Weighing the Positives and the Negatives

by Carl Tannenbaum, Asha Bangalore, Northern Trust

The U.S. economic expansion is approaching its seventh birthday. By historical standards, this is a major milestone, as it one of the four longest post-war expansions. There is a long list of positives supporting expectations of continued growth. At the same time, a few areas of concern are being monitored closely.

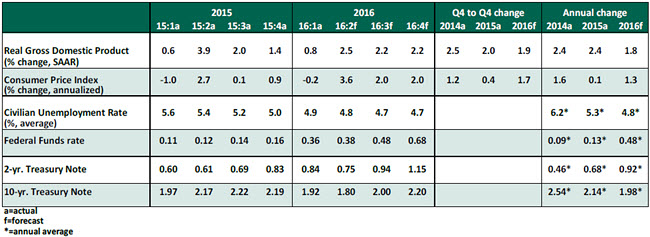

Based on the data available, the second quarter appears to have started on strong footing after a soft performance in the first three months of the year. Real gross domestic product (GDP) is predicted to advance a little over 2.0% during the rest of the year.

Key Economic Indicators

Key Elements of the Forecast

- Consumer spending is projected to pick up in the second quarter, following a modest increase in the first three months of the year. Goods purchases (+1.2%) were strong during April, while service outlays also posted their best reading since December. The gain in auto sales is part of the reason for the projected strength in consumer spending.

- Business investment was weak during the six months ending in March, reflecting widespread setbacks in the energy and non-energy sectors. The April durable goods report contained encouraging news, which validated expectations that the decline in investment spending was nearing an end. Shipments of non-defense capital goods excluding aircraft, a proxy for business investment in GDP, advanced in April. Expenditures on structures (the other component of non-residential investment spending) bears close watching, as it has dropped in four of the last five quarters.

- The housing sector remains a bright spot. Sales of new homes (619,000) during April hit the mark last seen in early 2008. Purchases of existing homes posted a mild gain, and housing starts increased 6.6% in the same period. The 30-year mortgage rate, at 3.60%, is down 30 basis points since January and bodes positively for housing market activity.

- Inflation rose 1.1% from a year ago in April, which is nearly 25 basis points higher than in the prior month. Higher energy prices were responsible for the increase in the overall price index. Oil prices continue to move up and have crossed the psychological threshold of $50 per barrel. If this trend is sustained, central bankers may face less pressure in achieving their inflation targets soon. There was no material change in core inflation (which excludes food and energy) readings in the past month.

- The May employment data were disappointing. The drop in the unemployment rate to 4.7% came about as more people left the labor force and not because more people found employment. Therefore, the jobless rate must be interpreted carefully. Payroll employment increased only 38,000 during May, a major blow to the economy’s outlook. The 3-month moving average (116,000) is down from 240,000 at the start of the year. Hourly earnings advanced at a decent 2.5% clip. One month’s report does not change the economy’s fundamentals, but we’ll need a strong recovery in June employment numbers to write off the May tally as an aberration.

- The 10-year Treasury note yield recorded a 10-basis-point drop in one trading day after the May employment report was published. It has held below 2.0% since late January.

- The advance April report on trade showed an increase in exports and imports. However, continued strength in exports is uncertain, given the dollar’s relative strength. The trade gap is projected to widen in the near term.

- Pulling together the economy’s fundamentals, the positives still outweigh the negatives and present a case for normalizing interest rates near term. The timing of the next Federal Reserve policy change is tied to the nature of incoming economic reports. The data-dependent central bank may not have adequate evidence to justify a rate hike this summer; the September Federal Open Market Committee (FOMC) meeting is the most likely venue to put in place a higher policy rate.

We’ll have a comprehensive preview of the next FOMC meeting and an update of our call on interest rates in our weekly commentary this Friday.

Copyright © Northern Trust