by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

June 12, 2017

Last week investors shrugged off even more drama coming out of Washington. Stocks continued to rally and hit record highs, even as former FBI director James Comey testified that, in his opinion, President Donald Trump fired him in an attempt to lift the “cloud” of the Russia investigation.

If true, this suggests obstruction of justice, an impeachable offense. And if impeached, or in the event of a resignation, Trump’s political agenda would likely be derailed. The last (and only) time a U.S. president resigned, the Dow Jones Industrial Average lost up to 40 percent, as a recent article in TheStreet reminds us.

But markets paid no mind to Comey’s insinuations, underscoring investors’ confidence that tax reform and deregulation will proceed as planned. And sure enough, just hours after Comey testified, the House of Representatives voted to repeal key parts of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which has contributed to an alarming number of small bank closures since its passage in 2010.

So once again, the wisdom of crowds prevails. If you remember, markets were forecasting as far back ago as last summer that Trump would win the November election.

This doesn’t mean, however, that Trump’s problems are behind him.

Last week I was speaking with Mike Ward, a top publisher with Agora Financial, who compared Presidents Trump and Ronald Reagan. It was suggested that, despite Trump’s apparent affection for the 40th president, he has so far failed to live up to the Great Communicator’s memory of optimism and deep respect for the office.

Whereas Reagan wanted to “tear down this wall,” Trump wants to “put up that wall.” Whereas Reagan insisted it was “morning in America,” Trump insists it’s “American carnage.” Reagan succeeded in building coalitions and unifying our allies against the Soviet Union. Trump has already managed to destabilize many of those alliances.

During the 1988 vice-presidential debate, Texas Senator Lloyd Bentsen famously ribbed then-Senator of Indiana Dan Quale for comparing himself favorably to John F. Kennedy. “I served with Jack Kennedy. I knew Jack Kennedy,” Bentsen said. “Senator, you’re no Jack Kennedy.”

Similarly, many observers are of the opinion that Trump is no Reagan.

Don’t get me wrong. I remain hopeful. President Trump wants to make America great again, and it’s still well within his power to do so—if he can practice some self-restraint and not get caught up in petty feuds. Voters support his vision. They gave him not only the Executive Branch but also Congress and most states’ governorships and legislatures.

You could say I’m hoping for the best but preparing for the worst. I advise investors to do the same. No one can say what the future holds, and it’s prudent to have a portion of your portfolio in gold, gold stocks and short-term, tax-free municipal bonds, all of which have a history of performing well in volatile times.

Gold Poised for a Breakout

Following bitcoin’s breathtaking ascent to fresh highs, gold rose to a seven-month high last week on safe-haven demand, stopping just short of the psychologically important $1,300 level. Supported by Fear Trade factors such as geopolitical turmoil—both in the U.S. and abroad—and low to negative government bond yields, gold’s move here can be seen as a bullish sign.

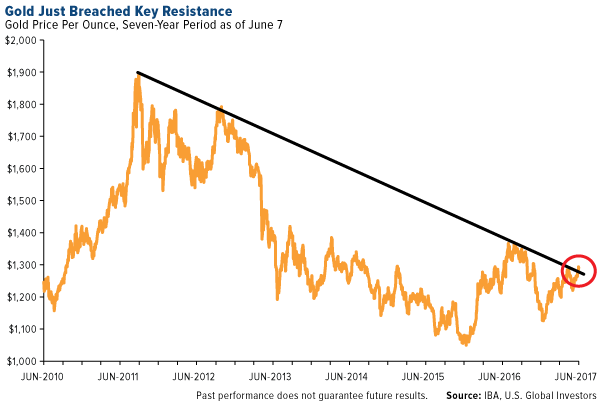

As others have pointed out, the yellow metal breached the downward trend of the past six years, possibly pointing to further gains.

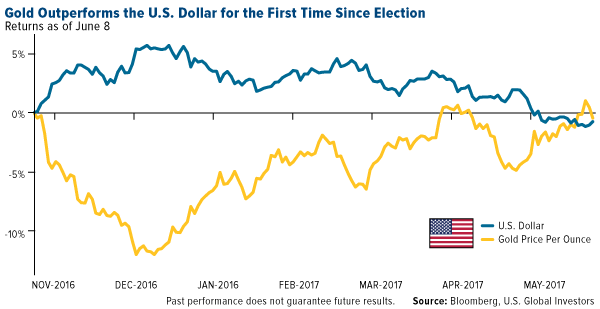

Under pressure from a beleaguered White House and stalled policy reform, the U.S. dollar continued to sink last week, with gold outperforming the greenback for the first time since the November election. Because gold is priced in dollars, its value increases when the dollar contracts.

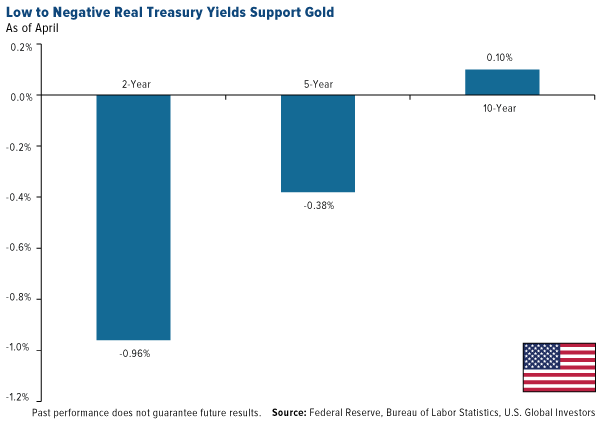

It’s also important for investors to remember that gold has often rallied when Treasuries yielded little or nothing. Why would investors knowingly lock in guaranteed losses for the next two or five years, or near-zero returns for the next 10 years? That’s precisely what Treasuries are offering, as you can see below:

Minus inflation, the two-year Treasury yielded negative 0.96 percent in April; the five-year, negative 0.38 percent; and the 10-year, a paltry 0.10 percent. (I’m using April data since May inflation data won’t be available until this Wednesday, but I expect results to look the same.)

When this happens, investors tend to shift into other safe-haven assets, including municipal bonds and gold.

Year-to-date, the yellow metal is up more than 9.7 percent, even as the stock market extends its rally. This runs counter to what we’ve seen in the past. As I’ve explained before, gold usually has a low correlation to other assets, including stocks and bonds, which is why investors all around the globe favor it as a diversifier.

So what gives?

Top Money Managers Sound the Warning Bell

One of the most compelling answers to this question, I believe, is that stocks appear to be overvalued right now, in turn boosting gold’s safe-haven investment case. This is the assessment of Bill Gross, the legendary bond guru who currently manages $2 billion with Janus Henderson.

Speaking at the Bloomberg Invest New York summit last week, the 73-year-old Gross said markets are now at their highest risk levels since before the 2008 financial crisis. Loose monetary policy has artificially inflated stock prices despite weak economic growth, he said, adding: “Instead of buying low and selling high, you’re buying high and crossing your fingers.”

Marc Faber, the Swiss investor often referred to as Dr. Doom, echoed Gross’ thoughts, telling CNBC last week that “everything” is in a bubble right now, similar to the days of the dotcom bust of the late 1990s. And when this bubble bursts, Marc said, investors could lose as much as half of their assets.

That stocks appear overvalued could be a driver of gold’s performance right now, with savvy investors, anticipating a possible market correction, loading up on assets that have historically held their value in times of economic crisis.

A cadre of other top money managers and analysts share Bill Gross and Marc’s less-than-rosy market view.

At the same Bloomberg event, billionaire hedge fund manager Paul Singer—whose firm, Elliott Management, recently raised $5 billion in as little as 24 hours—warned attendees that the U.S. was at risk of another debt shock.

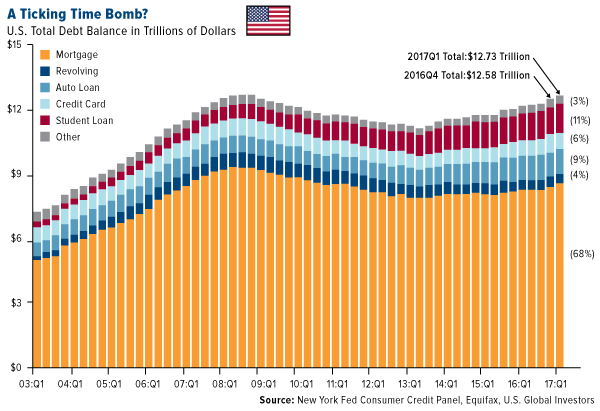

“What we have today is a global financial system that’s just about as leveraged—and in many cases more leveraged—than before 2008, and I don’t think the financial system is more sound,” Singer said.

Indeed, U.S. debt levels are higher now than they’ve ever been, according to the Federal Reserve Bank of New York. In the first quarter of 2017, total U.S. household indebtedness reached a mind-boggling $12.73 trillion. That’s $150 billion more than the end of 2016 and $50 billion above the previous peak set in 2008.

Even more concerning is the fact that the number of delinquencies grew for the second straight quarter as more income-strapped Americans binged on credit. We could be headed for a massive hangover.

Cumulatively, these warnings stress the importance of hoping for the best while planning for the worst. In the past, there have been few ways as effective at preserving wealth as gold, gold stocks and tax-free, short-term munis.

Gold Vaults a Sign of Increased Demand

The world’s two largest consumers of gold by far, China and India, are currently importing enormous amounts of the yellow metal on safe-haven demand. Bloomberg reports that China could boost its gold purchases from Hong Kong as much as 50 percent this year over concerns of currency devaluation, a slowing real estate market and shaky stocks. Imports could advance to 1,000 metric tons, which would be the most since 2013.

Meanwhile, India—whose affection for gold goes back millennia—saw its imports of the yellow metal rise fourfold in May compared to the same month last year as traders fear a higher tax rate on jewelry. Imports climbed to 126 tons, versus 31.5 tons last May.

As impressive as this news is, there’s no sign more compelling that investors have an insatiable appetite for gold right now than the growing demand for safety-deposit boxes. According to Bloomberg, companies in Europe are scrambling to meet customers’ needs for a safe, inexpensive place to store their bullion in the face of negative interest rates and rising inflation. Two firms in particular have plans to build additional facilities capable of holding 100 million euros ($112 million) each in bars and coins.

Daniel Marburger, CEO of European coin dealer CoinInvest, told Bloomberg that he had just finished working with a German customer whose bank account was charged negative interest rates. To prevent this from happening again, the customer converted his cash into gold and silver, which he sees as a more reliable store of value.

Negative rates are “definitely a driving factor and will lead to more sales and also more storage clients,” Marburger said.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors