Why investors should focus on maximizing consistency in returns

by Colin Moore, Global CIO, Columbia Threadneedle Investments

Global Chief Investment Officer Colin Moore discusses where he sees opportunities and risks for the remainder of the year, and why he thinks investors should focus on maximizing consistency of returns.

Q: What’s behind the volatility we’ve seen in global stock markets this year?

A: When there’s a lot of negative volatility in the marketplace, it’s usually because there’s a lot of fear. Expectations of growth were too high, and disappointing news caused investors to rethink those expectations. Then they become overly fearful that the world is going to melt down. As that fear is removed, markets bounce back. We believe that we will continue to see the modest economic growth rate we’ve been predicting for many years. In today’s low, slow growth environment, we’re going to have periods of over-expectation and over-fear. We’re going to have to learn to cope with that.

Q: Do you think the market’s reaction to a slowing Chinese economy was correct?

A: It was good that the market began to realize that the transition of the Chinese economy would take longer and probably be less even than some had forecast. China is making a big transition from an investment, project-led economy to a better balance between that and the consumer. Like a supertanker turning around, the transition will take time, and it’s unlikely that both components will move evenly. But the market reaction to China, at times, has been exaggerated, partly because we’ve become overly reliant on China as an engine for world economic growth. Japan and Europe are barely growing, and the U.S. looks to be on its current 2% growth trend for a long time.

Q: How would you describe the impact of the U.S. Federal Reserve on financial markets?

A: The Fed has been involved in extraordinary monetary policy for some time. I believe the first rounds of quantitative easing were necessary for reducing risk and stabilizing the financial system. However, I would argue that some of the subsequent elements of Fed policy were unnecessary and, in isolation, relatively ineffective in stimulating growth. The problem is that we did not see the appropriate response on the fiscal side of the economy, and, certainly, politicians failed to come forward with a comprehensive plan. That left the Fed trying more and more extraordinary measures with less and less impact. Last December’s rate hike shocked people, but I think it was the right thing to do, and I hope they raise rates at least one more time this year. Normalizing monetary policy will send the message that we no longer need extraordinary measures. Lower rates won’t make you spend money if you think there’s a crisis going on. But if you think the economy is relatively normal, then low rates may encourage you to spend on your business or yourself.

Q: We have seen more central banks pursue a negative interest rate policy this year. What do you think of this trend?

A: I believe the negative interest rate regime is dangerous, and I don’t think it creates the right behaviors. While a negative interest rate policy should encourage banks to lend more, it does nothing to increase demand for money. In fact, the messaging around negative interest rates is that the economy could be facing a crisis. So while the amount of money available may increase, I don’t think the demand for money will change, materially. I think, ultimately, it fails. In the interim, the policy is bad for savers and for financial institutions such as insurers.

Q: The world seems to be getting more dangerous by the day. What are the implications for markets around the world?

A: Geopolitical risk is ever-present, and it certainly looks like it is escalating. However, there is a major difference between how markets react and how human beings react to geopolitical tension. Our analysis of when such tensions affect markets is tied to three factors: Is there a superpower involved and potential armed conflict? Is oil involved? And is there a threat to the global financial system? Even though there may be horrific human costs to events that don’t match these criteria, markets tend not to overreact to them. As investors, we need to differentiate between geopolitical risks that create short-term volatility versus those that change the direction of markets if it’s determined that one or more of those three factors is involved.

Q: What is your outlook for financial markets for the remainder of the year?

A: I wouldn’t say there can’t be positive returns in equities. But I don’t think the return relative to the volatility is going to be a particularly good trade-off. Investors need to understand that just getting a positive return isn’t enough if they have to take on too much uncertainty to get there. When there is volatility in the markets, investors often don’t behave well. They sell at the wrong point and buy at the wrong point, which is driven by their emotional response. Similarly, a lot of areas in fixed income don’t look particularly cheap to me. You will probably get the coupon in a number of areas, which is not particularly exciting, but at least the volatility will probably be less.

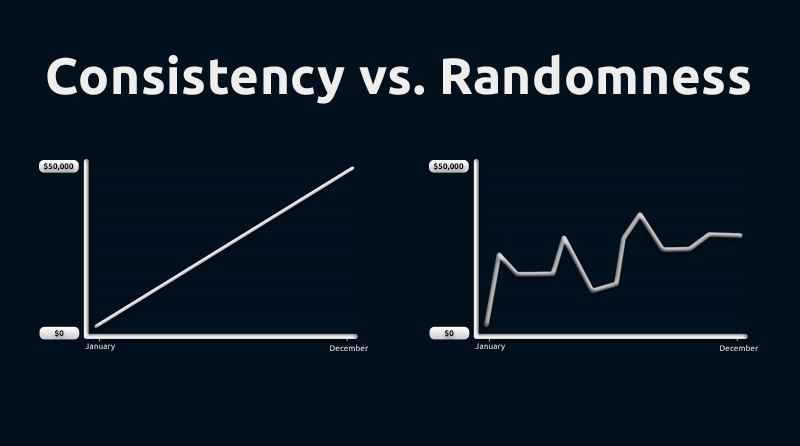

In this challenging environment, I think the question investors should be asking is “How do I maximize the consistency of my return?” rather than “How do I maximize my return?”

Q: What are some strategies investors can use to maximize consistency of their returns?

A: Diversification is the standard strategy, but the mistake many investors make is assuming that if they own a lot of things, they’re well-diversified. What we’ve learned, particularly through the last crisis, is that a lot of things are diversified when you don’t need them to be, and when you do need them to be diversified, in a crisis for instance, they’re not. They act together.

With more study and analysis of how to get proper diversification, investors can pursue opportunities beyond conventional asset classes. These may include alternative investments and accessing the futures market to hedge exposure to conventional asset classes. With help from their financial advisor, investors can implement strategies designed to generate reasonable returns while reducing overall portfolio volatility. I strongly recommend that we focus on ensuring that our clients are properly diversified.

Copyright © Columbia Threadneedle Investments