Section

active investing

334 posts

Debunking active management myths

by Johann Schneider, Russell Investments With $504 billion flowing into passively managed products and $316 billion fleeing actively…

July 10, 2017

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

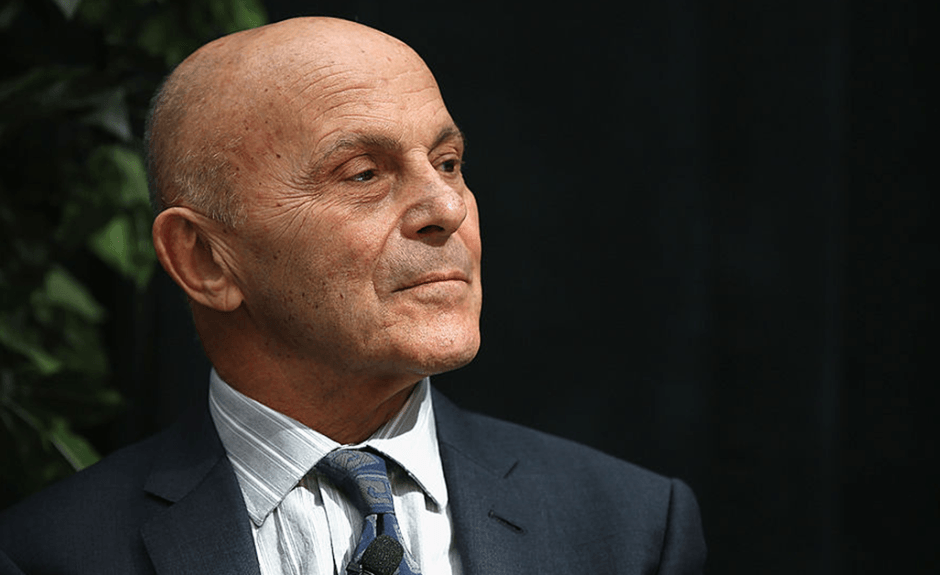

Eugene Fama: Stick with Basic Factors

by Ron Rimkus, CFA, CFA Institute Have the advances in technology, computing power, and data made the markets…

July 5, 2017

The 'Big Lie' of Market Indexes

by Lance Roberts, Clarity Financial Last week, I received the following email from a reader which I thought…

July 5, 2017

Indexing Evangelist Has Changed his Mind

by Cullen Roche, Pragmatic Capitalism Big news, nerds – Burton Malkiel has changed his mind. The investment legend,…

June 26, 2017

The Rise Of Robots & The Risk To Passive

by Lance Roberts, Clarity Financial In Tuesday’s post, “A Shot Across The Bow,” I discussed the recent “Tech…

June 18, 2017

Investment Strategy: How to diversify across active and passive

by Jeff Hussey, Russell Investments We all know that investing is inherently risky and that diversification is one…

June 9, 2017

The Active versus Passive Performance Debate Is Nonsensical

The Active versus Passive Performance Debate Is Nonsensical by Chuck Carnevale, F.A.S.T. Graphs One of the most hotly…

May 21, 2017

Investment Strategy: The right mix of active AND passive?

by Jeff Hussey, Russell Investments Active or passive? We’re past that binary decision by now, aren’t we? When…

April 7, 2017

The Active Equity Renaissance: Understanding the Cult of Emotion

by C. Thomas Howard and Jason Voss, CFA Institute “I know you are afraid and you should be…

March 27, 2017

The Active Equity Renaissance: Rejecting a Broken 1970s Model

by C. Thomas Howard and Jason Voss, CFA Institute The average active equity mutual fund underperforms its benchmark.…

March 23, 2017

Where Active Management Can Win

by Hamlin Lovell, CFA, CFA Institute It’s hard to beat some indexes. That doesn’t mean it’s hard to…

March 6, 2017

Managing Active Risk

by Corey Hoffstein, Newfound Research Position sizing is often the result of portfolio construction and is therefore largely…

January 23, 2017

Relationship Strain: The Sins of the Active Manager

by Jason Voss, CFA, CFA Institute Earlier this week we asked CFA Institute Financial NewsBrief readers: “What is…

November 22, 2016

Factor Shift: What ISN’T Working Anymore

by Jennifer Thomson, Gavekal Capital Regular readers are aware of our research showing that the Knowledge Effect is really…

November 2, 2016

Passive Negligence

by Michael Lebowitz, CFA, 720 Global Research The stock market is an essential cornerstone of capitalism, not a…

November 2, 2016