by Jeffrey Saut, Chief Investment Strategist, Raymond James

So, last week was interesting, huh? If nothing else, it was definitely a far cry from two or three months ago when investors could check in on the markets only every few days and not really miss much of anything. But after Donald Trump shocked the world on Tuesday night and the news networks first began reporting that the Dow Jones Industrial Average futures were down 500 points (then 600 points…then 800 points), Jeff Saut and I, like most market participants, came in Wednesday morning expecting stock market carnage. In our view, the most likely reaction was going to be “Brexit: The Sequel,” where stocks sold off on the uncertainty before finding a bottom in the subsequent days. So, accordingly, our advice Wednesday morning prior to the market opening was to stay calm, take a breath, and get ready to buy the anticipated dip.

But then a funny thing happened and market sentiment seemed to almost immediately flip just as we published our comments, as if a “Buy” switch had been thrown somewhere between Washington and Wall Street. Despite all indications prior to the election that the market favored a Hillary Clinton victory, investors, when finally forced to consider what a Trump presidency may actually mean, did not exactly hate the possibilities. The complete 180° turn is perfectly summarized by this email from a loyal follower that Jeff and I received just prior to the market opening on Wednesday:

...SELL EVERYTHING! THE END IS HERE!! SELL!! SELL!! SELL!! Well...except Biotech because the risk of price controls is over! Sell EVERYTHING but Biotech stocks!! Oh, and Financial stocks! Financial stocks will do very well with less regulation!! Sell everything but Biotechs and Financials! Of course there's Energy stocks, yeah they will do better with Republicans for sure. OK, we are selling everything EXCEPT Energy, Financials and Biotechs!! I can't sell [the big Tech companies] though because they will bring all that cash back from overseas now [and maybe invest more of it into their businesses]…Heck, if these stocks go up, it will drag ALL tech stocks higher. Alright, alright, we are gonna buy more Technology today! So here is the plan. Sell everything except Technology, Financials, Energy and Biotechs! But everything else has to go! Although...with the GOP controlling all three branches, they might actually get some infrastructure spending passed. That could really push Industrials and Basic Materials higher. OK, new plan- We buy Basic Material stocks, Industrials, Technology, Biotech, Financials and Energy, but nothing else!! Everything else, SELL! But wait, what if they cut corporate taxes like they promised??? That means more cash for share buy-backs, dividends and capital investment. And, if the GOP cuts taxes for individuals, they will have more for Consumer stocks. Well consumers make up 70% of the economy... that will make everything go higher!!! NEW PLAN!!! BUY EVERYTHING!!!!!...BUY...BUY...BUY!!!!!!!!!!!!!!!!!!

Ultimately, not EVERYTHING went up (Technology, for one), but, as we said in the months leading up to the election, there would certainly be areas of the market that would benefit under each outcome and there was not really a scenario that would undermine our long-term bullish thesis. And, yes, the initial market response is a gut-reaction to what should still be considered a “best case scenario” for the coming administration, but for the first time in a while it appears investors see a path toward much higher stock prices. Even we, as bullish as we have been, have admitted that while the market likely had a high floor underneath it that would prevent major losses, conditions weren’t SO great that we were going to see stocks take off and never look back. There is now at least a better chance that happens.

Whenever a market rallies on news that is still, at best, a high uncertainty event, it is generally a very bullish sign and implies a strong market. I won’t go so far as to call this a rule because no one has ever presented me with a stock market rulebook, but it does lead us to believe the probabilities favor higher prices over the coming months even if we are now a tad overbought in the short term. Also, the fact that we never even got a buyable dip post-election (unless you happen to trade futures), strengthens the argument that stocks want to keep moving higher, in our view.

Of course, the absence of a sell-off left many of our readers feeling disgruntled after they missed the sharp move last week. Our inboxes have been filled with questions from despondent advisors asking if it is too late to buy after the quick rally, but unless the market completely changes its opinion on a Trump presidency, the 11/4/16 low likely marked an important bottom and any subsequent dips over the coming days should remain above that level. Recall, even though we had been cautious and advised patience in the weeks heading into the election, we also said that the downside would likely be limited to the 3%-6% range in the S&P 500. Well, the move from the previous all-time high in August to the low on 11/4 ended up being just over 5%, so there is a good chance that was it and prices can now go higher.

Keep in mind, though, a Donald Trump presidency is a high risk/high reward scenario, where the eventual results will not be known for some time. There is a chance that things work out very well for the stock market, with a pro-business, Republican majority actually getting things done in Washington, making it easier for companies to run efficiently, and investing in areas of the country that have not recovered since the Great Recession. However, it does likely create some more negative tail risk if the policies don’t work, as the combination of less tax revenue and fiscal stimulus could end up doing nothing more than increasing the national debt while also bringing about higher inflation that will necessitate rates rising more quickly than they otherwise would have. We have said for two years now that higher rates are not a tremendous concern as long as they move up gradually and are supported by a strengthening economy, but what we don’t want is the Federal Reserve to be forced into quickly raising more than expected in order to combat inflation. An outcome such as that could pump the brakes on the bull market and is something to keep in the back of your mind before throwing all caution to the wind.

There is some long-term technical hope, though, that we could see the next major leg of the secular bull market start soon. The last two years have generally been regarded as quite volatile, and that is true in that we have had a number of quick rallies and dips (nine dips of 5% or more since October 2014). However, all that volatility has come within a very tight range by historical standards, a point I decided to explore further over the weekend by diving into the data and doing some fun “spreadsheeting.” I looked at all the rolling two-year trading ranges in the S&P 500 going back to 1962 and what I found was quite interesting (by rolling two-year trading range I mean the percentage difference between the highest price and lowest price from 2015-2016, then 2014-2015, then 2013-2014, and so on). The 2015-2016 trading range of 21% is actually the fourth tightest period in the last 55 years, with only 2004-2005, 1993-1994, and 1992-1993 having a smaller percentage difference between the low and high. In fact, the average rolling two-year trading range has been a whopping 48% since 1962 (median 45%), which means that we are likely due for a big move if history is any guide. And current conditions and the post-election reaction appear to indicate that big move is more likely to come on the upside than the downside.

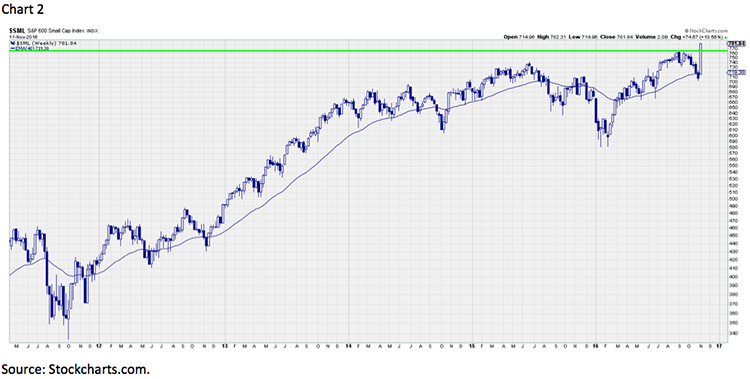

And, finally, the specific way the market rallied last week is also very promising. There were obviously winners and losers with respect to sectors after the election result, but the rally was not the narrow variety we have experienced the past two years where only a select few stocks were responsible for the gains. The equal-weighted version of the S&P 500 jumped 4.5% last week, its best weekly performance since January 2013 (source: Bespoke Investment Group), and small and micro-cap stocks did even better. The small-cap S&P 600 index jumped over 10% last week to a new all-time high and continued its run of sneaky outperformance over large caps that has been one of the under-reported stories of 2016. And with the exception of Technology (more on that later this week), the sectors that really lagged last week were the ones that we have been advising you stay away from the last few months – the yield-sensitive and defensive areas that were already too expensive for our taste. So, the fact that we are seeing a cyclical rally led by the smaller speculative stocks seems to bode well for the rest of this year and into 2017, and we will have some specific stock picks in the coming days to help you take advantage of what will hopefully be a fantastic investing environment.

The call for this week: We should start to see a return to a more normal trading environment in the coming days, as the election is left in the rear-view mirror and things like the economy and earnings once again become the focus. Remember, our view before the craziness of last week was that, overall, things are “good enuff” to keep this secular bull market going and we have not wavered on that. It would not surprise us to see some profit-taking in many of the stocks that experienced quick run-ups after the election, but long-term investors should likely leave the selling to the swing traders. Chances are any dips are limited to the 2120-2150 range in the S&P 500 and those dips should be for buying. And if you are thinking about selling right now, I’ll leave you with a quote from Reminiscences of a Stock Operator by Edwin Lefevre, which is about as close to a market rulebook as I have ever seen: “They say you never go broke taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.” And we think this is still a bull market.

Copyright © Raymond James