Section

Sentiment

205 posts

U.S. Equity Market Radar (July 1, 2013)

U.S. Equity Market Radar (July 1, 2013) The S&P 500 finished higher this week after dropping more than…

July 2, 2013

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Scott Minerd: Policy Induced Volatility Continues

June 26 2013 The recent bond market collapse is reminiscent of the Great Crash of 1994. Further pressure…

July 2, 2013

Albert Edwards: "Marc Faber Is Right. QE99 Here We Come"

The bloodbath in the bond markets has led some 'greatly rotating' commentators to see this as the end…

June 28, 2013

Technical Talk: Beware of 20-day and 50-day "Death Cross"

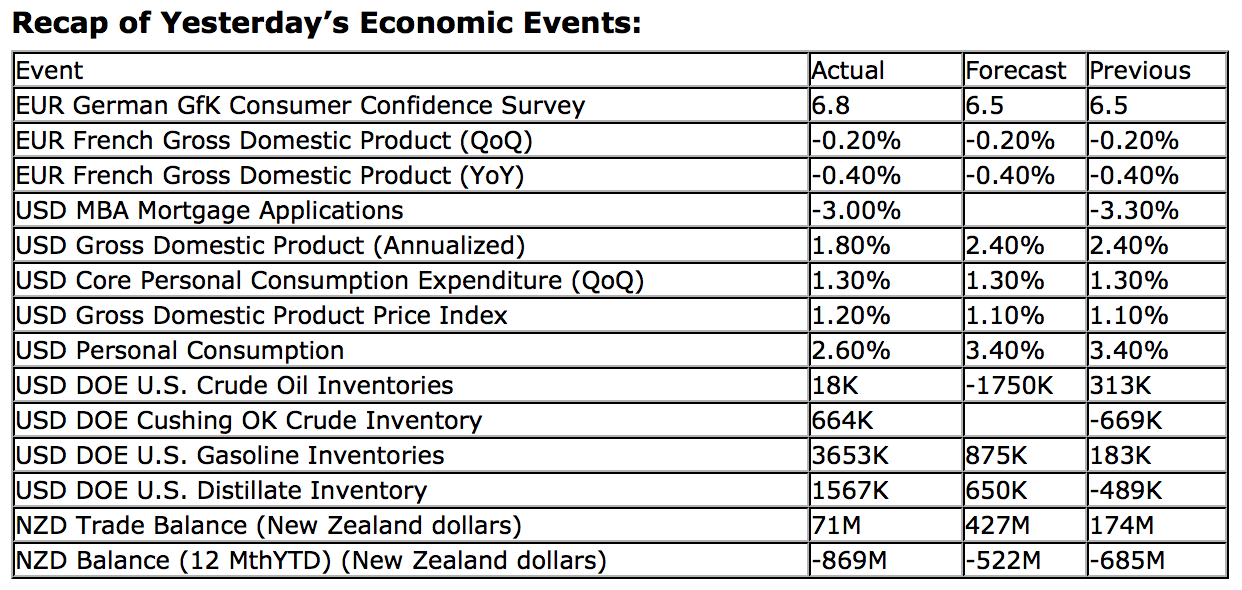

Upcoming US Events for Today: Weekly Jobless Claims will be released at 8:30am. The market expects 345K versus…

June 27, 2013

James Howard Kunstler's Mid Year Digest

Mid Year Digest (via Market Shadows) James Howard Kunstler's Mid Year Digest Wondering why the money world got…

June 27, 2013

Jeffrey Saut: "Welcome Back, Mr. Bond"

“Welcome Back, Mr. Bond” by Jeffrey Saut, Chief Investment Strategist, Raymond James June 24, 2013 “We’ve been expecting…

June 25, 2013

What’s an Investor to do in Markets like These?

What’s an Investor to do in Markets like These? 06-21-2013 By Frank Holmes CEO and Chief Investment Officer…

June 24, 2013

Managing Equity Risk: Some Rules for the Road

by Kurt Feuerman, AllianceBernstein Under the surface of May’s strong equity returns were major shifts in sector leadership,…

June 19, 2013

Jeffrey Saut: "Thinking About Thinking?"

“Thinking About Thinking?” by Jeffrey Saut, Chief Investment Strategist, Raymond James June 10, 2013 “Thinking, good thinking that…

June 11, 2013

Fickle Investor Sentiment

One common trait of individual investors during the equity bull market run since November is restraint. Based on…

June 10, 2013