by Cole Smead, Smead Capital Management

Any avid climber must be deeply anxious while watching the movie, Everest, a true story based on a 1996 expedition to the summit of Mount Everest. This gripping story, from a memoir called Left for Dead: My Journey Home from Everest, follows a climbing team whose journey turned disastrous from dealing with the naturally volatile conditions on Mount Everest.

It hasn’t taken long for business writers and thinkers to draw comparisons with what happened on Mount Everest to what goes on in business. Financial Times Writer, Andrew Hill, in his opinion piece called, “When the stakes are high, dissent is a sign of success,” introduced work by Jennifer Chatman. Her thoughts were published in a new book, What Works, and make us salivate as contrarians. We like to think that investment success comes to those who are willing to be lonely and getting to the top of the mountain has to be one of life’s loneliest endeavors.

Ms. Chatman and her co-authors studied 40,000 climbers from 80 countries that headed to the Nepalese peak of Everest. As the movie Everest highlighted, there is one goal: reach the peak. In the movie, there is a scene where the climbers are still in the city of Katmandu before beginning their trek to base camp. Each climber stated who they were and why they were going to the top. Motivation ranged from doing it for children back home, to conquering the highest peaks on all the continents, to simply summiting the highest mountain on earth.

What can be easily overlooked, according to Chatman, is the understanding of differences in a group with regard to experience. Whatever the reason for ascending Everest, the goal of getting to the top as an overriding goal can often blind you to the risks. Astutely, Andrew Hill in his piece applied the term “groupthink.” This was a factor that proved fatal for many in the 1996 expedition portrayed in the movie. It’s not the seen risks that kill you in business, it’s the unseen risks.

Disagreement as a starting point for the climb

Groupthink can be one of the most damning epidemics in climbing as well as in common stock investing. All investors would like to produce high returns and reach the peak of investing success. Many would argue that it is impossible to outperform the broad index and believe that owning the index is the only way to go. This could be a grave error. Chatman’s work reminds us of Martin Cremers and Anti Petajisto’s work on Active Share, which they jointly published in 2009. Cremers and Petajisto noted in their conclusion:

“There has been a significant shift from active to passive management over the 1990s. Part of this is due to index funds, but an even larger part is due to closet indexers and a general tendency of funds to mimic the holdings of benchmark indexes more closely. Furthermore, about half of all active positions at the fund level cancel out within the mutual fund sector, thus making the aggregate mutual fund positions even less active.”

Since the Cremers and Petajisto study of mutual funds was first published in 2009, indexing has gained even more popularity. As Active Share shows, you have to be willing to differentiate from the index and the consensus of investors around you. It doesn’t mean you will be successful. On the contrary, Active Share demands a willingness to look foolish in the short run.

Clouds on the horizon that may make the climb worse

In the movie Everest, the devastating circumstances surrounding the 1996 climb were compounded by a horrible storm. What bad weather could be on the horizon for U.S. large-cap common stocks? The S&P 500 Index is trading at 17x forward earnings. This is higher than average, but not egregious from a historical standpoint. We at Smead Capital Management would note, however, some anomalies in the broad index and recently addressed this in a piece titled “The Equity Valuation Paradox”.

In that piece, we showed that the 100 most expensive stocks are the most overpriced relative to the index and to the 100 cheapest stocks since the tech bubble broke in 2000. Based on our research, if Amazon and Netflix were added to the information technology sector, which we think more properly represents what they do, it would represent 23% percent of the S&P 500 Index vs. the 21% we see today. This would be its highest weighting since 2001. These levels may suggest a storm could be on the horizon, even as the narrowness of the current stock market suggests a furious pace of those seeking to reach the summit!

Higher interest rates may be another storm coming to those making the common stock climb, particularly in the broad index. The industries that would benefit from higher interest rates are in many cases among the most attractive on a relative valuation basis in the market today. These would include banks, insurance companies, homebuilders and other economically sensitive shares. As history has shown, higher interest rates reduce the price-to-earnings (P/E) multiples paid for common stocks. We would argue that this is particularly true of the broad S&P 500 Index. The share prices of companies that benefit from higher rates will be less impacted, because their earnings and profitability tend to grow in an above-average way, while valuations may be challenged across the broader stock market.

Going into the Death Zone

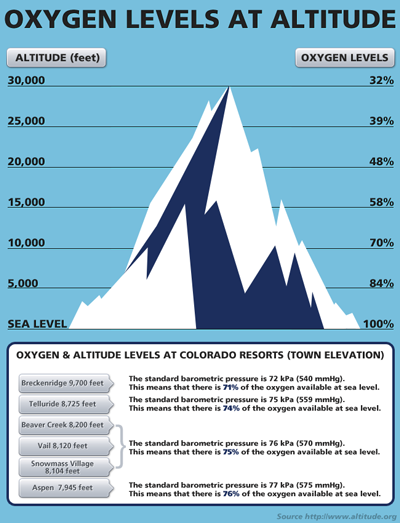

The problem with the narrowness of the broad indexes is that investors have been willing to pay nose-bleed multiples on certain stocks today. This risk in equities reaches a certain level that we feel is comparable to the risk of climbing Everest above the 8,000-meter altitude. This height is referred to as the “Death Zone.” The “Death Zone” creates its own risks, separate from the weather, due to the lack of oxygen. CNN, talking of this risk about Everest stated, “The lack of oxygen to the brain, called hypoxia, can cause people to make poor, rash and sometimes deadly decisions in the confusing landscape.” They go on to say, “The best and quickest treatment is for climbers to descend to a lower altitude, although many can’t do this on their own and must be helped or carried.” Paying 50 to 200-times earnings for exciting revenue growth or paying 25-times earnings for high-dividend, consumer staple shares, looks to us like a potential “Death Zone.” We have provided a chart that shows the percentage of oxygen relative to sea level.

At the peak of Everest, a climber only gets 32% of the oxygen compared to sea level. We see a lack of oxygen for a group of companies today which appear to provide very little profit and free cash flow to the owners. There are two reasons for this. On one hand, investors are paying high prices for stocks with high revenue growth. It is presumed that the revenue growth will someday cause much higher profits in the future. On the other hand, investors are paying high prices for consumer staple companies with little earnings growth. This is based on the expectation that low volatility stock trading and income from dividends will be factors which succeed in a permanently low interest rate environment. These slow growth businesses should not have leverage in an expanding economy and should not benefit from higher rates, in our opinion. What if the “groupthink” of today is wrong? Many investors could be carried to lower heights as they heal from hypoxia-related decision making.

Breathing Easy

At Smead Capital Management, we have made the decision to stay back and not go forward with the stock market participants to higher altitudes and multiples. As long duration investors, we know that storms do come and “groupthink” can be fatal. Attractive valuations in our portfolio provide us plenty of oxygen at these lower altitudes and lower P/E multiples. We don’t know what the future brings, but we can’t overlook risks that could cause a significant loss of capital similar to the loss of human capital that happened in 1996 on Mount Everest.

Warm Regards,

Cole Smead, CFA

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Cole Smead, CFA, Managing Director and Portfolio Manager, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2016 Smead Capital Management, Inc. All rights reserved.

Copyright © Smead Capital Management