Section

risk parity

11 posts

5 Risk-Balanced Asset Allocation with Alex Shahidi and Damien Bisserier, Evoke Advisors

Our guests are Alex Shahidi, and Damien Bisserier, both Managing Partners and Co-Chief Investment Officers at Evoke Advisors.…

April 28, 2021

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Maximizing the Rebalancing Premium: Why Risk Parity portfolios are much greater than the sum of their parts

by Adam Butler, CIO, Resolve Asset Management This short article investigates the rebalancing premium that investors may expect…

December 4, 2020

Ep. 48 Adam Butler, Resolve Asset Management

Risk Parity is the answer. What was the question? Adam and Pierre focus their discussion on diversification…

July 8, 2020

Rodrigo Gordillo: Why most advisors have portfolio construction backwards and how to fix it

Rodrigo Gordillo, Managing Partner and Portfolio Manager at Resolve Asset Management shines a light on one of the…

August 14, 2018

Tell Tail Signs: Is the Reflation Trade Alive? Yes and No...

Is the Reflation Trade Alive? Yes and No... An asset class outlook based on potential tail gains and…

March 31, 2017

Are Factor Portfolios Better Diversified Than Not?

by Corey Hoffstein, Newfound Research This post is available as a PDF here. The debate rages on over…

March 22, 2017

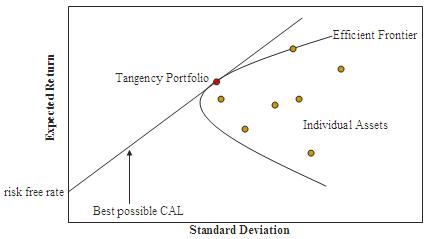

Risk Parity: Why We Lever

Risk Parity: Why We Lever by Clifford Asness, Ph. D. AQR Capital Management, Inc. The role of leverage…

November 10, 2016

Risk Parity and the Four Faces of Risk

by Adam Butler, GestaltU Benjamin Graham famously said that “In the short run, the market is a voting…

November 4, 2016

Cliff Asness: Investing success isn't about genius ― it is about having incredible fortitude

Cliff Asness: Investing success isn't about genius ― it is about having incredible fortitude "I used to think…

November 18, 2015

Bridgewater: Our thoughts about risk parity and all weather

Our thoughts about risk parity and all weather by Ray Dalio, Bob Prince, and Greg Jensen, Bridgewater Associates…

September 29, 2015

Behold the Bounce Back in Risk Parity Returns

by Macro Man Although tomorrow's Fed minutes will likely attempt to elucidate some semblance of a revamped exit…

May 21, 2014