by Don Vialoux, Timingthemarket.ca

Editor’s Note: Jon Vialoux is scheduled to appear on BNN’s Market Call tomorrow at 1:00 PM EDT

Observations

U.S. equity indices failed to follow through their move on Friday to new highs, implying likelihood of a “fake out” rather than start of another significant upside move.

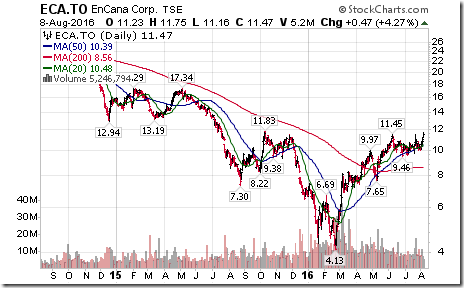

Interesting technical action yesterday in “gassy” stocks! See charts on “gassy” stocks and ETFs below.

Mr. Vialoux on Berman’s Call Yesteday

Following are links:

http://www.bnn.ca/video/berman-s-call-part-one~926202 Market Comment

http://www.bnn.ca/video/berman-s-call-part-two-viewer-questions~926204 Viewer Questions

http://www.bnn.ca/video/berman-s-call-part-three-educational-segment~926225

Educational Section

Charts and Information for the Education section

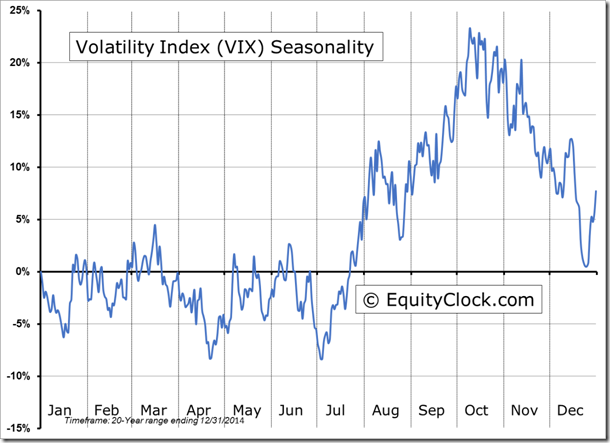

The mid-July to mid-October period for North American equity markets historically has been a period of increased volatility.

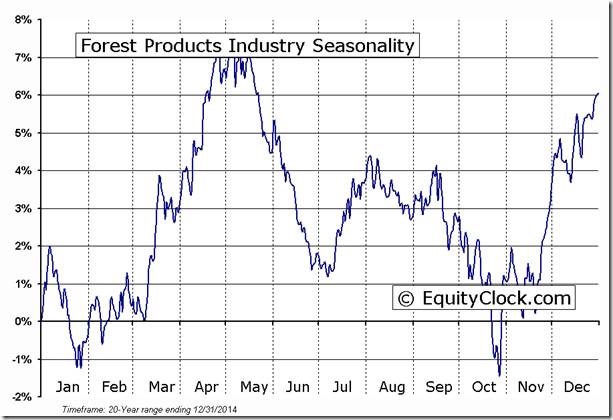

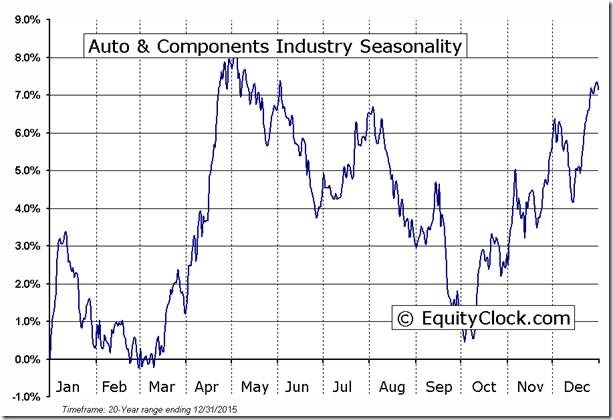

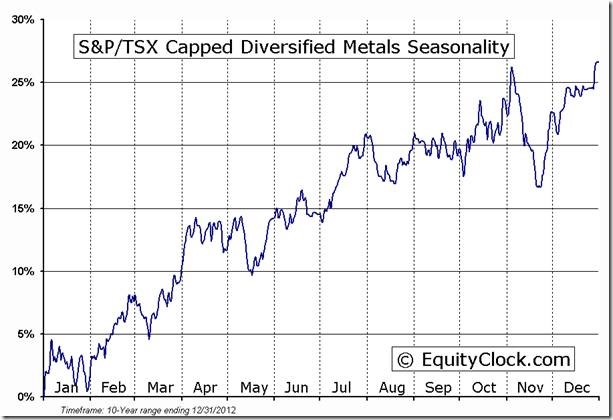

Sector rotation frequently occurs during the period of increased volatility into mid-October

Materials: Neutral to Negative

Industrials: Neutral to Negative

Consumer Discretionary (eg. Autos): Neutral to Negative

Mines & Metals: Positive to Neutral

Forest Products: Neutral to Negative

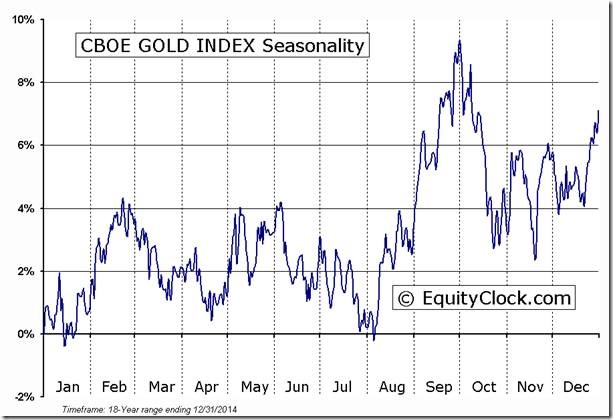

Precious Metals: Neutral to Positive

Examples using seasonality charts (Price charts confirm these trends this year)

StockTwits Released Yesterday @EquityClock

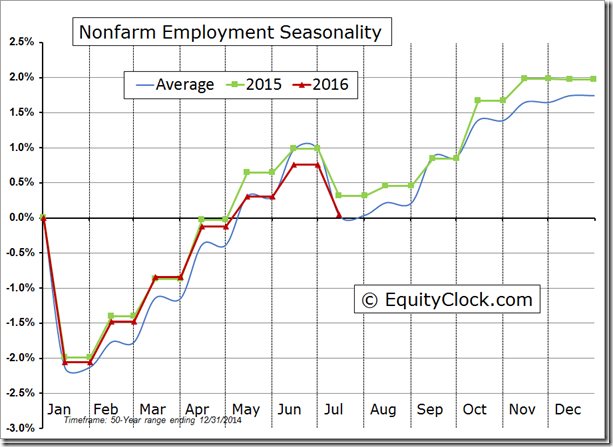

Breakdown of the Non-farm Payroll report from a seasonal perspective

Technical action by S&P 500 stocks to 1:30 PM: Bullish. Breakouts: $CXO, $DVN, $NOV, $PXD, $SLB, $BAC, $PRU, $FDX, $KSU.

Editor’s Note: After 1:30 PM, Dover broke to resistance to extend an intermediate uptrend.

“Gassy” stocks were notably stronger. Breakouts included $DVN, $ECA.CA, $ARX.CA, $PEY.CA

Nice breakout by $BNS.CA above $66.65 to a 2 year high extending an intermediate uptrend.

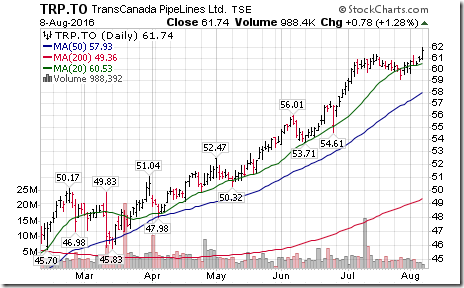

Nice breakout by $TRP.CA above $$61.44 to an all-time high extending an intermediate uptrend.

Trader’s Corner

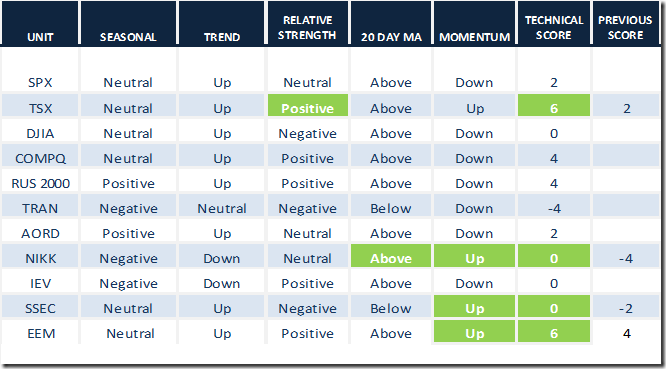

Daily Seasonal/Technical Equity Trends for August 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

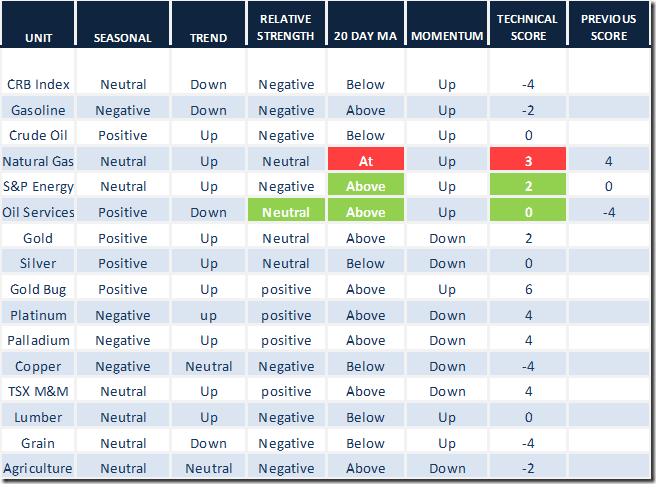

Daily Seasonal/Technical Commodities Trends for August 5th 2016

Green: Increase from previous day

Red: Decrease from previous day

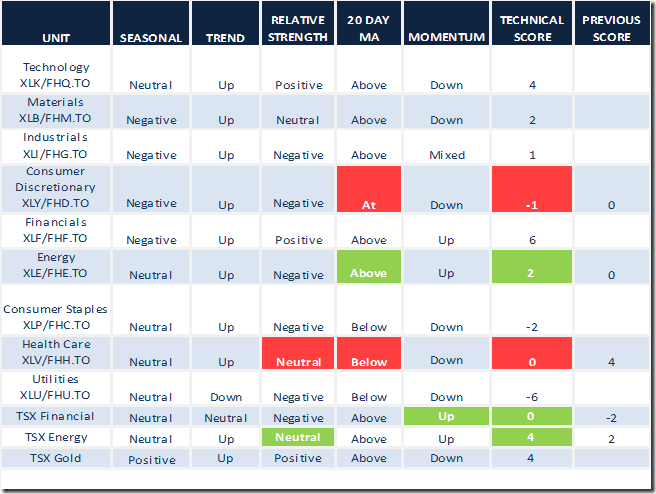

Daily Seasonal/Technical Sector Trends for August 5th 2016

Green: Increase from previous day

Red: Decrease from previous day

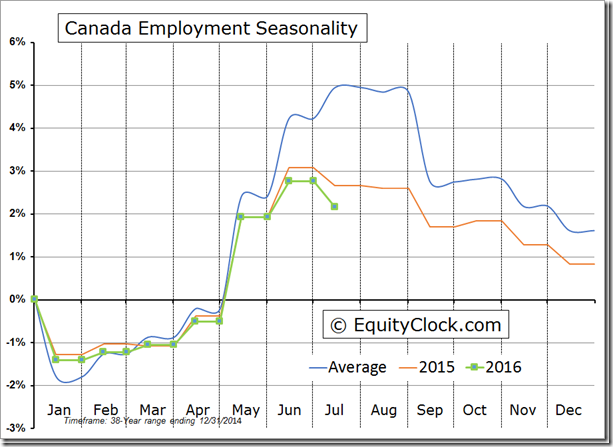

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer slipped 1.00 to 72.40 yesterday. It remains intermediate overbought and trending down.

TSX Composite Momentum Barometer

The Barometer added 5.87 to 76.39 yesterday. It became more intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca