Section

active investing

334 posts

Platform Traded Funds™ (PTF™): A breakthrough for investing

Platform Traded Funds™ (PTF™): A breakthrough for investing TORONTO, Oct. 1, 2015 /CNW/ - The financial services…

October 1, 2015

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

When to double down

When to double down by David Merkel, Aleph Blog Here is a recent question that I got from…

September 7, 2015

Are Active Managers Getting a Bad Rap?

Are Active Managers Getting a Bad Rap? by Jason Voss, CFA Institute Active management has taken a lot…

September 4, 2015

The Active-Passive Contradiction

THE ACTIVE-PASSIVE CONTRADICTION by Peter Kraus, AllianceBernstein Asset allocators continue to systematically reduce their exposure to active equity…

September 1, 2015

Great Investors Gain Most of Their Advantage During Bear Markets

Great Investors Gain Most of Their Advantage During Bear Markets by Jason Voss, CFA, CFA Institute One of…

August 31, 2015

The Sustainable Active Investing Framework: Simple, But Not Easy

The Sustainable Active Investing Framework: Simple, But Not Easy by Wesley Gray, AlphaArchitect The debate over passive versus active…

August 21, 2015

Luck vs. Skill in Active Management

by Ben Carlson, A Wealth of Common Sense In a post earlier this week I wrote about famed…

July 20, 2015

Charles Ellis: In Defense of Active Investing

By Charles D. Ellis, CFA, via The Enterprising Investor Investment management is at once both a profession and a…

June 26, 2015

Let’s Try this Again: Ending the Passive vs Active Distinction

by Cullen Roche, Pragmatic Capitalism My recent post on the Efficient Market Hypothesis brought about the usual pushback…

June 4, 2015

Jeffrey Saut: Active vs. Passive Redux

Active vs. passive redux Jeffrey Saut, Chief Investment Strategist, Raymond James March 23, 2015 Most of you know…

March 24, 2015

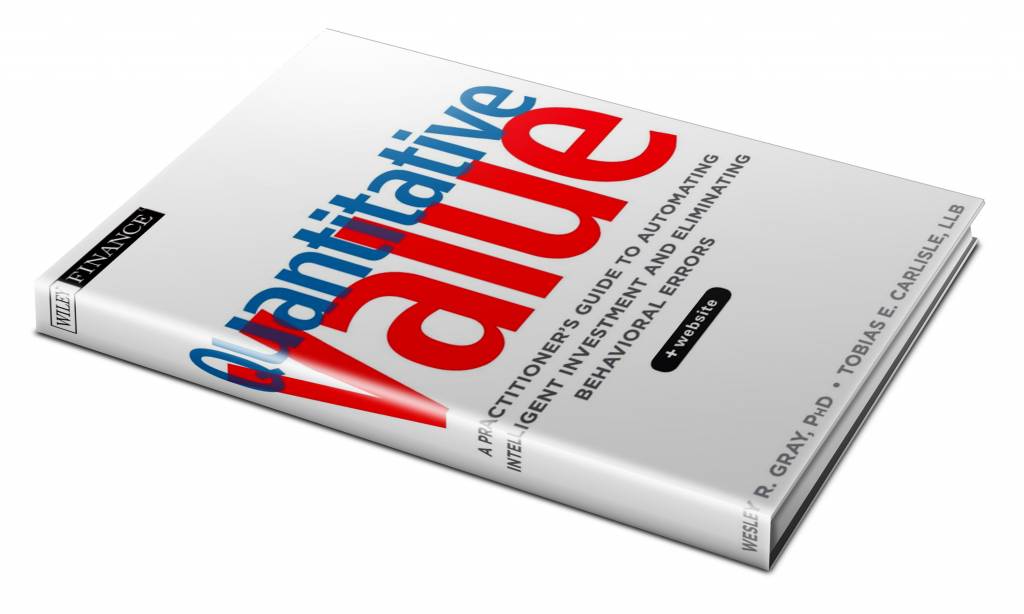

Five Good Questions for Wesley Gray, co-Author of "Quantitative Value"

After serving as a Captain in the United States Marine Corps, Dr. Wesley Gray became a finance professor…

February 20, 2015

One Way To Beat The Market

by Ben Carlson, A Wealth of Common Sense A couple weeks ago I looked at John Maynard Keynes’s investment…

February 12, 2015

Why the All-or-Nothing Nature of Market Timing is its Downfall.

by The Brooklyn Investor OK, so this is another post that follows a discussion in the comments section…

January 14, 2015

Brooke Thackray's Market Letter (January 12, 2015)

Market Update by Brooke Thackray, AlphaMountain Investments At this time of the year it seems that so many…

January 12, 2015

One of the Worst Arguments in Finance

by Ben Carlson, A Wealth of Common Sense “In the stock market, value standards don’t determine prices; prices…

December 22, 2014