by Don Vialoux, Timingthemarket.ca

Mr. Vialoux on BNN’s Market Call Tonight

Be sure to tune in this evening at 6:00 PM EDT

Observations

Trading action by North American equity markets was quiet yesterday. Traders were waiting for the July Employment Reports to be released at 8:30 AM EDT. Consensus for U.S. Non-farm Payrolls is 185,000. However, reports for May and June have been extremely volatile. Consensus estimates really are “a shot in the dark”. July Hourly Earnings will be watched closely. Consensus is a gain of 0.2% versus a gain of 0.1% in June. A report in excess of a gain of 0.2% will raise inflation concerns and higher expectations for an increase in the Fed Fund rate in September. In Canada the July employment report is expected to record a 10,000 gain, a trend that is starting to turn positive once again.

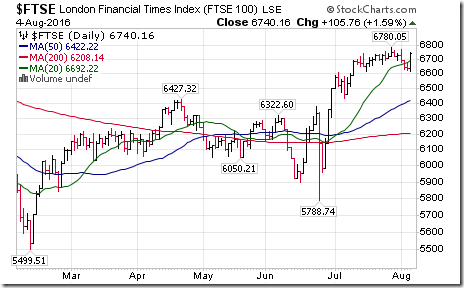

Reponses to the Bank of England’s move to lower its overnight lending rate to 0.25% and to add 60 billion pounds to its quantitative easing program was surprisingly muted. The British Pound dropped to the bottom of a recent trading range. The London FT Index recovered to the top of a recent trading range.

StockTwits Released Yesterday

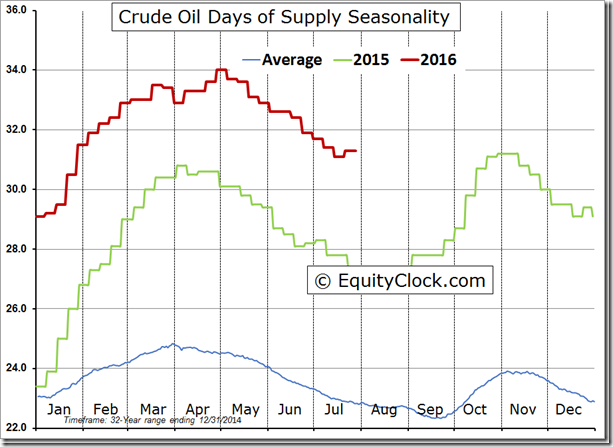

Declining production and high demand still can’t seem to make a significant dent on oil inventories.

Technical action by S&P 500 stocks to Noon: Mixed. Breakouts: $HAR, $XEC, $NFX, $ENDP, $PH, $BLL. Breakdowns: $FOXA, $HSIC, $CF, $FSLR

Editor’s Note: After noon, IR broke resistance and FOX broke support.

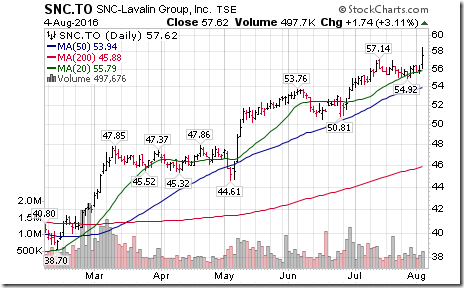

Nice breakout by SNC.CA above $57.14 to move to an all-time high.

Trader’s Corner

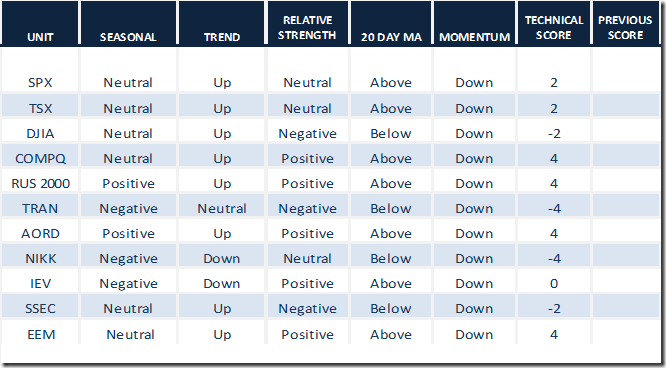

Daily Seasonal/Technical Equity Trends for August 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

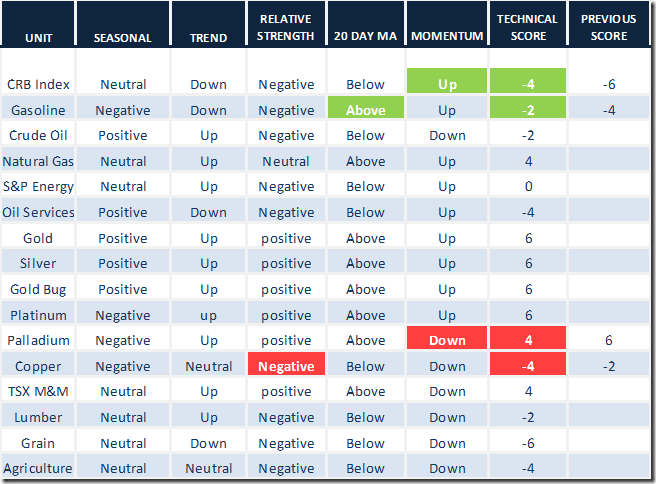

Daily Seasonal/Technical Commodities Trends for August 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

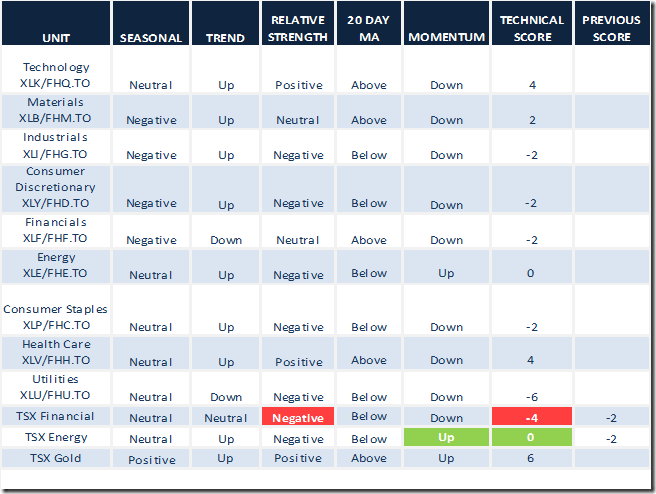

Daily Seasonal/Technical Sector Trends for August 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Index Momentum Barometer

The S&P Momentum Barometer slipped 1.40 to 67.20 yesterday. It remains intermediate overbought and trending down.

TSX Composite Index Momentum Barometer

The TSX Momentum Barometer added 3.43 to 66.95 yesterday. It remains intermediate overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca