Europe’s Bond Benchmarks Exposed - Context

by Fixed Income AllianceBernstein

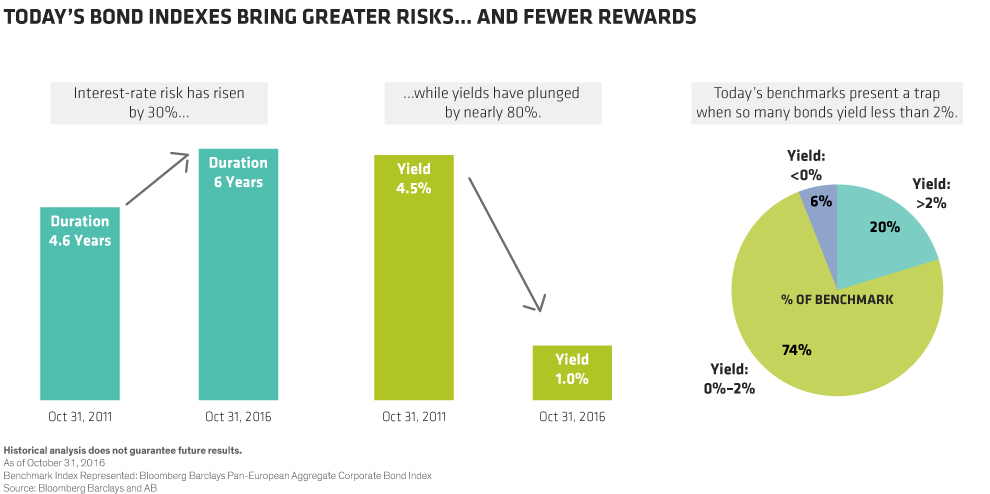

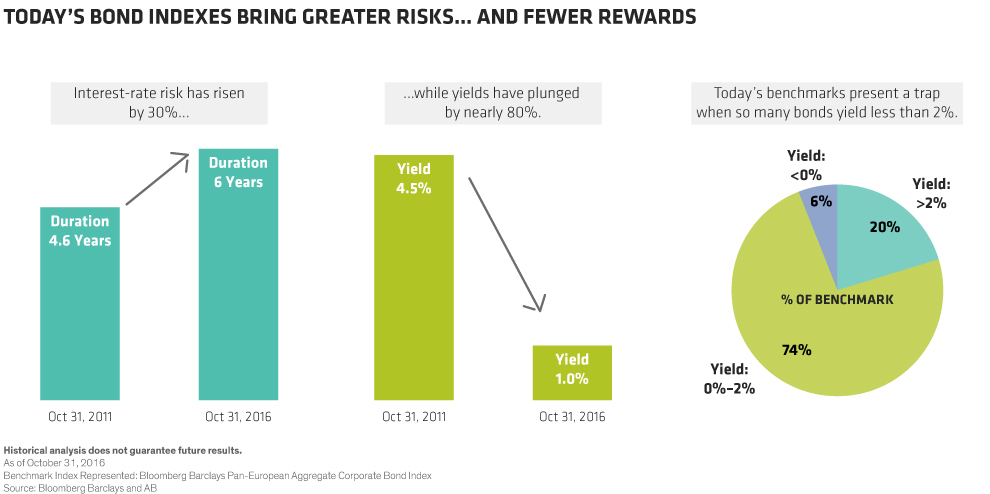

Like other traditional bond benchmarks, key European investment grade bond indexes have changed dramatically over the last five years.

Benchmark duration—which measures interest-rate risk—has risen sharply. And bond yields have plummeted. Worse, benchmarks now include many negative-yielding bonds. As a result, investors tracking bond benchmarks are exposed to greater risk, just when compensation for that risk is lower than ever before.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Copyright © AllianceBernstein