by Eric Bush, CFA, Gavekal Capital

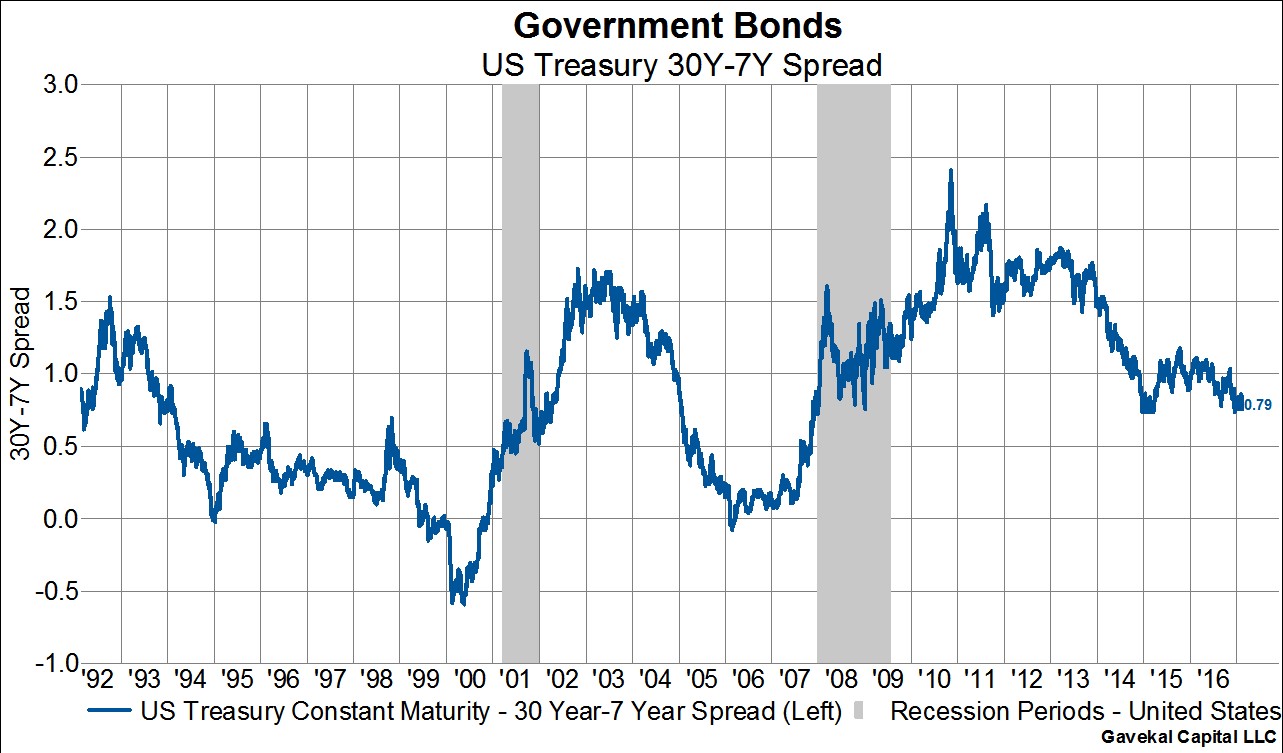

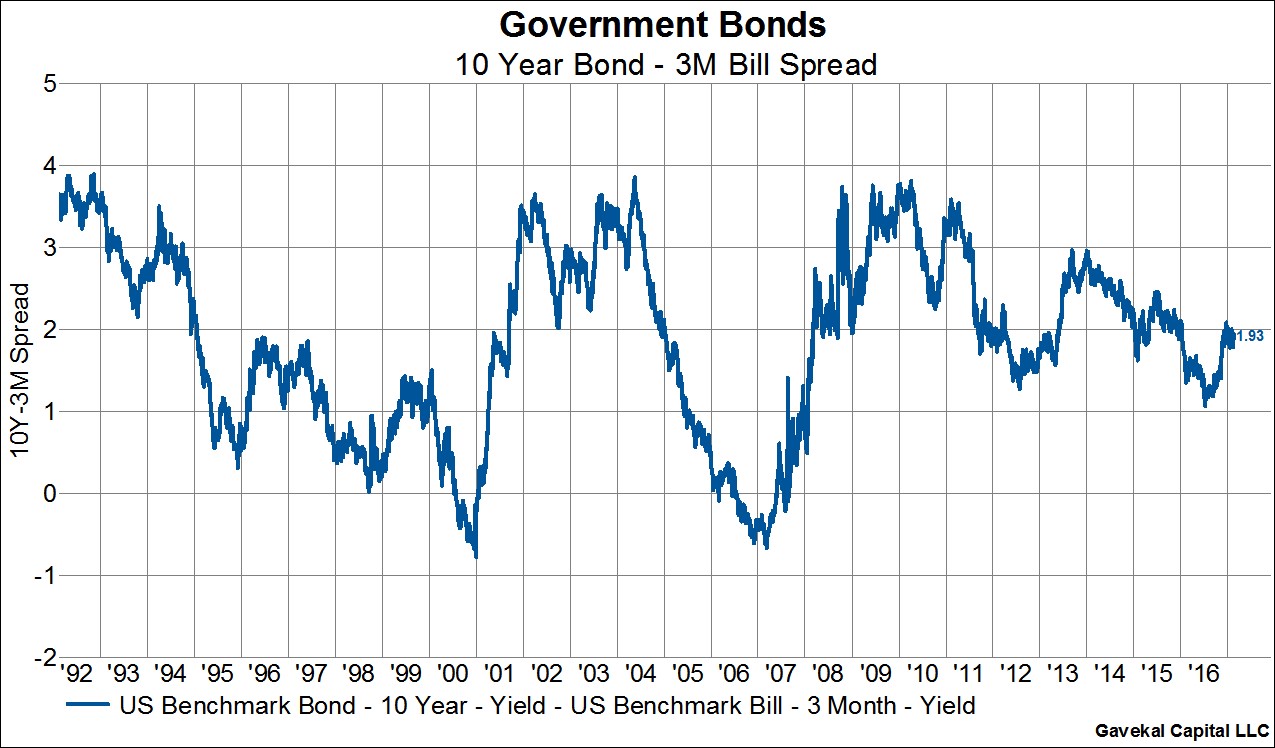

The spread between 30-year US treasuries and 10-year US treasuries has fallen to just 60 bps which is the smallest spread in about 2 years. The spread between 30-year bonds and 7-year bonds is down to 79 basis points, again basically at 2-year lows. What is interesting is that the spread between 10-year and 3-month bonds is well off the lows made in 2016. On 7/8/16, this spread was just 108 basis points. Today, it stands at 193 basis points. So since last summer the long-end of the yield curve has flattened by about 25 basis points while the front end of the yield curve has steepened 85 basis points.

Copyright © Gavekal Capital