2017 Stock Market Outlook: Gears Are Turning, But Parts May Need Grease

by Burt White, Chief Investment Officer, LPL Financial

KEY TAKEAWAYS

- We expect mid-single-digit returns for the S&P 500 in 2017, consistent with historical mid-to-late economic cycle performance.

- Expected mid- to high-single-digit earnings gains from corporate America in 2017 should help support the continuation of the nearly eight-year-old bull market for U.S. equities.

- In addition to earnings growth, we expect gains to be driven by a pickup in U.S. economic growth, stable valuations, and an expansion in bank lending.

Earnings are the key to 2017 stock market outlook. S&P 500 earnings passed an important milestone in 2016, returning to growth in the third quarter after mildly contracting for several quarters during an extended mid-cycle earnings recession. Expected mid- to high-single-digit earnings gains from corporate America in 2017 should help support the continuation of the nearly eight-year-old bull market for U.S. equities, and we expect mid-single-digit returns for the S&P 500 in 2017, consistent with historical mid-to-late economic cycle performance.

In addition to earnings growth, we expect those gains to be driven by: 1) a pickup in U.S. economic growth, partially due to fiscal stimulus, 2) stable valuations as measured by the price-to-earnings ratio (a stable price-to-earnings ratio [PE] of 18 – 19), and 3) an expansion in bank lending. However, gains could come with increased volatility as the economic cycle ages further and interest rates may rise, increasing borrowing costs and making bonds a more competitive alternative to stocks. Risks to our forecast include:

• a sharp rise in inflation that leaves the Fed playing catch-up;

• a trade war with key U.S. trading partners; or

• a policy mistake, domestic or foreign, that causes a recession or significant market disruption.

Mid-cycle support points to solid gains

Our forecast for U.S. economic growth in 2017 supports our expectation for stock market gains next year and the continuation of the bull market past its eighth birthday. In years when the U.S. economy does not enter recession, the S&P 500 produced an average gain of 12%. These numbers are also consistent with the first year of the presidential cycle. In the first year of the four-year presidential cycle (as 2017 will be), when the U.S. economy does not enter into a recession, the S&P 500 posts gains 92% of the time, with an average return of 9.3% (data back to 1950) [Figure 1].†

† The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

Earnings picking up

Earnings growth returned in late 2016 and may continue to gain momentum in the coming year. We expect earnings growth in the mid- to high-single-digits in 2017, well above the flat earnings of 2016 and more consistent with long-term averages. Better economic growth, potentially the fastest since the end of the Great Recession, would be supportive of corporate profits [Figure 2]. Our forecast of 4 – 5% nominal U.S. gross domestic product (GDP) growth (real GDP plus inflation as measured by Consumer Price Index) makes the consensus revenue growth forecast for 2017 of 5.6% achievable. Historically, nominal GDP growth has correlated well with S&P 500 revenue growth. The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI) for manufacturing, which has shown high correlation to corporate profits historically, has been above 50 in the last three months of 2016 (September through November data) and eight out of the past nine months, which is also an encouraging sign.

Profit margin headwinds?

Overall, corporate profit margins have been resilient despite the energy downturn as companies have done a terrific job controlling costs. Wage pressures (the biggest component of companies’ costs) are starting to build and may continue to do so in 2017 should steady job growth continue. Minimum wage increases in some states add to the upward pressure, along with the potential for higher borrowing costs as interest rates and commodity prices rise. Lackluster productivity gains in recent years make margin expansion even tougher. Profit margins may have a challenging time returning to the record highs set in late 2014, but we expect them to at least hold steady as energy sector profitability recovers and overall revenue growth picks up, which can help profit margins through scalable operating efficiencies. Steady margins would translate revenue growth directly through to earnings growth. Those factors, along with modest added support from share buybacks, may keep our profit growth target well within reach.

Energy sector profits return

After more than two years of declines, we expect earnings growth to return to the energy sector in the fourth quarter of 2016 (to be reported in early 2017). Falling oil prices and the corresponding energy downturn were a significant drag on overall U.S. corporate profits in 2015 and 2016. The downturn had an obvious direct impact on the energy sector itself, but other industries saw an indirect impact from energy-related credit losses and a sharp decline in demand for capital equipment. The energy drag, which we estimate at 5 – 6% of S&P 500 earnings in 2015 and 4 – 5% in 2016, is expected to completely reverse in 2017 assuming oil prices stay at or above current levels.

Should oil prices stay at current levels, the commodity would show a sharp year-over-year price gain of nearly 30% in the fourth quarter of 2016; and if oil prices were to average near $50/barrel in 2017, which we believe is reasonable given our economic outlook, oil would be up an average of 18% year over year compared with 2016. Higher oil prices, along with sizable cuts in capital spending and other costs by oil and gas producers, may enable the energy sector to generate strong earnings in 2017 and help counteract potential profit margin pressures on other S&P 500 sectors. The late 2016 agreement among some global producers to cut production may offer some support, but the ability of domestic shale producers to ramp up production may limit the benefit.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

U.S. dollar impact may be minimal

We expect any further rise in the U.S. dollar in 2017 to be contained, although we do consider currency to be one of the bigger risks to earnings for the year. The dollar had a negligible impact on U.S. earnings in the third quarter of 2016 and will likely only have a minimal negative impact in the fourth quarter of 2016, after reducing earnings by an estimated 4 – 5% during mid-2015 when the annual increase in the U.S. dollar index approached 20%. Should the dollar remain at current levels — at the high end of its recent range — the year-over-year change would average about 3% in 2017.

Protectionism risk

S&P 500 firms derive a substantial amount of their revenue overseas in foreign currencies (we estimate 35 – 40%, on average), so a more protectionist U.S. trade policy could hurt corporate profits. Trump has expressed interest in using tariffs on imported goods from China and Mexico in support of fairer trade. It is difficult to predict how U.S. trade policy will play out, but we see Trump moderating his stance based on his desire to drive economic growth, which would be at odds with a strongly protectionist policy. Checks and balances in Congress, competing priorities, and the time involved in rewriting trade rules suggest the earnings risk from trade in 2017 would be manageable.

Elevated valuations

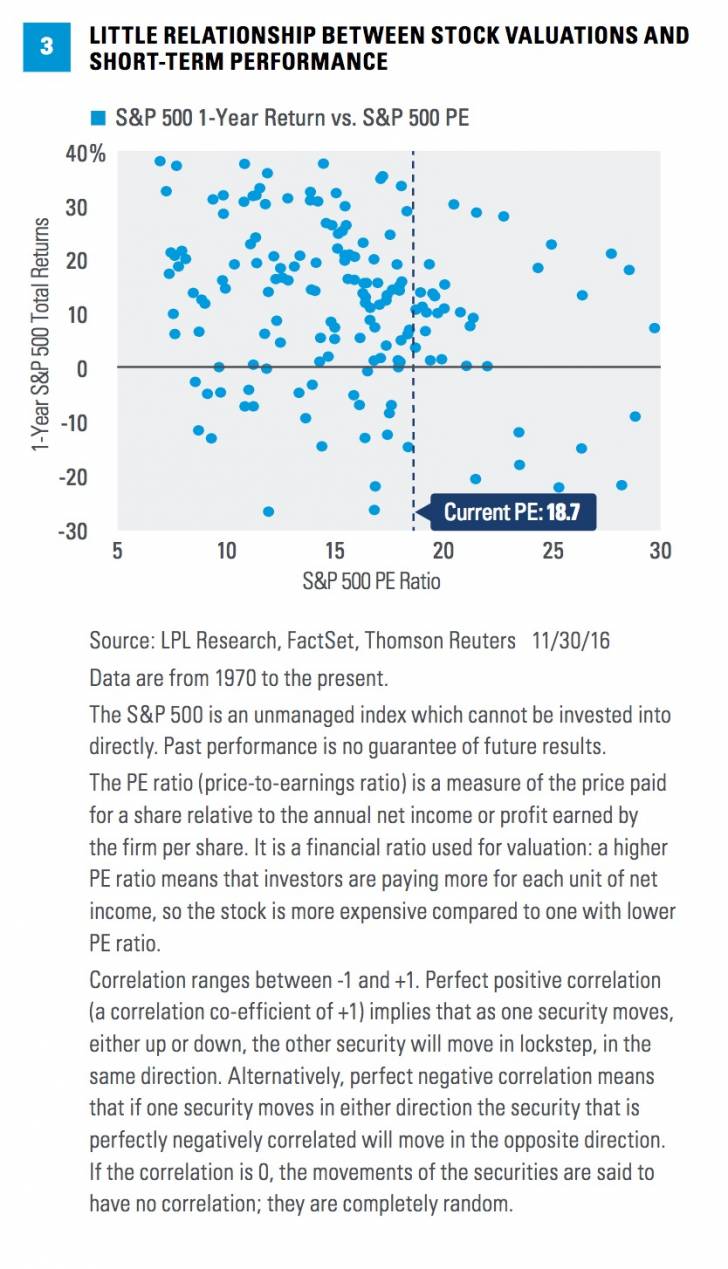

Elevated stock market valuations are another risk to our forecast, but one we believe is only relevant in a scenario in which the market begins to, or actually does, price in a recession. The current PE of 18.7 (trailing four quarters) is above the long-term average of 15.2 going back to 1950, and even above the higher post-1980 average of 16.4.

We don’t see high valuations as a reason to sell, as they have not been good indicators of stock market performance over the subsequent year, as shown in Figure 3. The correlation between the S&P 500’s PE and the index’s return over the following year, at -0.31, is relatively low (based on 45 years of data). Stocks can stay overvalued longer than we might think they should, so we focus more on macroeconomic and fundamental factors for indications of an impending market correction or bear market.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

All investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Institute for Supply Management (ISM) Index is based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The ISM Manufacturing Index monitors employment, production inventories, new orders, and supplier deliveries. A composite diffusion index is created that monitors conditions in national manufacturing based on the data from these surveys.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Copyright © LPL Financial