Fixed-Income Perspectives

MAY 2017 | PDF Version

“We allocate our risk budget to the areas where we expect to earn the most alpha through a research-driven investment process and team-based approach.”

by Jeff Moore, Portfolio Manager | Michael Plage, Portfolio Manager | Fidelity Investments Canada

Macroeconomic outlook

U.S. FEDERAL RESERVE

• We agree with the market consensus of two more interest rate hikes in 2017.

• The wild card is that the U.S. Federal Reserve (the Fed) might be “spooked” if the U.S. administration succeeds in providing fiscal stimulus and making tax cuts.

INFLATION

U.S.

• We expect a 3.0% to 3.5% range by the end of 2017, with small risk of a higher inflation rate.

• Oil at current levels is no longer a driver of higher inflation; the base effects appear to be over. A surge in oil to $75, on OPEC cuts or even on acceleration of global demand, would be a bump higher in oil-related inflation.

• Food prices have been deflationary over the last year. The base effect should this time turn to a positive impact on price levels.

• Job creation at the critical hourly employee pay scale is robust, and there are some signs of a start of higher inflation. Labour conditions are relatively tight.

Global

• Germany and France are no longer in deflation. Continued firming in price levels would lead to expectations of less quantitative easing (QE) from the European Central Bank (ECB) over time.

• Japan’s price levels are currently flat. Population decline and an aging society remain key issues. The country is a large net exporter of capital.

• Canadian and U.K. prices are flat but appear firm.

• The emerging market country inflation outlook is improving, which means less inflation. This should allow room for central bank easing in many emerging markets.

GLOBAL ECONOMY

European Central Bank

• Net new QE is not our base case, as the case is more and more difficult, particularly with very negative interest rates in Germany and France.

• As time moves on, and if European growth continues, the important market news could be in 2019 when the ECB leadership changes.

Bank of Japan

• Targeting zero yield has been relatively successful, and we see no change for now.

PORTFOLIO POSITIONING

Valuations

• High yield and floating rate loans: They are both fully priced for low default expectations and positive GDP growth. An equity market surge has improved sentiment. We have harvested gains on fully valued opportunities. We have significant room to add on any unexpected spread widening, and we have many top ideas that could offer solid excess returns.

• Investment-grade credit: We are back to very long-term averages in terms of spreads, and they are not nearly as attractive as they were in 2016. We have an overall neutral position in this area, with a larger weighting relative to the benchmark in banks and a lower-than-benchmark allocation to industrials.*

• Global credit hedged to the U.S. dollar: We have recently increased our larger-than-benchmark position in this area for diversification, correlation and lower spread volatility compared with U.S. dollar bonds. The allocation remains only modestly larger than the benchmark’s, because valuations here are also below 2016 levels.

• Non-dollar and non-U.S. dollar: Holdings remain modest (less than 1.5% of Fidelity NorthStar® Balanced Fund’s fixed-income portfolio). The majority of this position is in the Mexican peso, which has made solid total returns of late, on expectations of a negotiated trade settlement and on Bank of Mexico actions.

• U.S. Treasuries: We continue to allocate significantly less than the benchmark, due to Fed headwinds and our view of the economic cycle. However, yields have increased somewhat over the last 12 months, and Treasuries are becoming increasingly more interesting as long-term investments. However, patience is our attitude for now.

• U.S. TIPs: We continue to allocate significantly more than the benchmark, on expectations of stable to higher inflation prints for the rest of 2017 and 2018. As well, current inflation remains well below long-term levels. At this time, we also like the option of TIPs compared with nominal bonds.

• U.S. MBS: We currently have no exposure. The return opportunity remains too low compared with nominal U.S. Treasuries, although convexity is not as large an issue as it has been in the past. The end of Fed reinvestment of mortgage pay-downs could be a catalyst to add risk.

• Structured product (non-agency MBS, ABS and CMBS): Our allocations are running down and have near zero weight; new issuance in these sectors faces heavy regulation and, as a consequence, low spreads. There is limited upside at this stage.

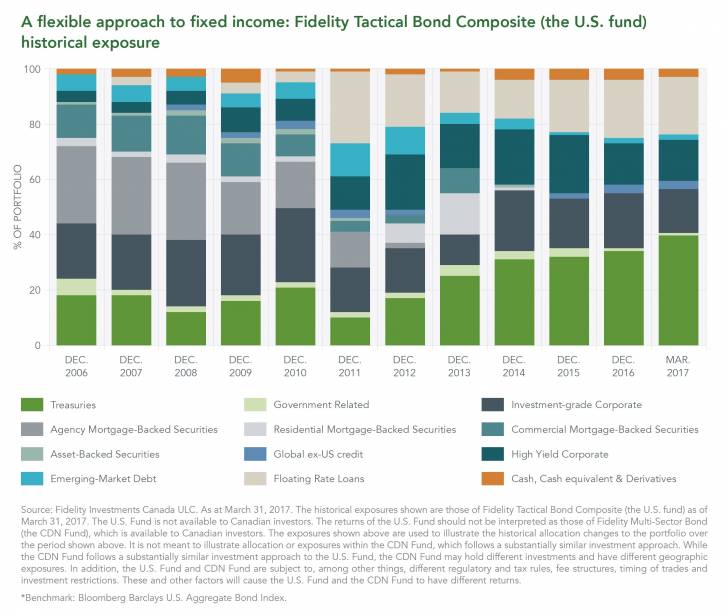

A flexible approach to fixed income: Fidelity Tactical Bond Composite (the U.S. fund) historical exposure

BIG STORY

• Bond market capital gains are difficult to envision in all but tail scenarios.

• Likewise, consequential capital losses are also difficult to envision in all but tail scenarios.

• Our best view is that the total return opportunity is the coupon, plus or minus a little.

Jeff Moore and Michael Plage co-manage Fidelity Multi-Sector Bond Fund and Fidelity Multi-Sector Bond Currency Neutral Fund. They also manage the fixed income subportfolio for Fidelity NorthStar® Balanced Fund.

*****

For advisor use only. No recipient is authorized to pass this communication on to any other person whatsoever or reproduce it by any means without the prior written consent of Fidelity.

Views expressed regarding a particular company, security, industry or market sector are the views of that individual at the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. These views may not be relied upon as investment advice, nor are they an indication of trading intent on any Fidelity Fund. These views are subject to change at any time based upon markets and other conditions, and Fidelity disclaims any responsibility to update such views.

Read a fund’s prospectus and consult your financial advisor before investing. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Investors will pay management fees and expenses, may pay commissions or trailing commissions and may experience a gain or loss.

Certain statements in this commentary may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest, and assuming no changes to applicable tax or other laws or government regulation. Expectations and projections about future events are inherently subject to, among other things, risks and uncertainties, some of which may be unforeseeable and, accordingly, may prove to be incorrect at a future date. FLS are not guarantees of future performance, and actual events could differ materially from those expressed or implied in any FLS. A number of important factors can contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events. You should avoid placing any undue reliance on FLS. Further, there is no specific intention of updating any FLS, whether as a result of new information, future events or otherwise.

© 2017 Fidelity Investments Canada ULC. All rights reserved. All rights reserved. Third-party trademarks are the property of their respective owners. All other trademarks are the property of Fidelity Investments Canada ULC.

SAL-22603 05/17 800091.1.0

Copyright © Fidelity Investments Canada