by Blaine Rollins, 361 Capital

The equity markets and risk sentiment continues to race higher in December, even before the last two-week seasonal lift into year end. It will be interesting to see what the tax-related selling impact is as the month progresses. For those with losses, they will likely want to be monetized to take advantage of the higher tax rate in 2016. But for those looking to cash in gains, they will want to wait for a 2017 selling date to hopefully get lower tax rates. Of course, the opportunists, investors and traders will be looking to take advantage of whatever extreme prices occur around year end. So far, the markets remain extremely healthy as very strong buying continues to push most indexes to records. Last week it was the transports time to break higher. Railroads will do better with their coal shipments under Trump, as will trucking with the lift in GDP, and leisure and business air travel could benefit from a cut in personal and business taxes. Even more interesting is that as the transports break out, crude oil is also on the verge of making a 52-week high. With the non-OPEC nations joining OPEC in curtailing production in 2017, it will be tough for portfolios to not own energy stocks into year end.

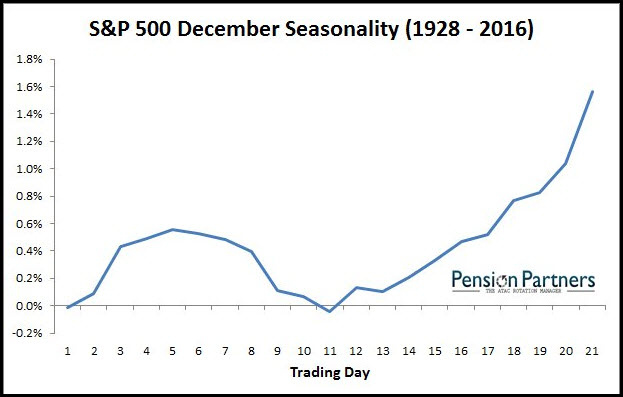

Tax loss selling mid-month has helped to create this seasonal chart. But once the tax-related activity is done, then flying reindeer take over…

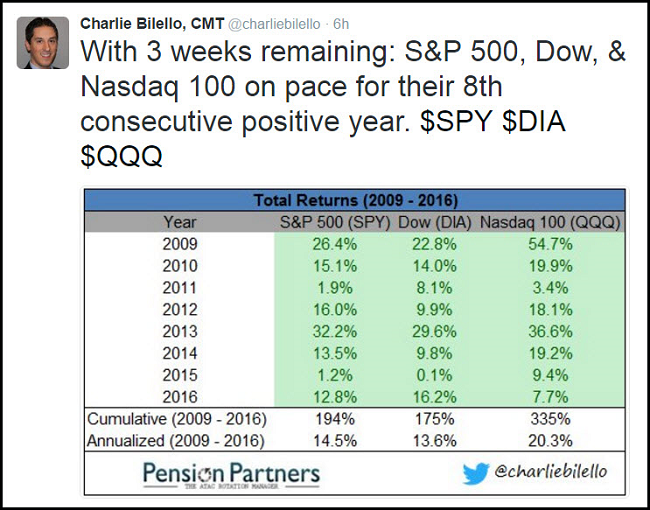

(@charliebilello)

What an incredible bounce from The Big Short…

Don’t be surprised. The Fed will raise interest rates this week. The markets have already cleared the path for them with two-year yields up 0.35% since the election…

@charliebilello: US Yield Curve ends the week at its steepest level of the year: 132 bps spread b/t 10-year and 2-year yields. $TNX

Most important news over the weekend: The Non-OPEC nations join the OPEC nations in cutting production and then Saudi Arabia drops a further reduction…

“I can tell you with absolute certainty that effective Jan. 1 we’re going to cut and cut substantially to be below the level that we have committed to on Nov. 30,” Saudi oil minister Khalid al-Falih said after today’s meeting.

The Saudi minister said he was ready to cut below the psychologically significant level of 10 millions barrels a day—a level it has sustained since March 2015—depending on market conditions.

Al-Falih made his announcement after non-OPEC countries agreed to reduce production by 558,000 barrels a day, suggesting he had been waiting for the deal before committing to further cuts. The non-OPEC reduction is equal to the anticipated demand growth next year in China and India, according to data from the International Energy Agency.

Crude oil will break out this week and it will get you to re-evaluate your energy weightings…

Usually energy and airline prices move in opposite directions…

But not when the airlines are making so much money that even United Airlines can charge for an overhead bin.

(@beckyhiu)

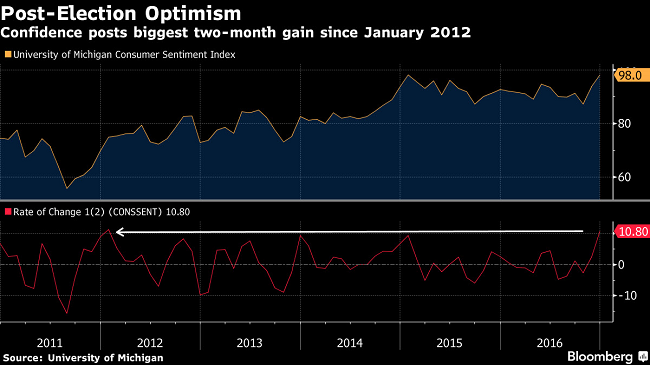

The Trump election victory parade continues and last week took consumer confidence to new highs…

Consumer confidence jumped more than forecast this month as Americans expressed the sunniest picture of their financial situation in 11 years, extending a boost following Donald Trump’s election victory.

The University of Michigan said Friday that its preliminary index of sentiment rose to 98, the highest since January 2015, from 93.8 in November. The median projection in a Bloomberg survey called for 94.5. The current conditions index, which measures Americans’ perceptions of their personal finances, increased by 4.8 points to 112.1, the highest since 2005.

A record share of respondents “spontaneously mentioned” the positive impact from new policies, according to the survey, with more people expecting the economy and job market to strengthen in the coming year.

The CEO of J.P. Morgan confirmed that the U.S. consumer is in fine shape…

“We see a fairly healthy consumer. And so if you look at macroeconomic data, home prices, the consumer balance sheet, debt service ratios, the number of people working, wages going up, etcetera, we see that pretty healthy. We see a mirror of that inside JPMorgan. So we have reporting quarter-after-quarter, credit card sales, deposits, new household accounts, all those types things are doing quite well and we expect that to continue.” —JP Morgan CEO Jamie Dimon (Bank)

Even Steven Schwarzman of Blackstone is talking up the potential for the U.S. economy…

“The changes as a result (of the election) are going to be very substantial in many areas, but particularly in the business community and the financial area. You’re going to have a very substantial reversal in regulations of all types…. if you look at the architecture of the financial world, it’s going to change very substantially…. this is as big a change happening all at once — I’ve been in finance for, I don’t know, 45 years? This will be the biggest…. When you have changes like this that are so profound, it’s going to drive higher GDP. It’s going to make the US a more friendly place for foreign capital. And it’s going to have significantly accelerated growth not just for financial institutions but for the country as a whole….So, this is like very important. It’s very important. And it’s not just about some stocks for financial companies, although that would be a nice thing. It’s much bigger and more impactful over a much longer period of time”

(JPMorgan)

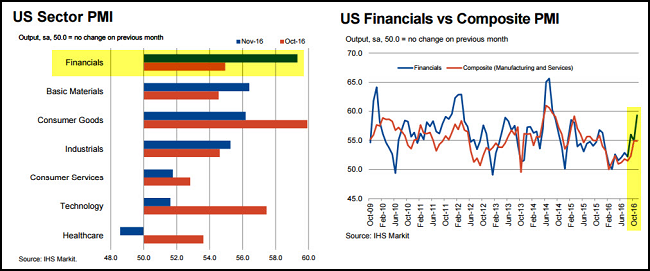

Leading the excitement in stock prices has been the financial space. Last week’s PMI Service data confirmed the rise in the sector’s optimism…

Latest US Sector PMI® data from Markit pointed to sharp upturns across a number of key sectors in November. The steepest of these came in financials, where output growth accelerated to a 27- month high. Marked growth was also seen in basic materials, consumer goods and industrials. Healthcare was the only sector to buck the trend, with activity falling for the first time in three months. Financials climbed two places to top the sector rankings during November. Both output and new business rose substantially. Given the close relationship between financial activity and overall private sector output (see chart), the pick-up bodes well for economic growth across the US as a whole.

Time to go all in on active equity management? Investors, Consultants and Bond Rating firms all hate active equity management. Is Steve Carrell available for a meeting with Moody’s?

Large investors have pulled $350bn from stockpicking portfolio managers and moved en masse into bond funds and passive equities since the start of the year, piling more competitive pressure on investment companies that try to beat the market.

By contrast, passively managed equity funds have hoovered up $22bn from investors over the same period, according to figures compiled exclusively for FTfm by eVestment, the data provider.

The shift away from active equity funds that charge higher fees to beat the benchmark to cheaper index-tracking alternatives has prompted two leading research houses to predict sharp falls in profitability for mainstream fund companies.

Moody’s, the rating agency, has lowered its outlook for the global asset management industry from stable to negative, blaming its increased pessimism on the “underwhelming” performance of actively managed funds and the faster growth rate of passive assets.

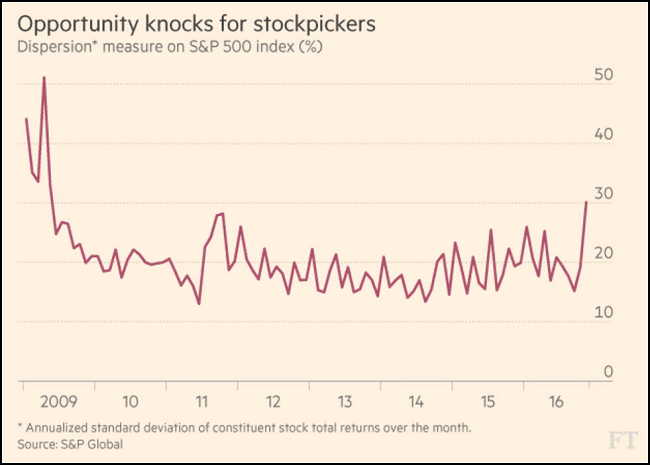

Christmas has come early for active investors as rising dispersion continues to offer them a way to beat up on passive index funds…

“Donald Trump is throwing you your first lifeline in a decade,” said Nicholas Colas, chief market strategist at Convergex, speaking about active managers. He said that a lot of the additional trading his firm’s desk has seen since the election has been concentrated in individual stocks, rather than ETFs, a sign investors are honing in on specific bets.

Correlations had already been trending a bit lower ahead of the election. But one thing that’s particularly notable over the past month is that the correlation breakdown has been spread across most sectors.

(WSJ)

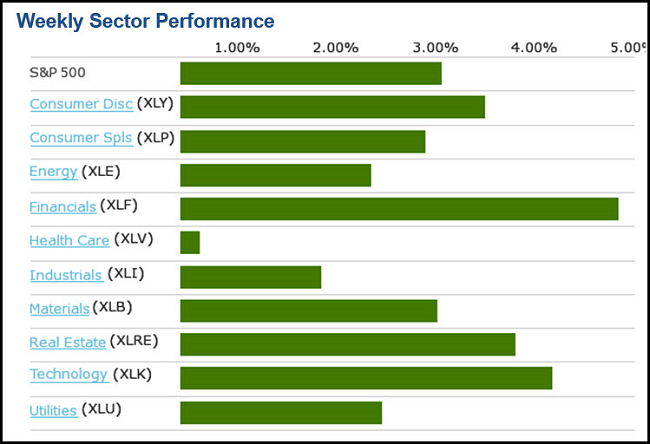

And while all sectors were in the green last week, there still was plenty of dispersion between the best and worst groups…

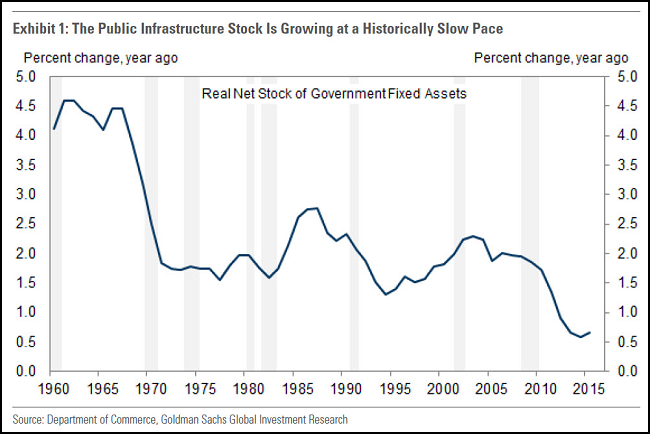

As we all guess as to the new Administration’s spending and taxation changes, Goldman Sachs reminds us that an easy issue to tackle will be infrastructure…

In his acceptance speech, President-elect Trump vowed to “rebuild our highways, bridges, tunnels, airports, schools, hospitals … rebuild our infrastructure, which will become, by the way, second to none”. While Congressional Republicans look primarily focused on tax cuts so far, we also expect a $25bn/year infrastructure component as part of a fiscal package next year. According to the transition website, the Trump Administration will seek to invest $550bn in transportation and infrastructure. The relatively poor state of existing infrastructure and the low level of interest rates make a solid case for higher public investment spending. The real net stock of public assets has grown at a rate of 0.8% in the last 5 years, significantly below the 2.0% average in 1980-2010 (Exhibit 1). Many economists support greater public investment, but the outlook for a new federal infrastructure program— including its size and the extent of private sector involvement—remains unclear.

(Goldman Sachs)

In another hint of what is to come, the President-Elect went after drug pricing last week…

President-elect Donald Trump, whose victory last month was greeted with a surge in pharmaceutical stocks, declared himself an opponent of high drug prices in an interview with Time magazine – “I’m going to bring down drug prices. I don’t like what’s happened with drug prices,” Trump said.

…and not at a good time for Healthcare investors…

@WhatILearnedTW: The XLV-to-S&P 500 ratio is breaking down, events favor the primary trend #firstwillbelast

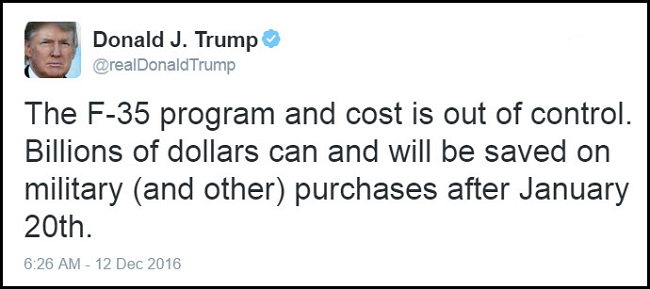

And after calling out the pricing on Boeing’s Air Force One contract, he is now targeting Lockheed Martin’s Fort Worth, Texas facility…

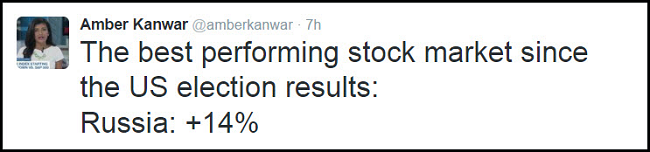

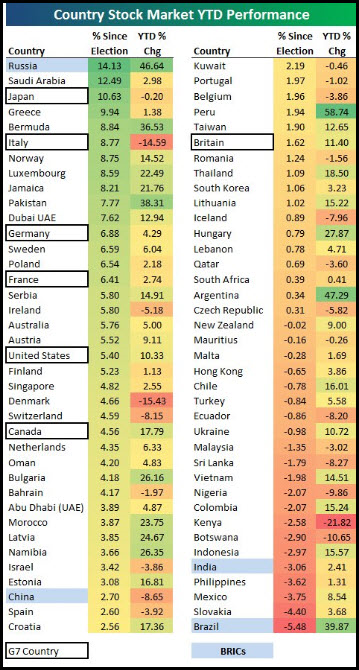

Since Russia has been out of the news for a while…

(@bespokeinvest)

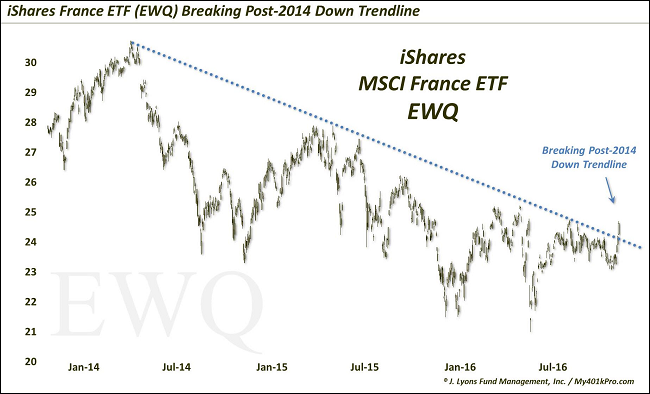

French equities look intriguing. Probably worth your time reading up on the upcoming April elections and the Republican nominee Francois Fillon…

(@JLyonsFundMgmt)

Finally, great move by the Houston Rockets. No more food/drink juggling at the top of the aisle for their fans…

Copyright © 361 Capital