Section

Insight

19352 posts

Why Short-Termism Hurts Investors

by Cullen Roche, Pragmatic Capitalism Earlier this year I spoke about the problem of “the long-term”. This is…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Market's Macro Story in Three Charts

by Brett Steenbarger, TraderFeed Every so often, it is worthwhile to step back and canvas the macroeconomic picture…

Jeremy Grantham: 10 Quick Topics to Ruin Your Summer

by Jeremy Grantham, Chief Investment Officer, GMO LLC 10 Quick Topics to Ruin Your Summer Introduction I have…

Price Insensitive Buyers at Prior Market Peaks

GMO’s Ben Inker had a new piece out this week, and sticking with the firm’s theme from the past few years, he’s doing his best to lower investor expectations: In today’s world, where prices of all sorts of assets are trading … Continue reading →

The post Price Insensitive Buyers at Prior Market Peaks appeared first on A Wealth of Common Sense.Click on the title of this article to go directly to www.awealthofcommonsense.com to see it in it's entirety. Thanks for reading.

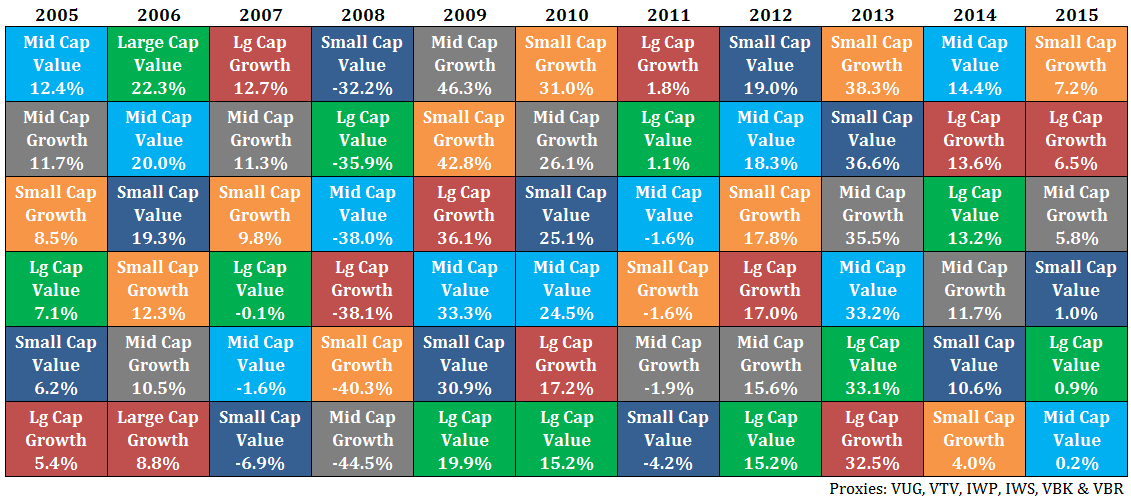

Avoiding Process Drift

We’re roughly seven months into the year and people are already starting to talk about how certain investment styles don’t work anymore. In the financial world people act like seven months is considered statistically significant because everyone assumes that short-term … Continue reading →

The post Avoiding Process Drift appeared first on A Wealth of Common Sense.Click on the title of this article to go directly to www.awealthofcommonsense.com to see it in it's entirety. Thanks for reading.

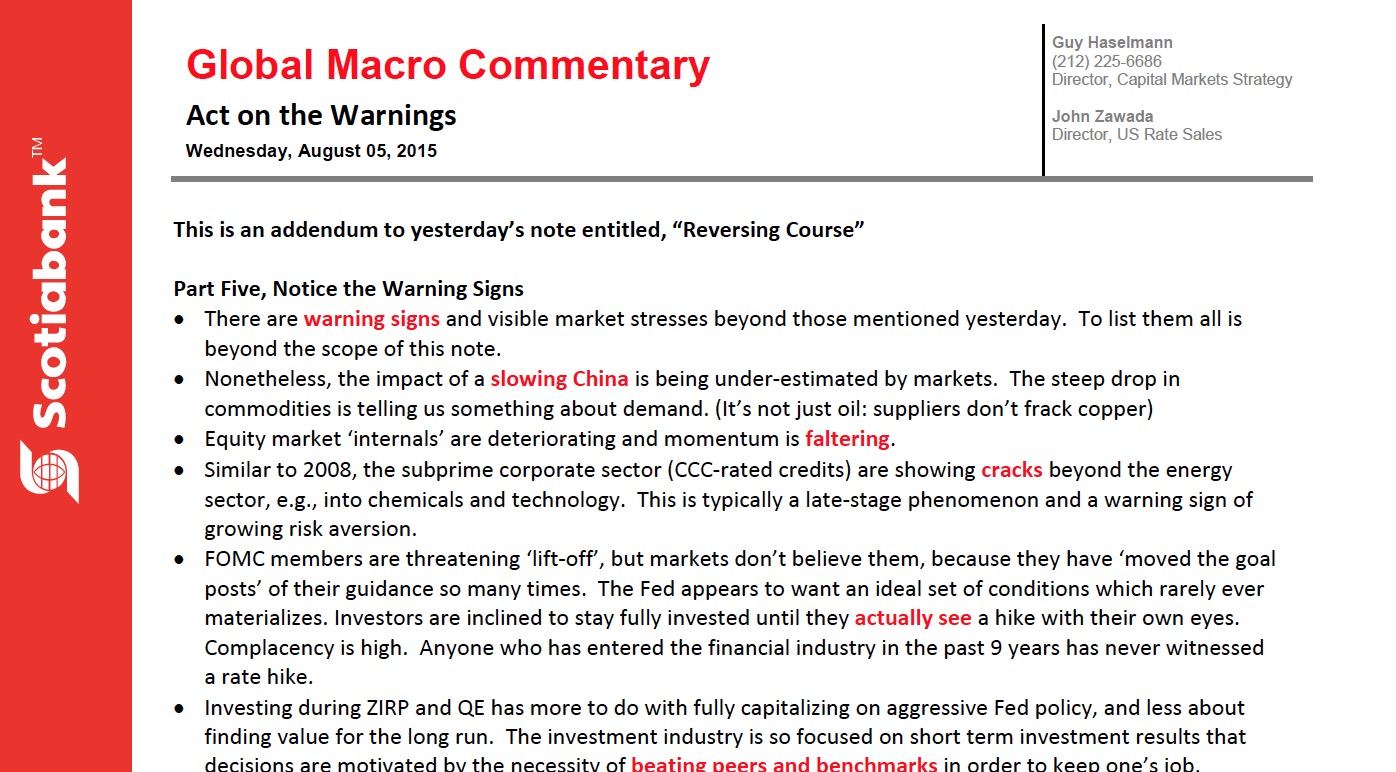

Guy Haselmann: Act on the Warnings

This is an addendum to yesterday’s note entitled, “Reversing Course” by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank…

The expert problem - Mawer

by Mawer Investment Management, via The Art of Boring Blog A better understanding of how and when to…

The expert problem - Mawer

by Mawer Investment Management, via The Art of Boring Blog A better understanding of how and when to…

The expert problem - Mawer

by Mawer Investment Management, via The Art of Boring Blog A better understanding of how and when to…

Guy Haselmann: Changing Course

Part One, China • An economic slowdown is underway in China. This is reflected in the steep drop…

Commodity Price Selling Climax?

by James Paulsen, Wells Capital Management (Wells Fargo Asset Management) Recently, a sharp selloff in the Shanghai stock…

Jeffrey Saut: "It's What You Learn After You Know it All That Counts"

by Jeffrey Saut, Chief Investment Strategist, Raymond James “It’s what you learn after you know it all that…