by Blaine Rollins, CFA, 361 Capital

The last two weeks of June are usually a good time to recharge the batteries and get away. Unfortunately, last week kept many of those out of the office attached to their smartphones and their boats tied up at the docks. Politics in Washington, London and Paris kept much of our attention while the Fed ignored current U.S. economic weakness and raised rates 25 basis points. Technology stocks continued to trade more violently than in recent months, while Amazon informed Alexa that it wanted to buy aisles 1 through 16. Equity volumes across the board were a bit lighter, but traders were still very active in the volatile sectors. For long investors, it was a week to lighten up on lower conviction names and add to recently depressed top picks. Without diving into the individual names, listed below are some areas of the market that I still want to own.

I want to own U.S. Tech stocks…

Sure the name has been hit hard with profit taking, but many of the names and the sector itself is still holding trend. The group has good top and bottom-line growth potential and is not expensive. If current economic weakness continues to flounder, its non-cyclical growth characteristics should make the group more attractive than cyclical stocks.

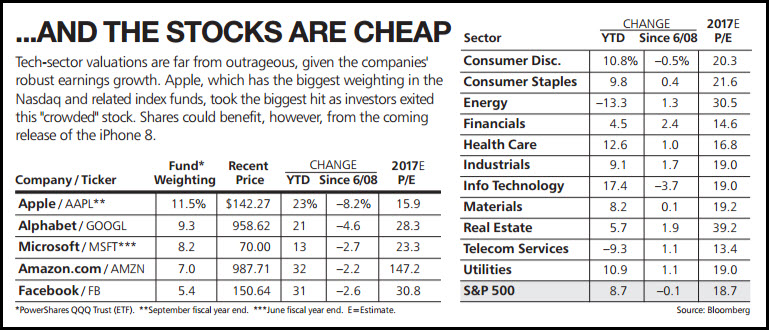

A good call by Barron’s this weekend with their ‘Buy Tech’ cover story which should pay for your subscription this year…

(Barron’s)

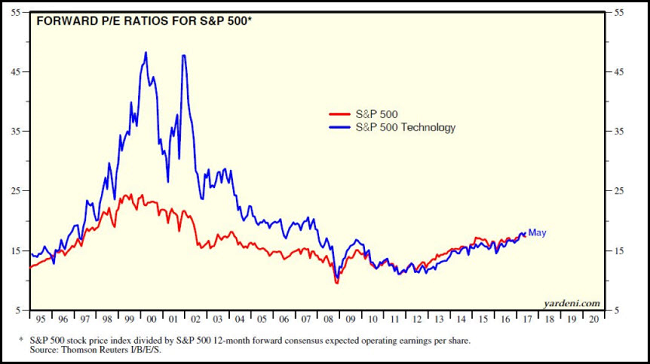

Looking back again at the long-term relative valuations shows that Tech P/E’s look quite similar to the overall market…

(@yardeni)

I want to own Consumer Discretionary stocks…

Grab the isolated market share growth stories and ignore those losing share, pricing and thus margins.

I want to own Healthcare…

Like Tech, if the U.S. economy flounders, growth will outperform. There are plenty of solid, non-cyclical growth stories within the Healthcare space. You can also own the Healthcare ETFs and get broad exposure across big drugs, biotech, HMOs and the device companies. With healthcare stuck in D.C., legislative changes don’t look like they will disrupt much at the companies in 2017 or 2018.

I want to own Developed International stocks…

Especially the European continent, Japan and developed Asia. U.S. dollar weakness and improving global growth should help to put the wind at the back of foreign stocks. And those big dividend yields in Europe are very nice.

I want to own Emerging Market bonds…

If you need to own bonds, or just want a diversifier to your all-equity portfolio, and gather some income, EM bonds are a good place. In a world awash in liquidity and improving foreign currencies, EM bonds are providing 4-6% yields.

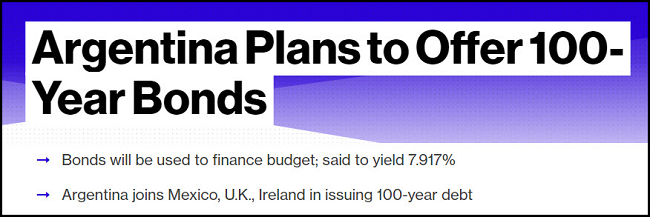

Times are so good in EM that now even Argentina can throw deep…

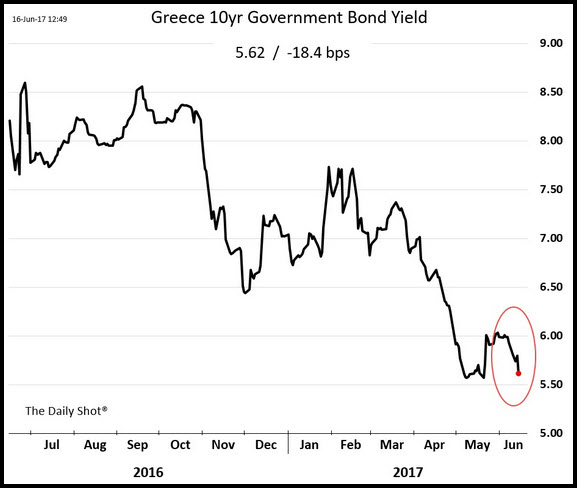

Next up, the 100 year Ouzo bond!

(WSJ’s Daily Shot)

Finally, a marriage of my two favorite retailers…

But as Recode notes, this is not just Bezos buying grocery stores. He is getting many retail locations that can also become package and pickup locations. They have a plan for retail grocery and I can’t wait to see it.

Amazon took a big leap into the grocery industry when it announced its intention to buy Whole Foods for $14 billion.

But the deal gives Jeff Bezos something else he craves: More than 400 brick-and-mortar stores that could also serve as same-day delivery hubs, especially in urban centers.

In its ongoing quest to put packages on customer steps as quickly as possible, Amazon has rolled out one-hour delivery in dozens of cities through its Prime Now service.

But there’s a very big obstacle to making the economics work for that business: Finding, and paying for, enough warehouse real estate to cover as many areas of a city as possible to increase delivery efficiency.

This deal could help long-term in this way, even if it’s just to store and supplement the fresh grocery component of Prime Now, which has a relatively small selection today.

(Recode)

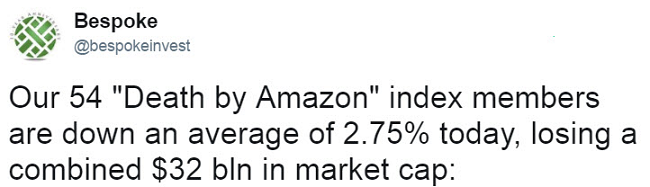

As you would expect, the rest of the brick and mortar retail industry was shook on Friday…

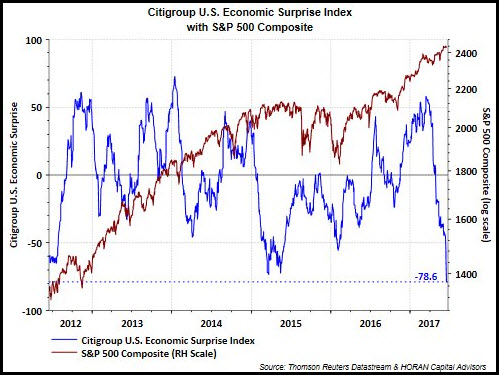

So is the market trying to tell us that the economic surprises are going to uptick?

Or is it that the cyclical components of the stock market are just ignoring all the weakness and that their multiples will continue to expand? I am just as perplexed as you are.

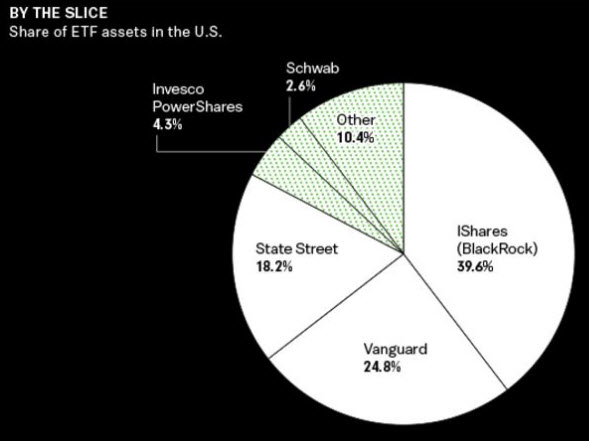

These are some amazing ETF statistics…

That’s because the dominance of BlackRock, Vanguard, and State Street is staggering: Together they oversee 83 percent of the ETF market in the U.S. The 50 largest funds in the world are theirs. They also capture more than half the American industry’s fee revenue, despite the bargain-basement prices they charge for many products. “It’s basically a battle between King Kong, Godzilla, and Mothra, with everybody else fighting over scraps and crumbs,” says Eric Balchunas, an ETF analyst for Bloomberg Intelligence.

Munis without broadband will need to open the coffers to spend on it or their towns will die…

In many rural communities, where available broadband speed and capacity barely surpass old-fashioned dial-up connections, residents sacrifice not only their online pastimes but also chances at a better living. In a generation, the travails of small-town America have overtaken the ills of the city, and this technology disconnect is both a cause and a symptom.

Counties without modern internet connections can’t attract new firms, and their isolation discourages the enterprises they have: ranchers who want to buy and sell cattle in online auctions or farmers who could use the internet to monitor crops. Reliance on broadband includes any business that uses high-speed data transmission, spanning banks to insurance firms to factories.

Rural counties with more households connected to broadband had higher incomes and lower unemployment than those with fewer, according to a 2015 study by university researchers in Oklahoma, Mississippi and Texas who compared rural counties before and after getting high-speed internet service.

“Having access to broadband is simply keeping up,” said Sharon Strover, a University of Texas professor who studies rural communication. “Not having it means sinking.”

(WSJ)

Finally, the best girl power tweet of the week…

Get us to space again girls! We have some asteroids that need to be mined.

Copyright © 361 Capital