by Don Vialoux, Timingthemarket.ca

Observations

Houston, we have a problem! That was the famous phrase used by the astronauts during the Apollo 13 mission when part of their space ship blew up during their return to earth. The phrase is synonyms with “You know that we have a problem, but we are not sure why it is happening” Yesterday was one of those days in the currency world.

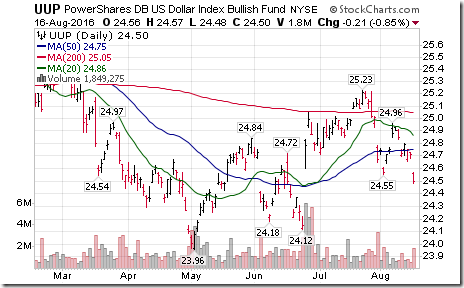

The U.S. Dollar Index dropped sharply.

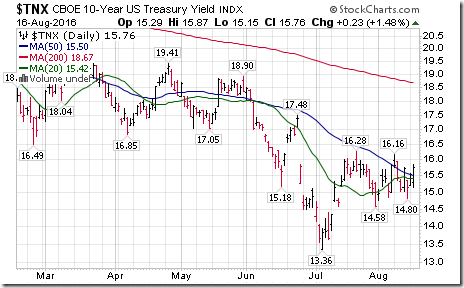

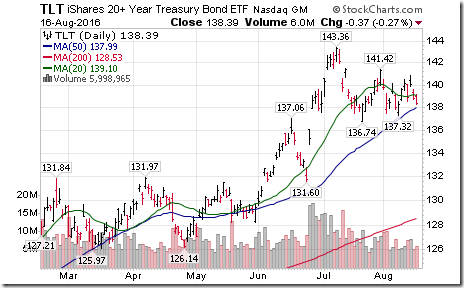

Normally, weakness in the U.S. Dollar Index corresponds with lower Treasury yields (higher Treasury prices). Yesterday, 10 year Treasury yields gained 2.3 basis points and TLT moved lower.

Conditions for at least a short term currency war have surfaced. The U.S. Treasury could be attempting to lower the value of the U.S. Dollar relative to other major world currencies.

The Euro, Japanese Yen and Canadian Dollar soared. Notable was a breakout by the Japanese Yen above resistance at 100.00 to a 2.5 year high. Even the British Pound was stronger.

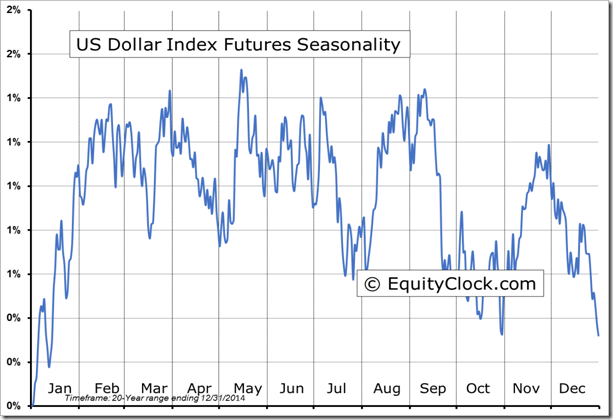

The U.S. Dollar Index has a history of moving lower from the third week in August until the end of October

Gold prices moved higher.

The VIX Index gained over 7%

StockTwits Released Yesterday @EquityClock

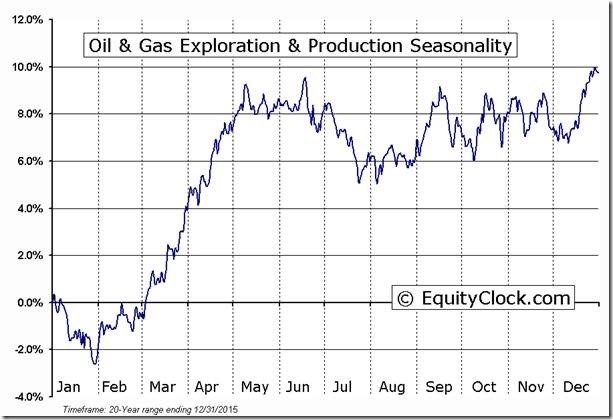

Oil exploration and production ETF showing bullish set up within period of seasonal strength.

Technical action by S&P 500 stocks to 10:30: Bearish. Breakouts: $CTAS, $APD, $PX. Breakdowns: $CAG, $FLIR, $VRSN, $EIX, $PCG, $UHS

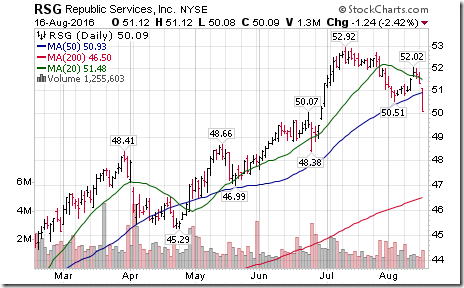

Editor’s Note: After 10:30 AM EDT, AAL and CAT broke intermediate resistance and FISV, RSG and ATVI broke support.

Short term breakdown by $UUP below $24.55 is boosting $GLD

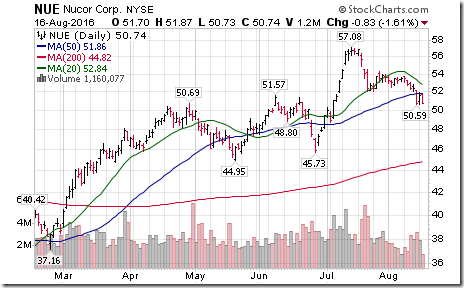

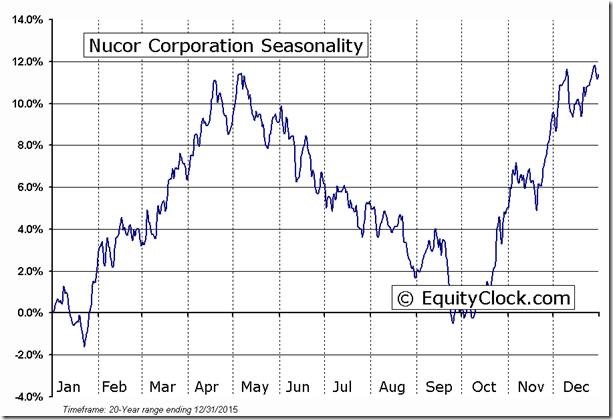

Technical cracks have appeared in selected stocks that have negative seasonality: $RSG, $NUE

‘Tis the season for weakness in Nucor $NUE

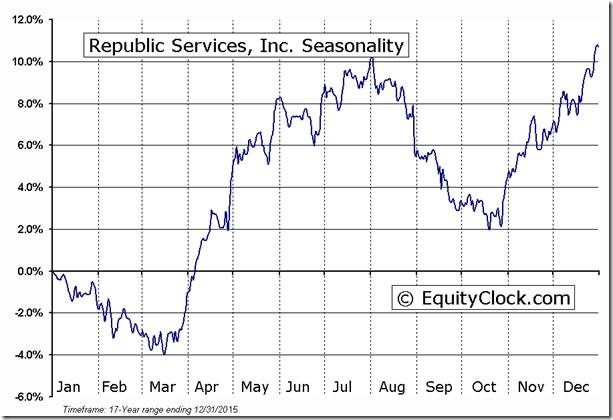

‘Tis the season for weakness in Republic Services $RSG

Trader’s Corner

More short term momentum indicators have rolled over from overbought levels

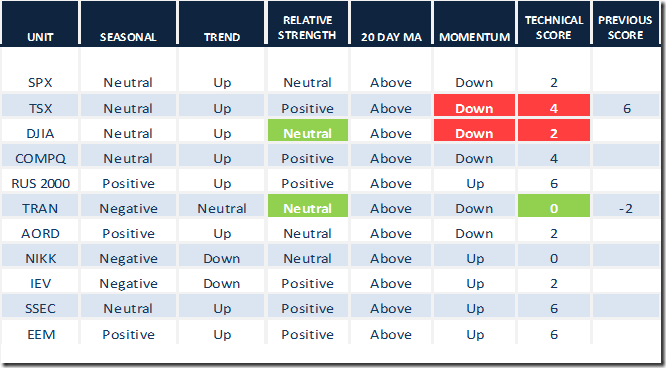

Daily Seasonal/Technical Equity Trends for August 16th 2016

Green: Increase from previous day

Red: Decrease from previous day

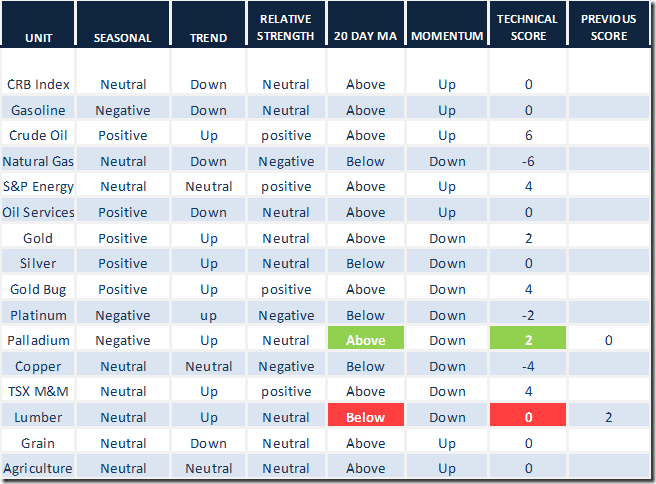

Daily Seasonal/Technical Commodities Trends for August 16th 2016

Green: Increase from previous day

Red: Decrease from previous day

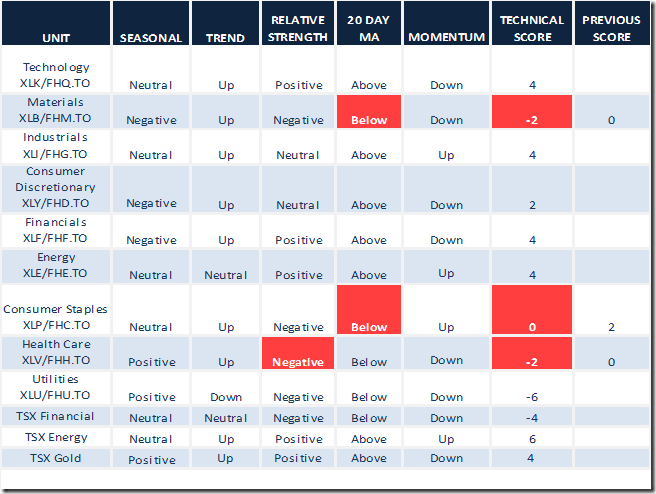

Daily Seasonal/Technical Sector Trends for August 16th 2016

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer dropped 5.40 to 67.40. It remains intermediate overbought, in an intermediate downtrend and about to resume a short term downtrend.

TSX Composite Momentum Barometer

The Barometer dropped 3.42 to 69.66. It remains intermediate overbought and continues to roll over.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca