by Fei Mei Chan, Director, Index Investment Strategy, S&P Dow Jones Indices

It’s been a roller coaster week in the aftermath of the startling conclusion to the U.S. Presidential election on November 8, 2016. As recently as a week before the election, equity markets were quite calm, although volatility levels recognized the possibility of a surprise Trump victory. When that victory occurred, U.S. futures declined significantly before markets opened on November 9, only to close the day with significant gains. But the market’s returns were not evenly distributed. Industries thought to benefit from Trump policies were revalued upward, while those that would have benefited more from a Clinton administration went in the opposite direction.

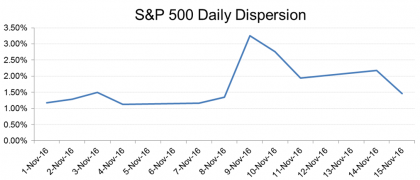

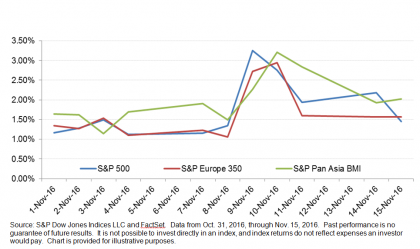

We can view this adjustment through the lens of equity market dispersion. S&P 500 dispersion, which measures how individual stock returns deviate from average, peaked this month on November 9 for the S&P 500. It has since leveled off and is currently almost back to its pre-election levels. It has similarly declined in Europe and Asia. As the Trump administration begins to take shape and we learn more about its priorities and legislative agenda, future surprises are possible, and we’ve learned in the last week how rapidly market conditions can change. For now, however, narrowing dispersion signals an end to the initial adjustment to a new market consensus.

Copyright © S&P Dow Jones Indices