Section

Fixed Income

3287 posts

What the Flows Show: Emerging Markets Ride the Fed Rollercoaster

The year of the policy-driven market continued in September, with the Fed’s shifting signals impacting global ETF flows…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

High Yield and Bank Loan Outlook - October 2013

Fundamental factors underlying the corporate sector continue to underscore our constructive stance on leveraged credit, however, investors should…

What to do when a Rising Rate Environment is NEAR

[quote]Despite the Fed’s recent decision to delay tapering, many investors are still preparing portfolios for an inevitable rise…

Jeffrey Saut: Ashes to Ashes (October 7, 2013)

“Ashes to Ashes” by Jeffrey Saut, Chief Investment Strategist, Raymond James October 7, 2013 The phrase “ashes to…

John Hussman: When Economic Data is Worse Than Useless

When Economic Data Is Worse Than Useless by John P. Hussman, Ph.D., Hussman Funds [quote]“Errors using inadequate data…

The Economy and Bond Market Radar (October 7, 2013)

The Economy and Bond Market Radar (October 7, 2013) Treasury yields rose modestly this week as attention was…

Government Shutdown: Time To Buy Or Sell Stocks?

by David Templeton, Horan Capital Advisors With the government shutdown completing its third day, investors are certainly asking…

Guest Post: Three Rising Risks to The Markets

Submitted by Lance Roberts of STA Wealth Management, I have written about in the past the detachment between…

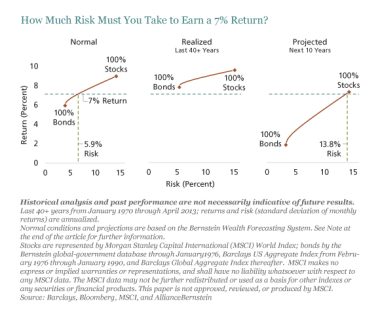

You've Got to Take Risk. So, Manage It

by Seth J. Masters (pictured), Daniel J. Loewy and Martin Atkin, AllianceBernstein Below-average expected returns will make it…

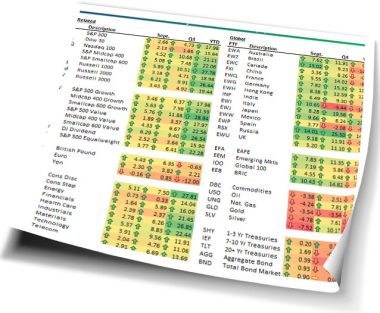

September, Q3 and YTD Asset Class Performance

by Bespoke Investment Group September and the third quarter have now come and gone, and below is our…

The Fed Did Nothing—but Bond Investors Can Act Now

by Douglas J. Peebles, AllianceBernstein The US Federal Reserve surprised the market on September 18 when it announced…

The Bigger Threat Than a U.S. Government Shutdown

by Russ Koesterich, Portfolio Manager, Blackrock Most headlines today are focusing on the looming possibility of a government…

Do We Actually Buy A Piece of A Business When We Buy Stocks?

by Ivan Hoff, Ivanhoff Capital When I try to explain the stock market to people with no experience,…

The Economy and Bond Market Radar (September 30, 2013)

The Economy and Bond Market Treasury yields rallied sharply again this week after last week’s surprise announcement from…