by Neil Dwane, Allianz Global Investors

As the markets close the books on another tumultuous year, investors should keep watch on the rise of populist politics, China's re-emergence as a global growth engine and a renewed focus on government spending as interest rates remain low.

Key Takeaways

- Populist politics will drive market volatility: Europe will confront a year of Brexit-fuelled political uncertainty within a slow, low and dull global economic environment. As US policy turns inward, we expect China and Russia to get more assertive.

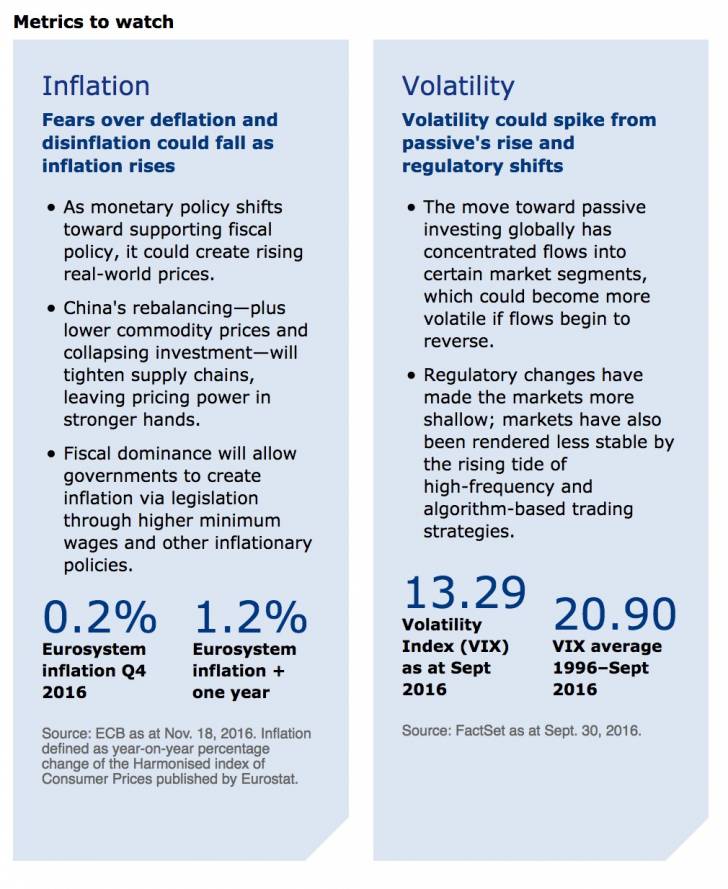

- Lower-for-longer rates will linger: Financial repression will remain in effect as the world finds new ways to delever. Inflation will remain key, but it takes decades to work. Facing volatility and low beta returns, investors must be active and seek alpha.

- Hopes will turn from monetary to fiscal policy: Negative interest rate policies and quantitative easing will evolve as countries shift attention from monetary to fiscal policy—though new fiscal efforts may not be big enough nor economically effective.

This past year has been an exhausting one for many investors: China started rebalancing, the Fed failed to raise rates, Europe grappled with Brexit, tensions rose in Ukraine and the Middle East, and the US suffered through painful elections before ultimately choosing Donald Trump. Surprisingly, while any one of these events could have caused a serious market setback, they kept plugging along valiantly—albeit with bouts of volatility—even as global growth stayed slow.

For their part, central banks all but exhausted themselves this year with their extreme monetary policies, prompting a renewed focus on fiscal expansion as one of the few remaining ways governments can hope to stimulate much-needed growth.

Moreover, economies around the world are still grappling with monumental levels of excess debt that are only serviceable at record-low interest-rate levels. As such, we expect 2017 to be a year of nominal growth and low returns as our long-running thesis of financial repression remains in full effect.

2017 outlook by region

- US: Escape velocity elusive as Fed tries to raise rates—yet consumers see little wage growth, and health-care costs may start to rise. Trump boosts infrastructure and defense spending, pushes for return of cash held overseas. US dollar could weaken.

- Europe: Investors grow nervous about cloudy outlook from elections and triggering of Article 50. Euro-zone financials weaken, hurt by ECB's moves toward tapering. Equities look attractive and highyielding in a marketplace distorted by QE and NIRP. Growth should slow.

- Asia and EM: Fundamental economic restructuring in China, India and Indonesia offset stronger USD and slower global trade momentum. Rising global protectionism boosts regional development, spurring local consumer spending. Commodity outlook changes with China's shift to oil and softs.

- Japan: Economic growth still very fragile as demographics and policy uncertainty affect confidence. New fiscal dominance allows Abe (with BOJ support) to legislate for inflation, which boosts domestic activity at yen's expense.

5 investment themes to understand in 2017

As the markets close the books on one year and turn their attention to the next, investors looking to make informed decisions need to understand what's driving markets and economies. Here are the core themes to watch in the coming year.

Global economic growth: Still low, slow and dull

Investors should expect muted growth as the US enters its late-cycle period, Japan struggles with its ageing population and Europe suffers from Brexitosis. The US and EU should ultimately avoid recessions while staying stuck in the weakest economic expansions ever recorded. Emerging markets should prosper as China rebalances and much of Asia reforms.

Central banks: Rates "lower for longer” overall

We expect the US Federal Reserve to modestly increase rates, prompting central banks in emerging markets to lower their rates as inflation falls. The European Central Bank and Bank of Japan should maintain their loose monetary policies. We have passed peak global liquidity as central banks have pushed past negative interest-rate policies to begin supporting government spending.

China is still the big story, with Asia attractive overall

The biggest contributor to global growth is still China, which is requiring fewer industrial commodities and more oil and soft commodities as it urbanizes rapidly. Concerns remain over its capital position, but its "one belt, one road" policy for expanding trade and investment may be the new Marshall Plan the world needs after the Global Financial Crisis. With India and Indonesia now making significant reform progress, Asia offers the best balance of growth and investment.

Oil sees demand and supply fall into balance

For some time, we have advised investors not to expect oil prices to stay too low for too long, and our constructive position has begun to be validated. These very same low oil prices have led to receding industrial capital expenditures, and have helped demand and supply fall into balance. We believe a slightly rising oil price in 2017 should boost oil investment and global inflation, but we believe it will not ignite a new shale boom in the US. Supply will still be pressured by a fraught geopolitical situation in the Middle East, Latin America and Africa.

A change in political trends is underway

The tides of de-regulation continued shifting in 2016, and nationalism and populism gained ground: Brexit, the Walloons, Bernie Sanders and Donald Trump all played a part. Given the significant elections looming in Europe in 2017, politics should remain a key investment consideration—though some investors may simply stay away from certain markets despite attractive valuations. Monetary policy will also become more political as it becomes subsumed by explicit government policies of fiscal domination. As to where governments will spend the money their central banks print, we believe domestic infrastructure and defence spending will be the focus of many countries in the coming years.

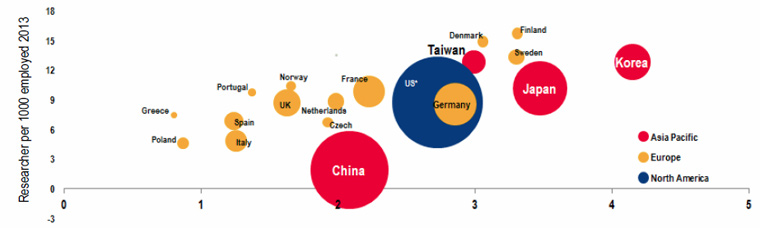

Asia is investing in long-term competitiveness through increased R&D

Research and development as a percentage of GDP is highest in Korea and Japan

Source: OECD, Allianz Global Investors, data as at December 2013. *US, Canada and Israel data are as at December 2012. Size of the circle reflects the relative amount of annual R&D spending by the indicated country.

Taking action with a renewed focus on active investing

In many ways, 2017 will offer the same diet as 2016: Thanks to low market returns, investors who take insufficient risk will generally find insufficient results. Moreover, the historical long-term performance many investors hope to see again looks to be just that—a thing of the past. The future demands active, incisive hunting for capital-growth and income opportunities as we wait for a turn in the economic cycle to come one year closer.

Reaching objectives means taking risk

The broad market returns (beta) of many asset classes could feasibly go even lower: Without the earnings growth the markets have been waiting for, yields cannot fall further and equities cannot rerate higher. Taking some credit and duration risk—and employing dividend-focused strategies—may help protect the purchasing power of savings against inflation's ability to slowly increase health-care, education and living expenses.

Become more selective and active

As beta becomes more volatile, investors need to assess their desire for capital growth (through real assets like growth-style equities and property) against their need for income (which can be found in fixed-income and short-duration assets in Asia, the US and emerging markets). Investors can then use active strategies appropriately to generate above-market returns (alpha). Significant diversification with alternative investments can help.

Investing requires patience

As the markets increasingly focus on the short term, investors ironically must become more patient and contrarian: The power of compounding takes time to work in growth- and income-focused strategies, so a long-term perspective is essential for optimizing results.

Diversify, don't herd

Asset correlations and volatility are high, which could cause different asset classes to swing wildly in the same direction. Extreme monetary policy measures from central banks—such as negative interest-rate policies and quantitative easing—have also herded many investors into the same positions, which may reduce returns. Look for strategies that offer risk-mitigation and diversification potential—like alternatives.

Volatility is unavoidable, but manageable

Markets are increasingly susceptible to volatility as politics, geopolitics, divergent monetary policies and internal market structures all converge and evolve. Navigating this sea of uncertainty requires a clear direction and an ACTive mindset, with investors staying agile in their asset allocations, confident in their processes and thorough in their research.

The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts and estimates have certain inherent limitations, and are not intended to be relied upon as advice or interpreted as a recommendation.

Copyright © Allianz Global Investors