by Richard Turnill, Global Chief Investment Strategist, Blackrock

Wall Street’s fear gauge, the VIX, remains below its long-term average, even after last week’s spike. Richard explains how not to interpret today’s low equity market volatility.

Wall Street’s fear gauge spiked last week amid Washington turmoil. Yet the VIX remains comfortably below its long-term average of around 20, after a stretch of near-record lows. Low volatility isn’t a signal to sell or of imminent sustained higher volatility, in our view.

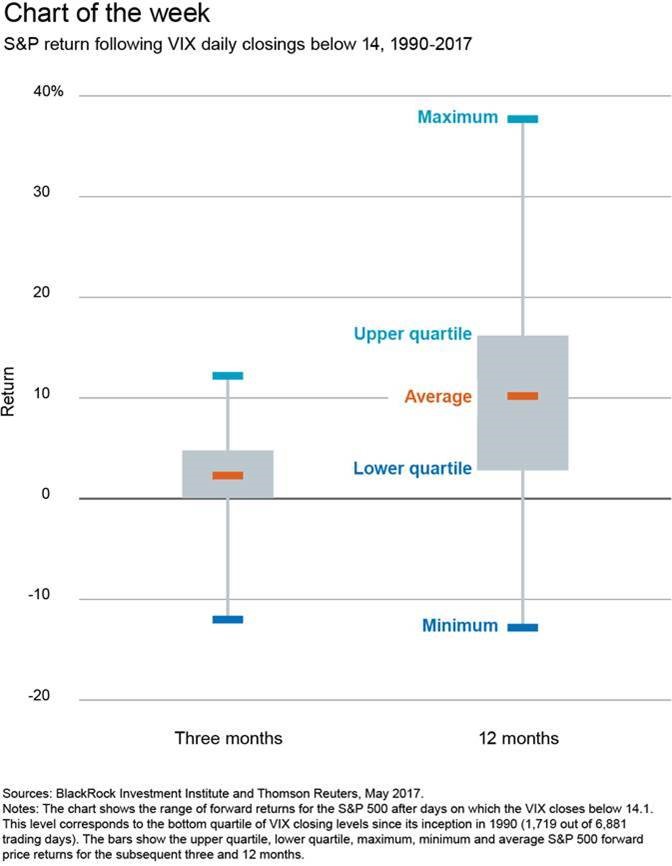

The VIX represents current near-term stock market volatility levels. Very high VIX levels have been reliable buy signals. The opposite isn’t the case. Low volatility tells us little about the direction of future equity returns, our analysis suggests. There has been a wide range of returns in the three- and 12-month periods following daily closes of the VIX below 14, as the chart above shows.

Focus on fundamentals

Periods of low volatility also do not imply that higher volatility is imminent. Low-volatility periods historically have lasted a long time. They have generally occurred amid economic expansion and predictable monetary policy, both of which we see today. Low volatility today likely in part also reflects investors seeking income by selling volatility in options markets.

We believe a steady economic environment should help keep equity market volatility relatively low, with a sustained and synchronized global expansion in full swing. We see few signs of late-cycle equity market complacency, with a broad swathe of stocks behind gains in major markets. Yet investors should be wary in asset classes where low volatility has encouraged many to herd into similar trades, we believe.

A move to a new regime of extended higher volatility would be negative for risk assets. It’s impossible to predict what could trigger this but candidates include a credit crunch in China and a much more aggressive pace of Federal Reserve tightening. Neither is our base case. We also do not rule out short-lived volatility spikes on risks such as further U.S. political turmoil. For now, we believe equity investors are being compensated to take risk, particularly outside the U.S. Bottom line: Look beyond short-term volatility and stay focused on fundamentals. Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Copyright © Blackrock