Section

Interest Rates

1013 posts

Why Low Interest Rates and Large Cash Balances Skew P/E Ratios

by Aswath Damodaran, Musings on Markets For an asset that should be easy to value and analyze, cash…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

What's Up With the USD and Rising Long-term Yields?

by SIACharts.com It has only been a month and a half since we last looked at both the…

Despite Historic Compression, Stocks are Stuck in a Range

by Dana Lyons, J. Lyons Fund Management, Inc. On April 24, we posted what we thought (and hoped)…

Guy Haselmann: Down Side Up

“It isn’t that they can’t see the solution. It is that they can’t see the problem.” – G.K.…

Macro Market Musings for May: The Case for TIPs

by Erik Swarts, Market Anthropology The U.S. dollar index pulled back sharply last month from the relative performance…

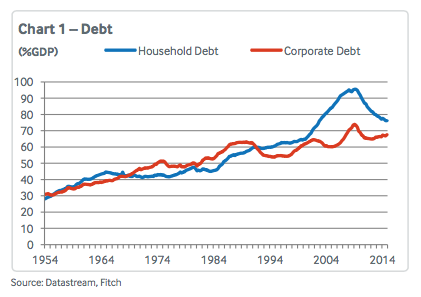

Where to Now for the US Recovery - Can Indebtedness and Interest Rates Both Increase?

For the first time since the early 1980s, the US economic outlook may face simultaneous increases in debt…

Anthony Valeri: Cross Currents

KEY TAKEAWAYS Intermediate to long-term Treasury yields increased by 0.01% to 0.11% for the week ending April 24,…

Let The Economists Obsess Over Rising Rates

by Michael Batnick, The Irrelevant Investor At this point you’re probably tired of all the speculation about whether…

Afraid of Rising Rates? Don’t Be.

by Ashish Shah and Ivan Rudolph-Shabinsky, AllianceBernstein Sometime this year, the Federal Reserve will probably raise interest rates…

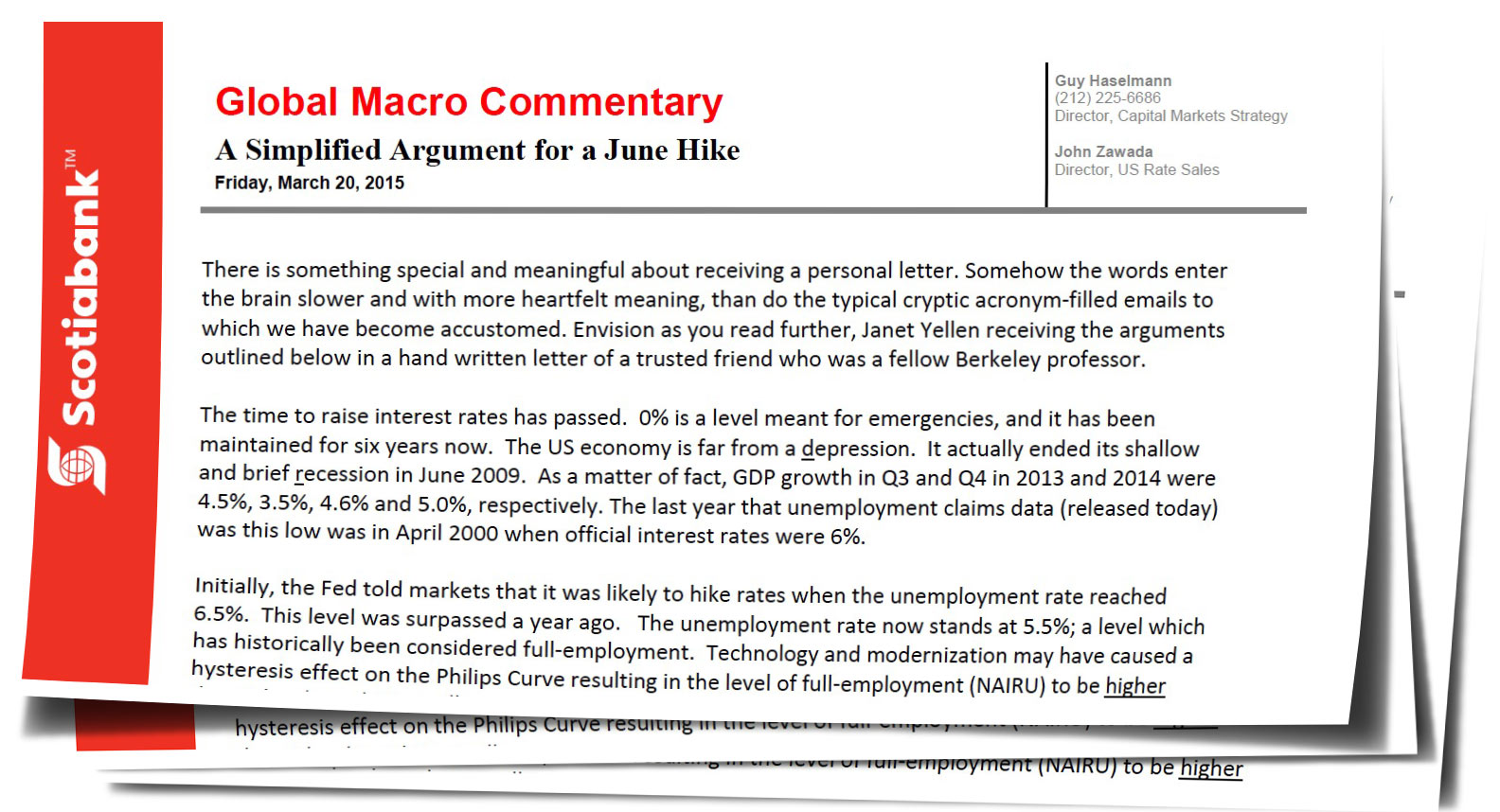

A Simplified Argument for a June Hike

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM There is something special and meaningful about receiving a…

Fed tightening + HY distress = 2015 bear market?

by Cam Hui, Humble Student of the Markets Despite my bullish stock market outlook (see my last post…

LPL Research: Outlook 2015 Spring Update

LPL provides a Spring update to their 2015 outlook on the stock market, bond market, and economy.

The World is Topsy Turvy, Thanks to Heavy Distortions

by Kara Lilly, Investment Strategist, Mawer Investment Management For a country whose population is smaller than that of…

Could the Search for Income Lead to Instability?

by Daniel Loewy and Morgan Harting, AllianceBernstein Years of quantitative easing has pushed yields on government bonds down…

Guy Haselmann: How Far Behind the Curve is the Fed, Anyway?

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM I responded to an email question this morning with…