4 Threats to Prosperity (Part 1)

by Brian Wesbury, First Trust Portfolios

- Conventional wisdom is up in the air right now. There’s protesters in the street, Trump is tweeting, he’s got things going on with foreign countries

- many people are suggesting that this instability, this uncertainty, could lead to problems in the market or with the economy

* We don’t agree

There are four threats to prosperity:

1) monetary policy

2) trade policy

3) tax policy

4) spending and regulatory policy

- those are the 4 things that can cause recessions

- the number one cause of recession is monetary policy

- that’s what I’m going to talk about today

- very briefly, its a complicated issue

- the Federal Reserve, typically, by over-tightening, and creating a lack of money in the economy, i.e. a squeeze, is the number one cause of recessions in the modern era from 1913 until today.

Where are we?

- the Federal Reserve is holding the federal funds rate at 0.75% and we don’t know anyone who thinks that’s too high, but they are talking about raising rates three times this year and that would push us to 1.5% and because so many people believe that we’ve lived through a sugar high for the last 7 1/2 - 8 years, that the Fed is responsible for creating our growth, often they believe that small increases in rates are going to throw us into recession and I couldn’t disagree more.

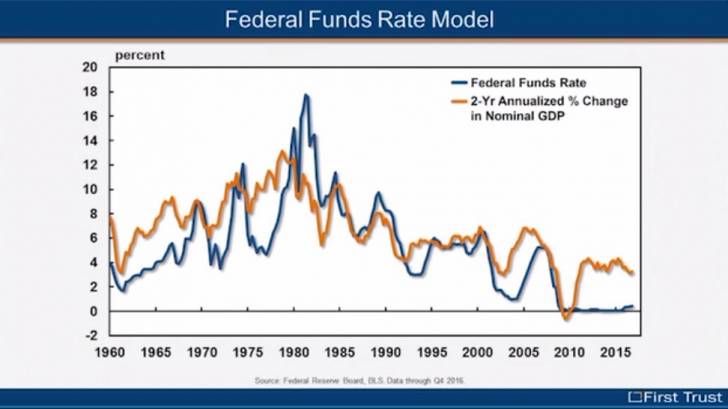

- Look at this chart: its a picture of the nominal GDP growth rate (the orange line) versus that blue line, which is the Federal Funds rate.

- The chart goes all the way back to 1960 - the reason I did that I believe Nominal GDP is the correct target for the Federal Funds Rate.

- In other words, the Fed is not tight unless it lifts the blue line, Federal Funds rate above that orange line, the Nominal GDP Growth rate, and we have a long way to go.

- Nominal GDP, overall spending in the economy, has been about 3.5%, roughly 2% real growth, and 1.5% inflation, put those together, you get 3.5%

What does this mean?

- My belief is that the Fed will not be tight until it gets interest rates to 3.0-3.5%, in that range, that’s when the Federal is actually threatening growth.

- They are a long, long way from that.

- In addition, the Fed has allowed over 2 trillion dollars of excess reserves to stack up into the system, and until they take those reserves out, there is a threat that inflation, and excessive liquidity could result.

- And so, even if the Federal Reserve raises interest rates, until they unwind their quantitative easing, and take those excess reserves out of the system, it is hard to say that the Fed is tight.

- In other words, that first threat to prosperity, at least in my view, today, is NOT a threat to the economy

- In other words, we have green lights for investors if we look at monetary policy, the first threat.

- Stay tuned, we’ll do part 2, 3, and 4 and cover the other 3 threats to prosperity

Brian Wesbury, Chief Economist

Copyright © First Trust Portfolios