Section

Alternative Investing

728 posts

Infrastructure steady as equities swing

ClearBridge Investments: Despite recent strong performance for listed infrastructure versus equities, infrastructure valuations are still attractive on a risk adjusted basis, and could have room to run.

June 4, 2025

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Turning the Page: Why 2025 May Be the Year Merger Arbitrage Steps into the Spotlight

Strategic Resilience in 2024: Playing Defense to Win "If you were to summarize it in one word, it…

May 28, 2025

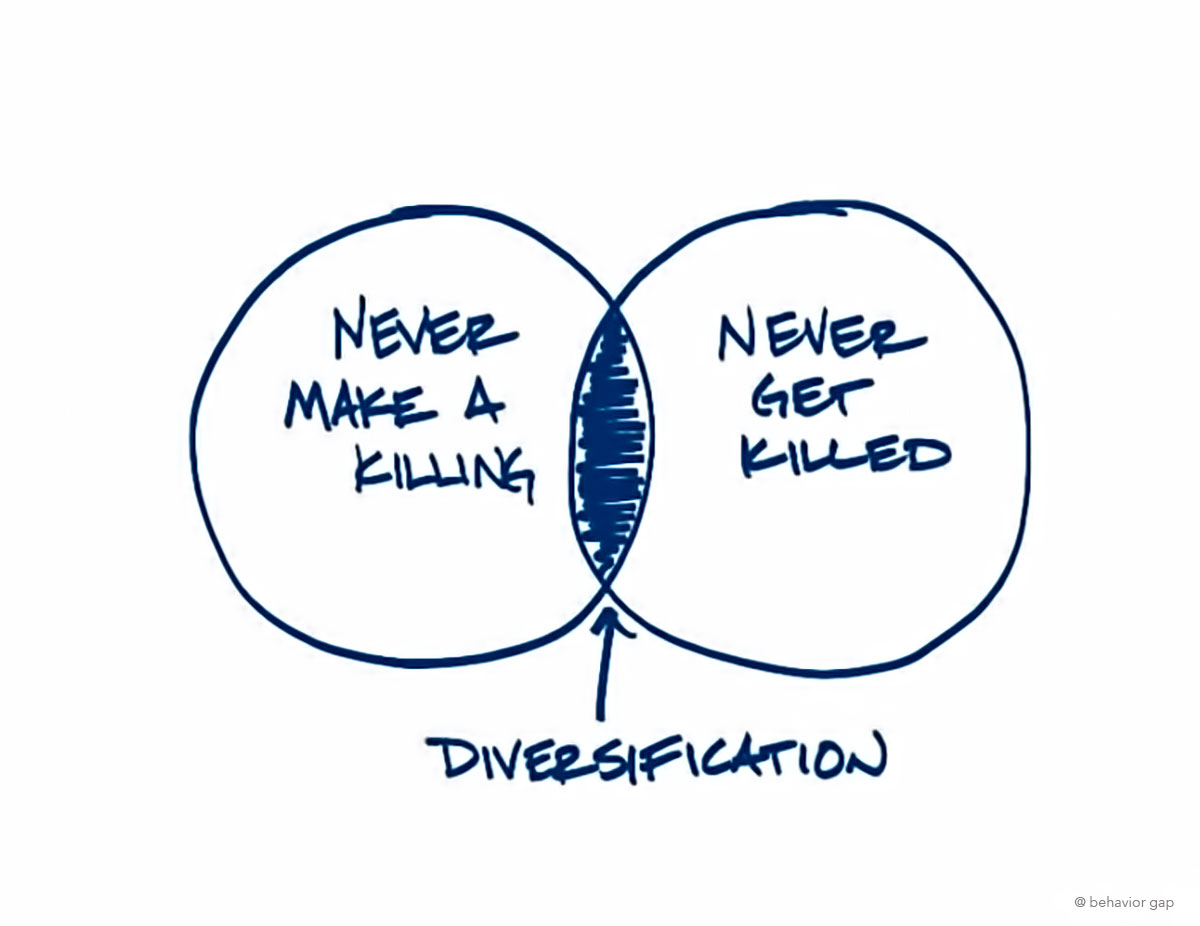

Bond Voyage! Saying Goodbye to Traditional Diversifiers

When your “diversifiers” stop diversifying, what do you do? ETF analyst Tony Dong has a few ideas—some that…

May 15, 2025

Elbows Up: Fidelity's Strategic Pivot Amid US Policy Uncertainty | Ilan Kolet on Global Outlook

Listen on The Move Summary In this timely episode of Insight is Capital, Pierre sits…

April 9, 2025

The World’s Most Dangerous Game of Chicken

by Nick Mersch, CFA, Associate Portfolio Manager, Purpose Investments People thought Trump was playing 4D chess. Instead, he’s…

April 9, 2025

Understanding CTAs: The Structural Core of Modern Liquid Alternatives

Why Commodity Trading Advisors Deserve a Prominent Seat at the Alternatives Table In an investment climate increasingly shaped…

April 9, 2025

Merger Arbitrage Advantage: Delivering Durable, Uncorrelated Return Streams

Introduction: Understanding the Opportunity in Merger Arbitrage Merger arbitrage—a subset of event-driven investing—represents a distinctive opportunity for portfolio…

April 3, 2025

Rethinking Diversification: Navigating Correlation, Concentration, and Crisis in Modern Portfolios

Long revered as the only free lunch in finance, diversification now finds itself on trial, its once-unquestioned wisdom…

March 23, 2025

Harnessing the Power of Private Equity in a Diversified Portfolio

In the world of investing, diversification remains a cornerstone strategy for minimizing risk while maximizing potential returns. While…

March 20, 2025

Riding the Edge of Chaos: Why Advisors Must Embrace the New Era of Diversification

There’s an old saying in investing: past performance is no guarantee of future results. It’s a phrase so…

March 18, 2025

Simplify's Paisley Nardini: Market Outlook—Time for Tail-Risk Protection?

Listen on The Move 🔹 Is your portfolio riding the edge of chaos? - Discover why diversification…

March 18, 2025

Rebuilding resilience in 60/40 portfolios

by Jeffrey Rosenberg, Managing Director, & Team Systematic Fixed Income, BlackRock Key points Heightened fiscal, trade, and policy…

March 14, 2025

The World is Evolving. So Too Must Portfolio Construction.

Rethinking Portfolio Construction: Why 40/30/30 is the Key to Balance Since 1950, the investment portfolio has remained largely…

March 10, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

March 5, 2025

Crowded Trades & The Passive Investing Paradox

The most dangerous investments are the ones everyone believes are safe. Today, the largest passive funds in the…

February 23, 2025