by Don Vialoux, Timingthemarket.ca

Observations

The world waits for FOMC meeting news and media conference with Janet Yellen to be released at 2:00 PM EDT today. Weakness yesterday in the Financial sector implied no change in the Fed Fund rate, Fed concerns above Brixit and a Fed leaning toward a 0.25% increase in the Fed Fund rate on July 27th

StockTwits Released Yesterday @EquityClock

No easy task for FOMC. VIX spikes, employment growth slows and inflation expectations hit multi-year hurdle.

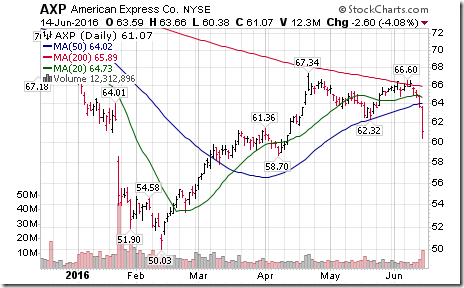

Technicals for S&P 500 stocks o 11:00: Bearish. Breakdowns: $DLPH, $DISCK, $CCE, $MPC, $TSO, $AXP, $BLK, $C, $COF, $SYF, $WFC, $WY, $IR, $MAS, $ALK, $MA, $FCX, $FTR

Editor’s Note: After 11:00 AM EDT, another 11 S&P 500 stocks broke intermediate support: RCL BIIB, REGN, SNA, HBAN, JBHT, R, ADSK, FTI, KEY, PNC. No stocks broke resistance.

Financials dominate list of S&P 500 stocks breaking support: $AXP, $BLK, $C, $COF, $SYF, $WFC, $MA.

Editor’s Note: After 11:00 AM EDT, HBAN, KEY and PNC broke support.

Another Dow Jones Industrial stock breaks support establishing intermediate downtrend: $AXP. Joining $DIS, $HD, $GS

Cdn. lumber stocks break support prior to lumber export negotiations with U.S. $CFP.TO, $WFT.CA

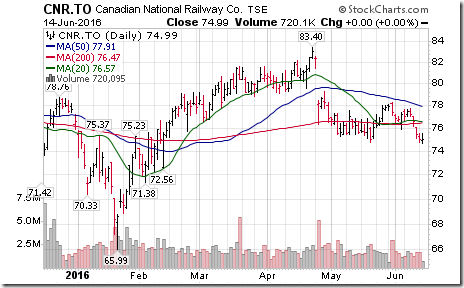

Cdn. National Railway $CNR.CA broke support at $74.73 extending intermediate downtrend

S&P Financials Index broke support at $306.50 to complete a double top pattern $SPF $XLF

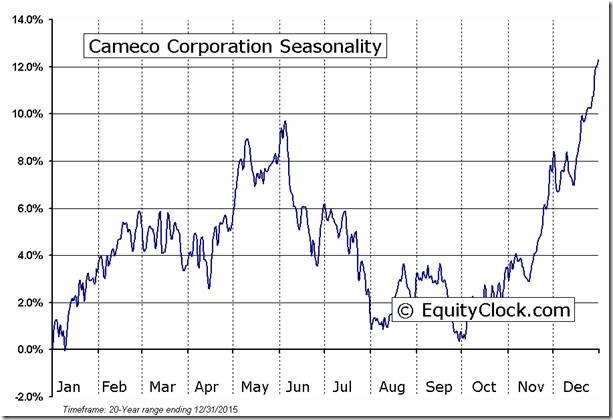

Cameco $CCO.CA $CCJ broke support at $14.47 to reach 7 year low extending downtrend.

‘Tis the season for weakness in Cameco to early October! $CCO.CA $CCJ

Interesting Chart

Producing power through solar energy is proving to be uneconomic (much to the chagrin of the environmentalist who are pushing governments to expand the sector). The Solar ETF dropped below support to reach a 3 year low:

Trader’s Corner

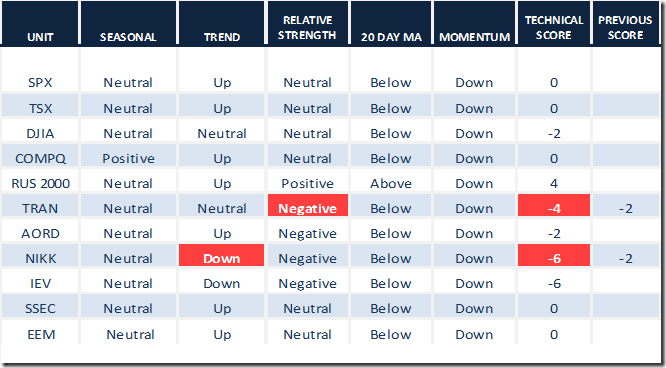

Daily Seasonal/Technical Equity Trends for June 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

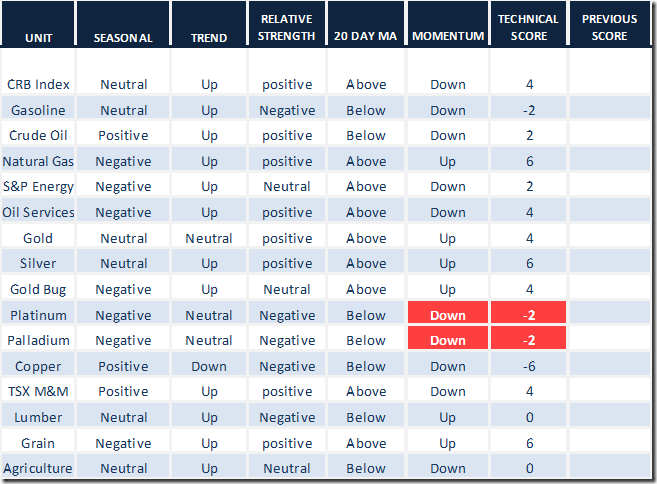

Daily Seasonal/Technical Commodities Trends for June 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

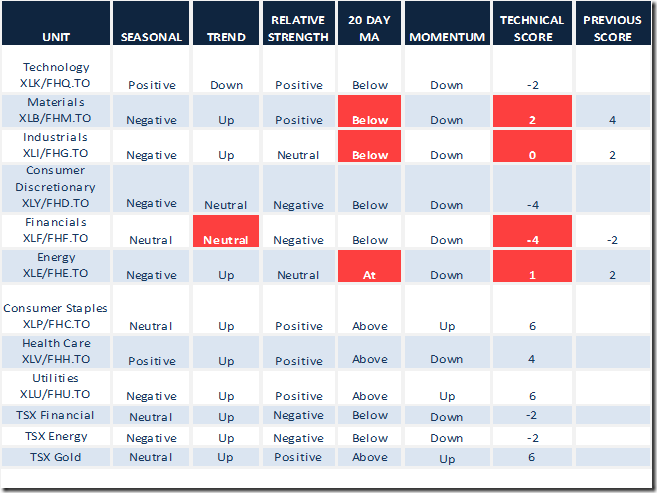

Daily Seasonal/Technical Sector Trends for March June 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

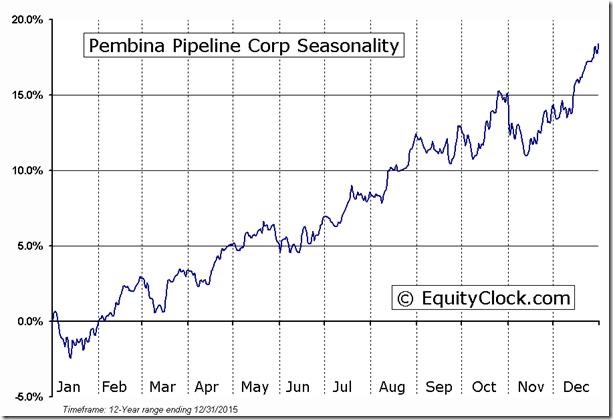

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer dropped another 3.00 to 52.60 yesterday. The Barometer remains intermediate overbought with a short term downtrend.

TSX Composite Momentum Barometer

The Barometer dropped another 4.76 to 63.20 yesterday. The Barometer remains intermediate overbought with a short term downtrend.

CSTA Annual Meeting

Please join us at the Toronto Special Event June 22: Hall of Fame Luncheon Presentation with Don Vialoux and Annual Awards Ceremony. Register here to ensure your seat is held.

The CSTA is proud to announce this year’s class of inductees into the Canadian Technical Analysts Hall of Fame.

· Larry Berman

· Ron Miesels

· Martin Pring

· Don Vialoux

We will be honouring this year’s class of inductees with a keynote speech from Don Vialoux at our annual luncheon being held in Toronto at the Sheraton Centre starting at 11:30 am.

Also, at the luncheon we will be announcing the winners of this year’s inaugural CSTA awards.

We look forward to seeing you at this exciting event, a great opportunity to meet other technicians and to celebrate technical analysis before the summer.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca