by Will Robson, Executive Director and Head of Real Estate Applied Researc, MSCI

Institutional investors use factors to capture returns and understand drivers of risk and return in their listed securities portfolios. Can factors that have generated long-term premia in equity markets help identify private real estate assets that have outperformed historically?

By slicing data in custom ways, such as by using the MSCI Global Intel Plus database, real estate investors potentially can enhance their ability to identify new asset selection strategies based on factors. Such an advance would offer clients new tools in addition to traditional approaches that dissect assets by sector and geography.

We use a thought experiment to illustrate how one can employ the quality factor, one of six factors that have provided excess returns over long time periods, in evaluating real estate assets.

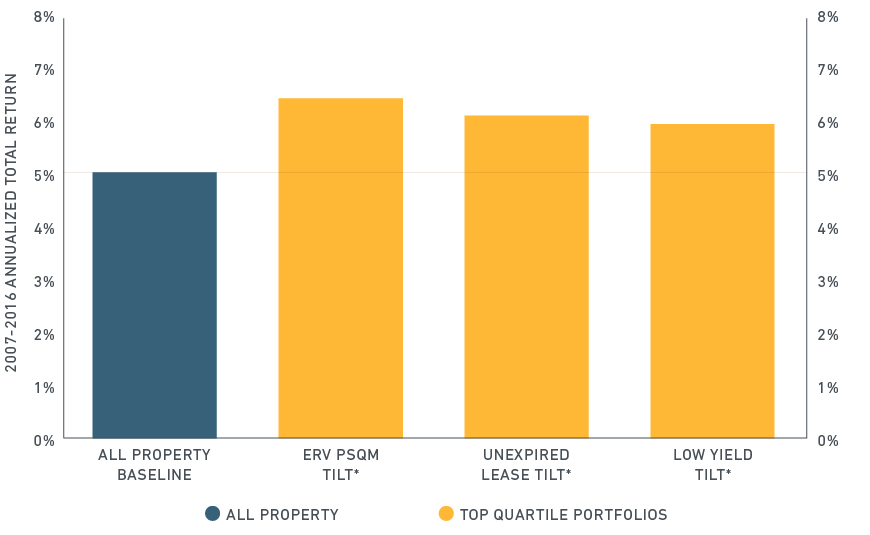

For equities, the quality factor helps explain the movement of stocks that have low debt, stable earnings growth and other “quality” metrics. In applying this concept to private real estate, we used three measures that together serve as proxies for quality: estimated rental value per square meter (a reflection of occupier preference), unexpired lease term (reflecting income security) and equivalent yield (reflecting investor preference). Properties in the top quartile for each of the three quality measures outperformed the All Property baseline over the eight years ended December 2016, suggesting that a quality factor premium existed during this period.

Quality measures outperformed the baseline return

* To calculate quartile indexes, assets are ranked quarterly and included in the relevant quartile sample based on their position at the end of the quarter.

Because the analysis applies three descriptors to a single country over a relatively short period, we cannot conclusively prove the existence of a quality premium in private real estate. Even if we could do so, it may be hard to harvest these risk premia through passive factor index strategies, given the higher transaction costs, longer transaction lead times and the overall illiquidity of private real estate (compared with equities) involved.

However, the experiment illustrates the potential for the identifying factors that may provide risk premia that are common across broad groups of real estate assets. Using this approach, private real estate investors may be able to develop new tools to help them select portfolio assets.

Further reading:

Is your real estate portfolio resilient enough?

Copyright © MSCI