By Craig Burelle, VP, Macro Analyst, Loomis Sayles

With limited evidence of excess in the global financial system and mostly low interest rates around the world, we remain optimistic about global economic prospects. The expansion is poised to continue, led by growth in emerging economies.

Long Road to Travel Before Reaching “Tighter” G-3 Monetary Policy

The global economy’s post-crisis economic recovery is a little over eight years old. And now, after years of monetary stimulus, the US, Europe and Japan are seeing firmer growth and inflation data, but inflation data continues to indicate price growth beneath each central bank’s target—including the Federal Reserve’s (Fed’s). For this reason we believe monetary policymakers will shift gears slowly, removing monetary accommodation over a period of years, and at a pace commensurate with underlying economic fundamentals.

KEY TAKEAWAYS

- Annual global growth is expected to accelerate in 2017 but level off at the same growth rate in 2018.

- Global headline inflation looks headed for a slight uptick in 2017 and a modest decline in 2018.

- EM profit and economic growth are running ahead of DM, and we believe this can continue.

- Central bank transparency is contributing to low realized market volatility.

- Risk assets and government bonds should be able to earn positive total returns in the current environment.

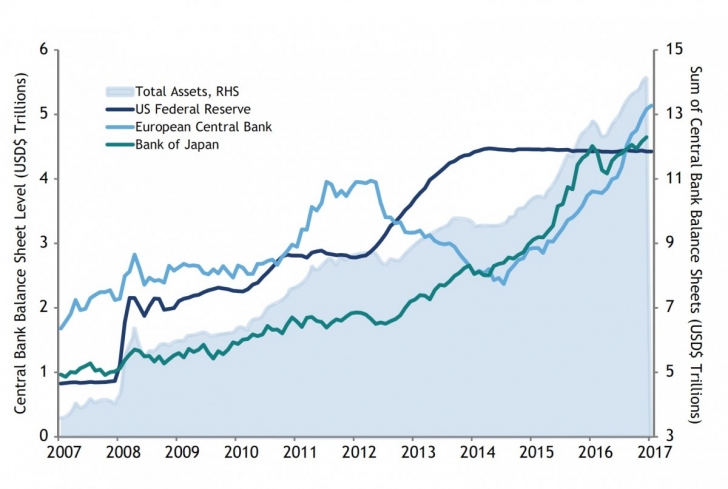

G3 CENTRAL BANK BALANCE SHEETS

Source: US Federal Reserve, European Central Bank, Bank of Japan, data as of 9/13/2017.

The US expansion is more advanced than Japan and Europe, prompting the Fed to move to less accommodative policy sooner than other central banks. The Fed has hiked four times since December 2015, with another hike expected in December 2017. Market watchers are now turning their attention to the Fed’s balance sheet taper, an effort to shrink the central bank’s $4.5 trillion balance sheet, set to begin in October. The tapering process allows maturing securities to roll off at a monthly pace of $6 billion for Treasurys and $4 billion for agency MBS. We expect the monthly pace to grow by $6 billion and $4 billion for Treasurys and agency MBS, respectively, per quarter until reaching monthly limits of $30 billion for Treasurys and $20 billion for agency MBS. The Fed is taking a conservative approach in our view, and we believe it will most likely become a blueprint for other developed market (DM) central banks when they eventually begin decreasing their balance sheets.

In the euro zone, annual real GDP has been decent since 2014, growing at a rate of between 1.3% and 2.0% annually for the past three years with 2017 expected to show approximately 2.1% growth. However, the inflation data has been disappointing and considerably behind the US, which is prompting the European Central Bank (ECB) to maintain ultra-accommodative policy. While the current ECB quantitative easing program is scheduled to expire in December of this year, a further tapering of purchases is up for debate. In either event, we do not expect an ECB rate hike within the next 12 months. The timeline for balance sheet shrinkage is even further out on the horizon for the ECB. In Japan, economic recovery is progressing more slowly than in the US and Europe, particularly on the inflation front. Annual real GDP growth has trended around 1.0% for the past few years, but inflation has been disappointing, failing to break above 1.0% for any meaningful period of time. Japan’s struggle to prop up inflation should keep the Bank of Japan in accommodative mode for the foreseeable future.

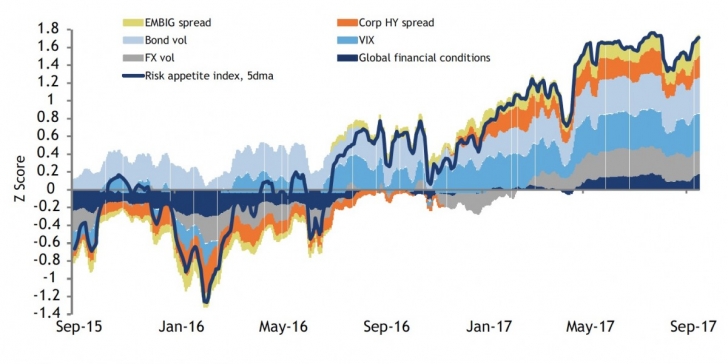

Risk Appetite Remains Strong as Markets Shrug Off Alarming Headlines

The macroeconomic environment is quite sanguine thanks largely to measured positions from major central banks and steady economic activity. Our proprietary risk appetite index, which aggregates six variables across asset classes, indicates a level of investor tolerance for holding securities of higher risk than Treasurys. Risk appetite has remained strong this year, and we expect the trend to continue into 2018, barring any unexpected events that would dramatically raise systemic risk. The markets have shrugged off recent headlines related to US politics, geopolitics, cyber security threats and even weather, and most asset prices have continued to appreciate. Rather than focusing on known risks with unknown outcomes, most markets appear to be focused on underlying fundamentals. The US dollar’s decline relative to foreign currencies year to date has been a key driver of emerging market (EM) asset performance and has supported US multinational corporate profits. Globally, corporate profits are in a synchronized upturn for the first time since 2006, and equity and credit indices in the US and abroad have embraced this profits acceleration.

RISK APPETITE REMAINS STRONG

Source: Loomis Sayles, data as of 9/15/2017.

The risk appetite index is a proprietary indicator maintained by the Loomis Sayles Macro Strategies Group.

Looking forward, we believe the US dollar should remain stable to slightly weaker relative to global peers, particularly in EM where economic growth in aggregate has been outpacing the US. While short-term US Treasury yields have moved higher this year along with the federal funds rate, longer-term yields from the 5- to 30-year maturity have actually declined year to date, supporting the global fixed income carry trade. An inflation shock could tighten financial conditions and cause yields to rise in the future, but over the next 12 months, we think stable to slightly higher medium- to long-term yields are more likely. Central banks have also telegraphed policy changes quite clearly, which seems to have increased investor confidence that a policy error is less likely.

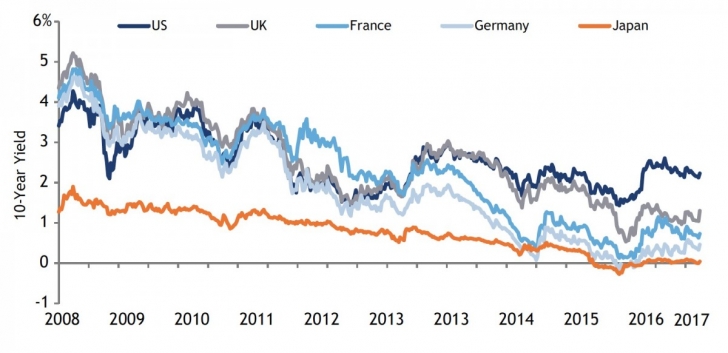

Government Bond Yields are Expected to Rise, but Not Substantially

Most government bond yields are below pre-crisis levels, and changes to the inflation outlook and monetary policy should continue to drive yields. Fed policy has helped make the US 10-year one of the highest yielders in the developed world. ECB policy shifts may increase euro zone yields next year and thereafter. Japan’s government bond market should follow suit, but in the more distant future.

GLOBAL YIELDS BENEATH PRE-GFC LEVELS 10-Year Developed Market Government Yields

Source: Thomson Reuters Datastream, data as of 9/18/2017.

Although DM should see higher yields in the future, the trajectory looks low based on our benign view of inflation and monetary policy over the near to medium term. Developments like increased competition and technological advancement have contained inflationary pressure in many economies during this cycle. A muted rise in medium- to long-term yields over time should have limited impact on long-duration securities like investment grade corporates; however, an inflation shock would likely spur less positive outcomes.

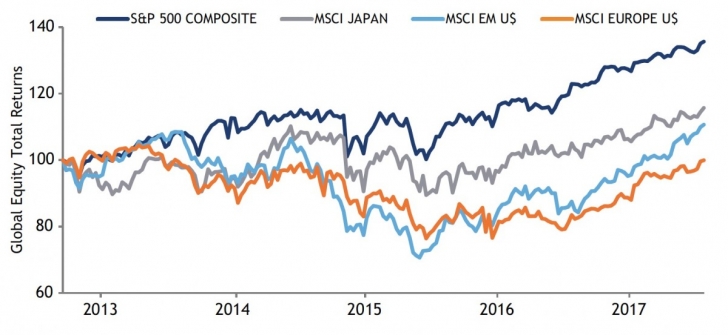

Strong Profits Growth and Low Rates Continue to Support Equity Valuations

Corporate profits rebounded globally earlier this year and have since broadly exceeded market consensus expectations. This development has propelled global equity markets higher and supports somewhat elevated price-to-earnings multiples (P/Es). At this stage in the US expansion, we do not believe P/E multiples have much further to rise given our economic outlook and interest rate expectations. However, multiples can remain somewhat higher than historical comparisons if long-term interest rates stay low and profits continue to grow globally. In fact, the S&P 500® Index operating earnings yield (the inverse of the P/E ratio) relative to long-term US Treasury bond yields indicates Treasurys have been relatively overvalued since the global financial crisis. Even when measured to US investment grade or high yield credit indices, the S&P 500 Index still looks relatively undervalued, an important factor supporting the index P/E ratio.

GLOBAL EQUITIES WORKING TO CLOSE THE PERFORMANCE GAP

Global Equity Total Return

Source: Bloomberg History and Consensus Forecast, Thomson Reuters Eikon, data before extraordinary items as of 6/22/2017, forecast through Q1 2018.

In what is still a fairly low economic growth environment, we have seen more growth-oriented sectors like information technology generally show global performance leadership year to date and in the third quarter. Sectors with relatively higher profits growth have outperformed the broader market, which partially explains why growth has outperformed value year to date. Value sectors like financials and industrials tend to outperform when an economy is accelerating, and while growth has improved since 2016, the level of acceleration was not material from a sector allocation perspective. In the US, large cap corporate profit growth has run ahead of US small caps this year, and relative performance reflects that outcome. We expect US multinationals and EM equities to benefit from positive currency translation effects through the fourth quarter of 2017.

Second-quarter profit growth in global equity markets like Europe and Japan exceeded the US on a year-over-year basis, but relative performance did not reflect those results. On a year to date basis, a relative performance gap remains between the US and global indices when measured in local currency terms. However, in US dollar terms Europe and Japan have shown strong outperformance relative to the S&P 500 for the period due to euro and yen rallies, respectively. The S&P 500’s nearly 14% return on equity (ROE) is a leader compared to EM at nearly 12% and Europe and Japan at about 10%. Global equity index ROE has been higher in the past, and we are not ruling out fundamental improvement in the future. We believe strong profits growth can continue, albeit at a slower rate than during the first half of 2017, giving global equity performance a chance to catch up to the US.

Macro Backdrop Should Remain Positive for Risk Assets Moving into 2018

A steady global economic backdrop has fostered an environment where risk assets like high yield credit and equities, as well as less risky government bonds, can potentially deliver positive total returns to investors. We remain optimistic about global economic prospects and will look to riskier assets to generate excess returns over US Treasurys in the quarters ahead. The macroeconomic backdrop of stable growth and inflation is expected to persist moving forward as long as systemic risks do not emerge and cause major disruptions. Valuations, whether option-adjusted spreads on credit indices or equity P/E multiples, remain on the high side; however, continued profit growth should remain a key pillar supporting valuations. If financial conditions remain commensurate with economic activity, meaning monetary accommodation is not removed too aggressively, we believe that many asset classes could generate positive absolute annual returns moving forward over the next 12 months, although perhaps less than historical averages.

*****

Forecasts contained herein are the product of Bloomberg, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Other industry analysts and investment personnel may have different views and opinions.

Disclosure

This commentary is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis do not represent the actual or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office.

AUTHOR

CRAIG BURELLE VP, Macro Analyst

MALR020731

Copyright © Loomis Sayles