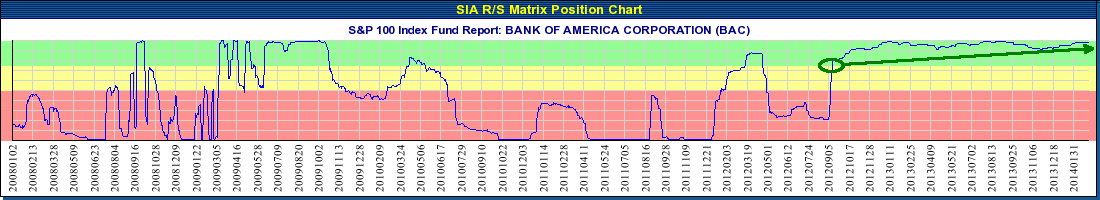

BANK OF AMERICA CORPORATION (BAC) NYSE - Mar 06, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

THE WALT DISNEY CO (DIS) NYSE - Mar 05, 2014

SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock Report utilizes a proven strategy of uncovering outperforming…

Rick Ferri: Beat the S&P 500 with the S&P 500

It’s easy to beat the S&P 500. Just hold all stocks in the S&P 500 in an equal…