Section

QE

208 posts

Gold And The Four Words That Define Western Economic Policy

Submitted by Tim Price via Sovereign Man blog, Despite nearly $17 trillion reasons, there are investors stupid enough…

October 11, 2013

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Alfred Lee: Investment Outlook (October 10, 2013)

Fed Fake-Outs and Debt Ceilings by Alfred Lee, CFA, CMT, DMS Vice President, BMO ETFs Portfolio Manager &…

October 10, 2013

Tipping the Scale Toward High Yield Bonds

The U.S. Federal Reserve’s decision in September to delay at least for now any reduction in its asset…

October 10, 2013

Meet the New (Fed) Boss: Yellen

Amid partisan political rancor over fiscal policy comes the nomination of Janet Yellen for the next Chair of…

October 10, 2013

What the Flows Show: Emerging Markets Ride the Fed Rollercoaster

The year of the policy-driven market continued in September, with the Fed’s shifting signals impacting global ETF flows…

October 9, 2013

Guest Post: Five Years In Limbo (And Counting)

by Joseph Stiglitz, originally posted at Project Syndicate, When the US investment bank Lehman Brothers collapsed in 2008,…

October 9, 2013

James Paulsen: Investment Outlook (October 8, 2013)

While Washington Argues ... Adam Smith Solves Problems! The current fiscal drama highlights the cultural obsession this country…

October 8, 2013

Jeffrey Saut: Ashes to Ashes (October 7, 2013)

“Ashes to Ashes” by Jeffrey Saut, Chief Investment Strategist, Raymond James October 7, 2013 The phrase “ashes to…

October 8, 2013

'Til Debt Do Us Part

Here we go again. As if the federal government shutdown isn’t bad enough, the U.S. government now has…

October 7, 2013

Fear The Boom, Not The Bust

Submitted by Frank Hollenbeck via the Ludwig Von Mises Institute, If you listen to TV commentators, you’ve been…

October 7, 2013

The Fire Fueling Gold

The Fire Fueling Gold By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors Gold took…

October 6, 2013

The Economy and Bond Market Radar (October 7, 2013)

The Economy and Bond Market Radar (October 7, 2013) Treasury yields rose modestly this week as attention was…

October 6, 2013

Scott Minerd: Buying the Shutdown

October 2nd, 2013 Volatility from the government shutdown and other political developments in Washington D.C. will likely continue…

October 4, 2013

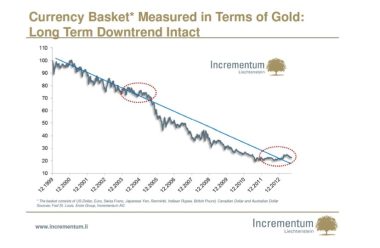

Bearish USD Outlook is Bullish Tailwind for Commodities

It continues to appear as if the major metals are in a bottoming process. When I last wrote…

October 3, 2013

The Death Knell of the Global Synchronized Trade

by William Smead, Smead Capital Management Dear Fellow Investors, At Smead Capital Management, we believe the interest on…

October 2, 2013