3 Rebalancing Strategies for Reducing Risk

by Commonwealth Financial Network

During times of uncertainty, many of you likely face a barrage of e-mails and phone calls from concerned clients demanding action. Answering their questions is no easy task, and your natural reaction might be to readjust portfolio allocations in periods of turmoil. Indeed, many investors do make knee-jerk reactions to bad news—although evidence suggests that a long-term, strategic approach to investing generates the most attractive returns for investors over time.

During times of uncertainty, many of you likely face a barrage of e-mails and phone calls from concerned clients demanding action. Answering their questions is no easy task, and your natural reaction might be to readjust portfolio allocations in periods of turmoil. Indeed, many investors do make knee-jerk reactions to bad news—although evidence suggests that a long-term, strategic approach to investing generates the most attractive returns for investors over time.

If that's the case, how can you help your clients position their portfolios to better withstand market volatility? Here, I’ve outlined three rebalancing strategies for reducing risk that can be deployed—over time—to help build more robust portfolios.

Rebalancing is often thought of as a return enhancer. In fact, it should probably be thought of as a risk reducer, particularly for those investors who employ a buy-and-hold approach.

Without a rebalancing strategy, a balanced equity (e.g., 60/40 stock/bond) portfolio would experience an increase in risk for every month, quarter, or year of equity market appreciation. This is because the equity portion would continue to grow and compound in size relative to the fixed income allocation—potentially ending up somewhere close to a 70/30 or 80/20 portfolio after a period of strong equity market appreciation. As a result, a balanced equity profile would actually take on the risk profile of a more aggressive allocation, possibly leading to a compliance red flag. This is considered a simple buy-and-hold strategy, for obvious reasons.

This is a dynamic or “do-something” strategy. This tactic lends itself well to volatile periods, such as the one witnessed post-financial crisis, because the investor rebalances to an increased equity weight in periods of weakness and sells after periods of strength (buy low, sell high). This is the simplest form of rebalancing—and the one employed by many individuals across the industry. It also ensures that the risk profile for a portfolio is generally constant through time, as the mix between equities and fixed income doesn’t drift too far from the strategic weights. Here, you can see the value from a risk reduction standpoint.

As most market environments are characterized by oscillations, practitioners usually opt for a constant-mix strategy. Also, when entering risk into the equation, it’s viewed as the most prudent of the rebalancing options.

One of the most underutilized—though effective—rebalancing strategies is known as constant proportion portfolio insurance (CPPI). A bit more complicated than the other options discussed here, this method includes a floor value, a multiplier, and the use of two asset classes: risky asset (equities) and lower-risk asset (cash or Treasury bonds). To illustrate how it works, let’s look at an example.

The investor decides to allocate $100 to a portfolio and denotes $75 as the floor. The allocation to the risk asset at inception is determined by the multiplier times the difference in the portfolio value and the floor. Here, let’s assume a multiplier of 2:

- The allocation to equities would be 2 × (portfolio value – floor) or $50 at inception.

- If markets decline over the next year and the portfolio level reaches $95, the investor would rebalance the equity portion to $40 (2 × [$95 – $75]).

If fear grips the market and the portfolio drops to the floor, the investor would allocate all proceeds to the lower-risk asset, such as Treasury bonds. As a result, the stock allocation will be dynamic and will increase (decrease) along with the appreciation (depreciation) in stocks at a faster pace than would a simple buy-and-hold strategy. The main difference between the two strategies is the multiplier and the incorporation of a floor value, also called the insurance value.

As you may realize, this strategy can be most effective in strong bull markets, like that of the late ’90s, where each successive increase in equities results in the purchase of more shares. In severe bear markets, the strategy can provide downside protection because the floor value insulates and provides insurance against large declines in value. Oscillating markets and those characterized by severe short-term reversals, however, can wreak havoc on a CPPI design. As a result, its return payoff is the opposite of that of a constant-mix strategy.

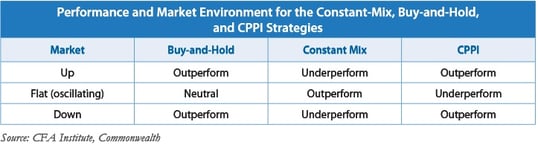

Which strategy should you choose? To help illustrate when you might implement each of these options, the chart below outlines the types of environments that may be suitable for each strategy.

It may seem somewhat counterintuitive, but doing nothing when the going gets tough and adhering to a well-thought-out rebalancing strategy has proven to be the best course of action over time, on average, for many investors. Behaviorally, it can be a tough concept for clients to grasp; in just about every other aspect of our lives, we are taught that reaction in the face of perceived danger is necessary. Sitting tight is not something that goes over well, especially when the perceived danger involves future cash flows and retirement.

When it comes to planning for retirement, however, investors who are in the game of chasing returns and constantly rotating through positions will find that their portfolios underperform compared with the portfolios of investors who have simply stayed the course.

What other strategies do you use to reduce risk in your clients’ portfolios? How do you handle the call from worried clients during times of volatility? Please share your thoughts with us below.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Investors should contact their financial professional for more information specific to their situation.

All examples are hypothetical and are for illustrative purposes only. No specific investments were used. Actual results will vary.

Asset allocation programs do not assure a profit or protect against loss in declining markets. No program can guarantee that any objective or goal will be achieved. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network