Section

Energy & Natural Resources

994 posts

Why the Future Still Means Fossil Fuels, for Now

by Fred Fromm and Matthew Adams, Franklin Equity Group, Franklin Templeton Despite some news reports that suggest the…

February 2, 2021

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

MacroView – The Energy Rally Is Likely Premature

by Lance Roberts, RIA The rally in energy companies is likely premature. To understand why such may be…

December 13, 2020

Extraordinary Opportunity: Investing in the Great Energy Transition

While the environmental and economic threats posed by climate change are immense, the investment opportunities being created in the search for renewable power are equally unprecedented. It’s become evident that the great transition from fossil fuels to renewable energy stands to be one of the most important developments of the new millennium – for both investors and the planet.

October 30, 2020

Smead’s Folly Becomes Newsom’s Folly

by William Smead, Smead Capital Management We became extremely bearish on energy in 2011. At the time, we…

September 29, 2020

Canada’s changing energy sector

by Craig Basinger, Derek Benedet, Chris Kerlow, Alexander Tjiang, Brett Gustafson, Richardson GMP Canada’s energy sector has gone…

September 28, 2020

Precious Commodities: Assessing Gold and Oil in the Pandemic Age

Dynamic Funds' Portfolio Managers, Robert Cohen and Jennifer Stevenson views on gold and oil, and positioning in the current economic climate.

June 24, 2020

What Plunging Oil Prices Mean for Energy Bonds

by Gershon Distenfeld, Co-Head, Fixed Income, AllianceBernstein On April 20, the price of oil skidded into negative territory…

April 23, 2020

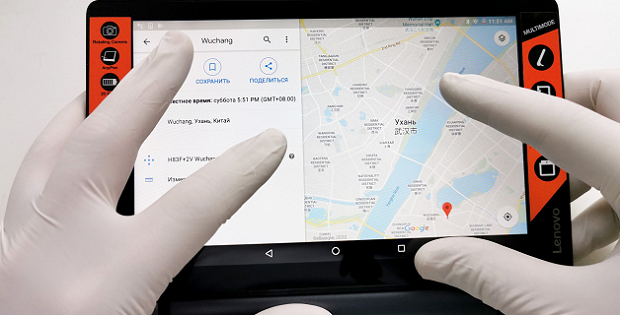

Implications of the Coronavirus for Natural Resource Investors

by Fred Fromm, Franklin Templeton Investments There’s no question the Novel Coronavirus has brought suffering to many people,…

February 19, 2020

Roil over oil? How rising Iran-U.S. tensions could impact markets

by Paul Eitelman, Russell Investments On the latest edition of Market Week in Review, Senior Investment Strategist Paul…

June 17, 2019

Niels Jensen: Addicted to Oil?

by Niels Jensen, Absolute Return Partners LLP We aren't addicted to oil, but our cars are. R. James…

May 5, 2019

Earnings season is beating expectations. How low were the expectations?

by Erik Ristuben, Russell Investments Q1 U.S. GDP number blow past expectations. Why did markets fail to respond?…

April 29, 2019

What Impact Chair Powell's Speech May Have on Rates, and a Look at Natural Gas Prices

Stock markets around the world have run into a number of headwinds this year that have led to…

November 30, 2018

The Crude Reality of Oil’s Bear Market

Oil has garnered a lot of attention from market watchers in recent weeks after entering a bear market…

November 22, 2018

Why the energy stock selloff may be overdone

Unless oil prices collapse, energy stocks now appear to be cheap, as Russ explains. While much ink has…

November 19, 2018

There is a Huge Disconnect Between Energy Credit and Equity

by Stephen Vanelli, CFA, Knowledge Leaders Capital Oil prices have swung drastically over the last couple months. The…

November 14, 2018