by Don Vialoux, Timingthemarket.ca

Editor’s Note: Next Tech Talk report is released on Tuesday May 24th. Monday is a holiday in Canada

Pre-opening Comments for Friday May 20th

U.S. equity index futures were higher this morning. S&P 500 futures were up 4 points in pre-opening trade.

The Canadian Dollar dipped 0.05 to US 76.32 cents following release of Canadian economic news at 8:30 AM EDT. Consensus for Canadian April Consumer Prices was an increase of 0.3% versus a gain of 0.6% in March. Actual was 0.3%. On a year-over-year basis, April CPI rose 1.7%, in line with consensus. Core April CPI on a year-over-year basis rose 2.2%, higher than consensus at 2.0%. Consensus for Canadian March Retail Sales was a decline of 0.6%. Actual was a drop of 1.0%. Excluding auto sales Canadian March Retail Sales dropped 0.3%.

S&P 500 companies that reported quarterly results since yesterday’s close included Applied Materials, Foot Locker, Deere and Campbell Soup.

Pacific Crest raised its target of Applied Materials to $26 from $23 after the company announced higher than consensus quarterly results. Applied Materials gained $1.35 to $21.26.

Stifel Nicolaus downgraded Gap Stores (GPS $17.35) to Hold from Buy.

RBC Capital raised its target price on Wal-Mart (WMT $69.01) to $69 from $66.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/19/stock-market-outlook-for-may-20-2016/

Note seasonality chart on the Philadelphia Fed Manufacturing Index

Observations

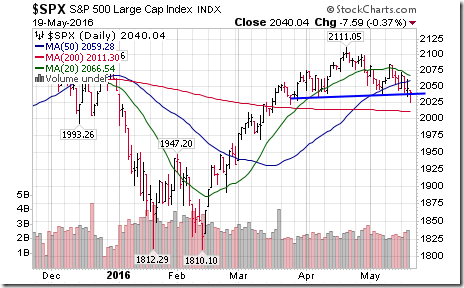

Early weakness by U.S. equity indices yesterday was related to technical selling triggered by a drop by the S&P 500 Index below the 2,039 level.

StockTwits Released Yesterday

Treasury ETFs trade lower from triple-top resistance, moving back within consolidation range.

Technical action by S&P 500 stocks to 1:00 PM: Bearish. 19 stocks broke support including $HON, $MMM, $VZ, $GILD, $ROK. Breakouts: $ETFC $STI

Early warning for equity markets by $VIX on a move above 17% to a 10 week high.

Trader’s Corner

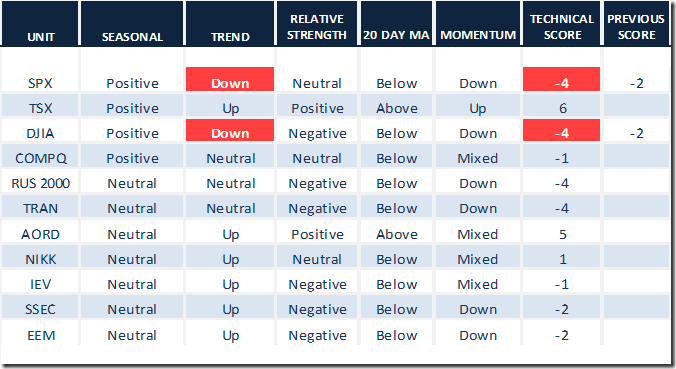

Daily Seasonal/Technical Equity Trends for May 19th 2016

Green: Increase from previous day

Red: Decrease from previous day

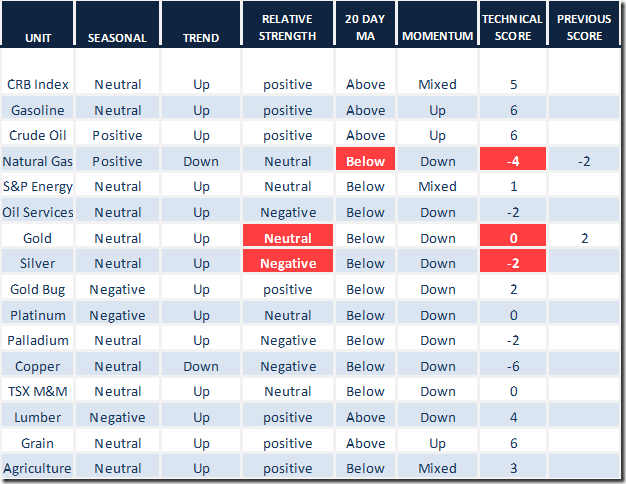

Daily Seasonal/Technical Commodities Trends for May 19th 2016

Green: Increase from previous day

Red: Decrease from previous day

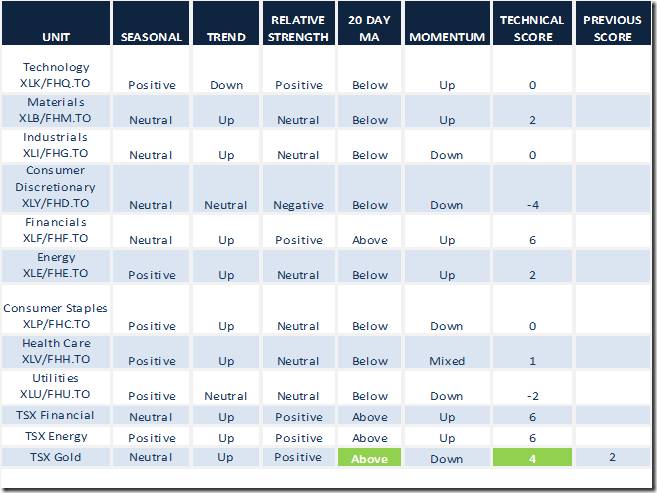

Daily Seasonal/Technical Sector Trends for March May 19th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

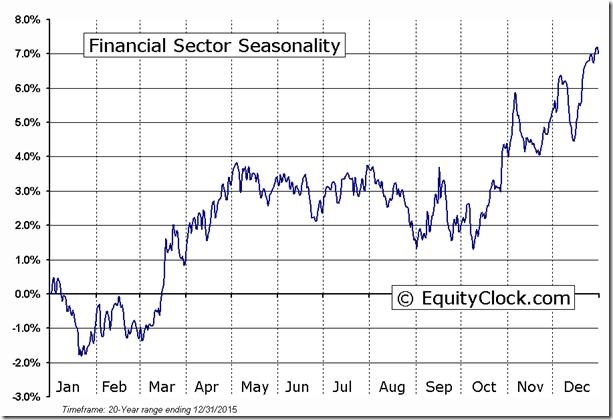

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

S&P 500 Momentum Barometer

The Barometer dropped another 4.80 to 42.80. The Barometer is now slightly oversold, but has yet to show signs of bottoming.

TSX Composite Momentum Barometer

The Barometer added 0.85 to 68.09. The Barometer remains intermediate overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca