Why Bond Investors Should Mix Rates and Credit - Context

by Fixed Income AllianceBernstein

Fixed-income assets come in two varieties: risk-reducing and return-seeking. Most of the time, they add value at different times and in different market environments.

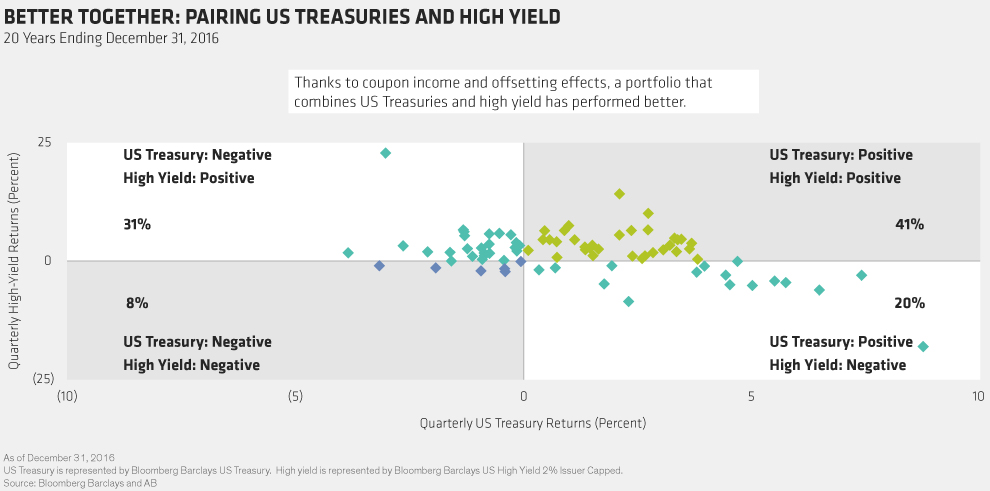

High-yield bonds, a return-seeking asset, and US Treasuries, a risk reducer, took turns outperforming each other more than half the time over the last two decades. Pairing them in a single portfolio allows an investor to rebalance regularly by selling the outperformers and buying the underperformers. Over time, that can minimize drawdowns and provide a relatively high level of income.

But here’s another thing about bonds: they’re very good at generating income. That means they often generate positive returns even when their prices decline. Over the last 20 years, high-yield bonds and US Treasuries did that 41% of the time.

That’s something to keep in mind in a rising-interest-rate environment. Sure, most risk reducers are highly sensitive to interest-rate changes; when rates rise, their prices fall. But as they mature, their prices drift back toward par, and investors can reinvest their coupon income in higher-yielding securities. What investors earn in income can outweigh the losses they sustain when bond prices fall.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein

.jpg)