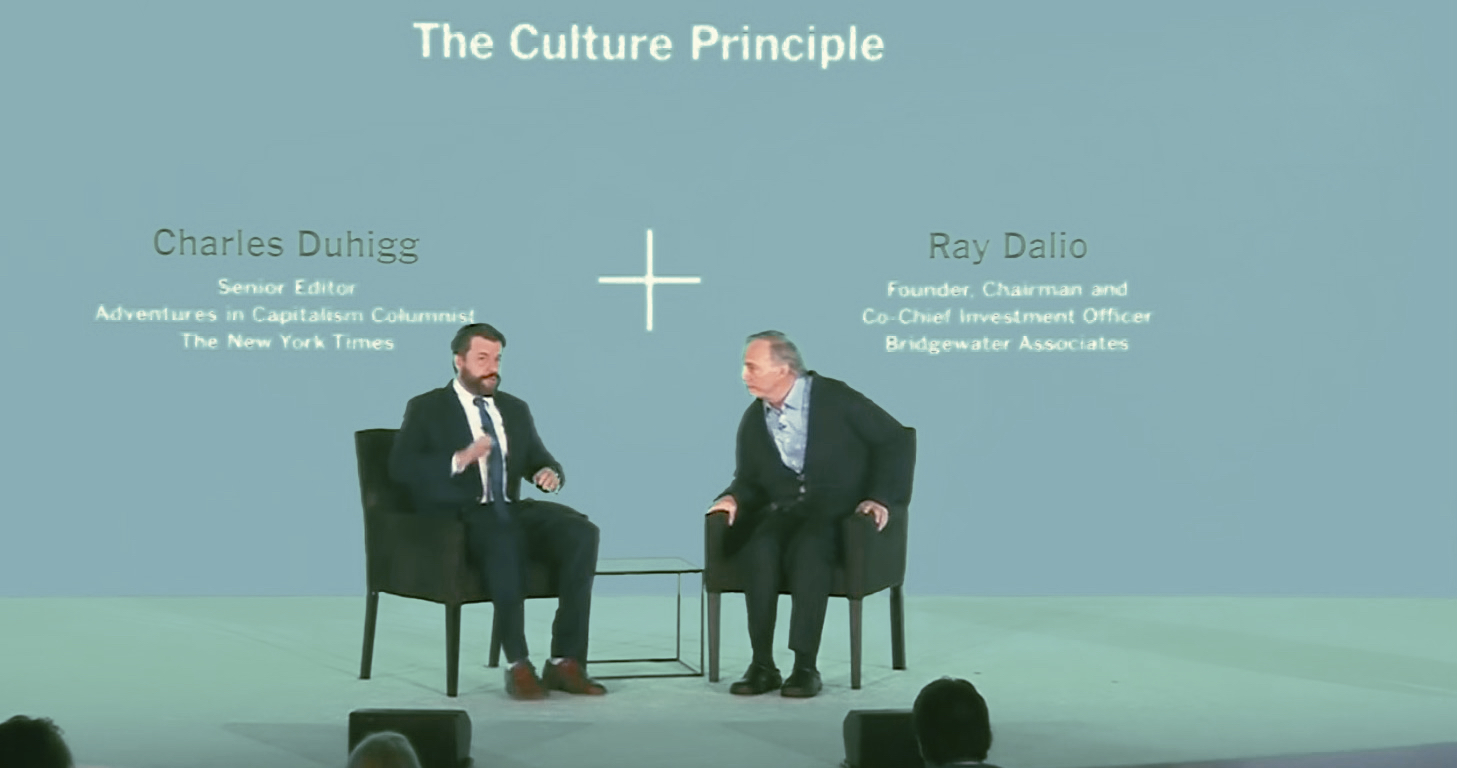

For over 40 years, Ray Dalio's Bridgewater has pursued meaningful work and meaningful relationships through radical truth and radical transparency. This unique way of operating has obviously worked extremely well, and Ray Dalio joins Charles Duhigg to discuss Bridgewater's unique workplace culture.

Related Posts

7 biggest mistakes investors are making now

Turn today's investing missteps into tomorrow's smart moves.

Will the market be ready when you are?

by Nick Goetze, Fixed Income, Raymond James Nick Goetze discusses fixed income market conditions and offers insight for…

Will a Weak Dollar Enhance International Returns?

International stocks have outperformed the broad U.S. stock market so far this year. If the U.S. dollar continues to weaken, it could boost international returns even more.

Research in Focus: Has click search met its match in AI?

Research Analyst Divyaunsh Divatia explores the explosive growth in chatbot usage for routine search queries and how the trend might impact legacy search functions – and revenues.

Guardian Capital’s Next Chapter: Going Private with Desjardins in a $1.67 Billion Deal

In a landmark move that reshapes Canada’s asset management landscape, Guardian Capital Group Limited has agreed to be…

The 4th Turning of Markets: Darius Dale on Inflation, Debt & Investing in 2025

What if everything you thought you knew about the Fed, fiscal policy, and recession playbooks is already obsolete? In this episode, Darius Dale reveals why the U.S. economy has entered “Paradigm C” — a regime of fiscal dominance, deregulation, and coordinated support — and what it means for portfolios, the Fed, and your financial future.

Deutsche Bank vs. The Market: Why Treasuries Could Be the Next Big Short

by SIACharts.com As of late August 2025, U.S. 10-year Treasury yields are trading near 4.21%. While the prevailing…

S&P 500 Index: All Twisted Up in the Game

by William Smead, CIO, Smead Capital Management Dear fellow investors, One of my favorite comedy movies was Bringing…