by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday March 24th

Editor’s Note: Next Tech Talk report is released on Monday March 28th

U.S. equity index futures were lower this morning. S&P 500 futures were down 11 points in pre-opening trade. A stronger U.S. Dollar is weighing on commodity sensitive stocks

Index futures were virtually unchanged following release of economic news at 8:30 AM EDT. Consensus for Weekly Jobless Claims was 268,000, up from 259,000 last week. Actual was 265,000. Consensus for February Durable Goods Orders was a drop of 2.9% versus a gain of 4.9% in January. Actual was a decline of 2.6%. Excluding Transportation, consensus for February Durable Goods Orders was a decline of 0.2% versus a gain of 1.8% in January. Actual was a drop of 1.0%.

Micron slipped $0.05 to $10.60 after Wedbush lowered its target price to $10.50 from $11.50

Buffalo Wild Wings gained $2.51 to $145.00 after Goldman Sachs added the stock to its Conviction Buy list.

Wells Fargo dipped $0.32 to $49.44 after UBS initiated coverage with a Sell recommendation.

KB Homes added $0.65 to $13.75 after reporting higher than consensus quarterly earnings and after issuing positive guidance.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/23/stock-market-outlook-for-march-24-2016/

Note seasonality charts on Crude Oil Supply and New Home Sales

StockTwits Released Yesterday

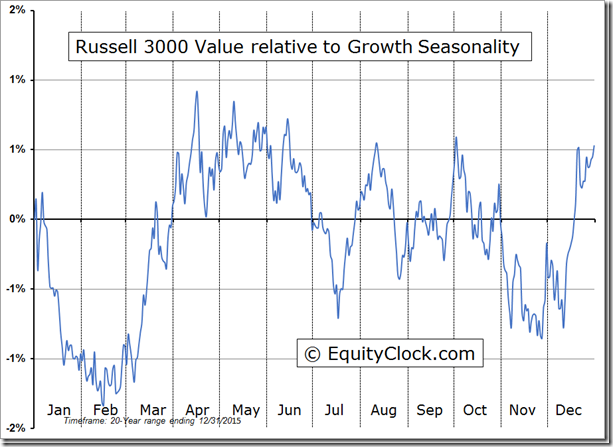

Value outperforming Growth in a trend that seasonally continues to mid-April.

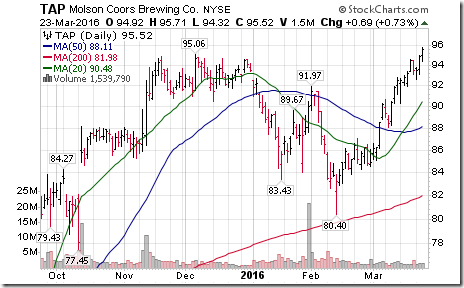

Technical action by S&P 500 stocks to 10:15 AM: Quiet. Molson Coors $TAP broke to an all-time high. No breakdowns.

Editor’s Note: After 10:15 AM, four more S&P 500 stocks broke intermediate resistance: PDCO, LLL, SRCL and POM. None broke support

Trader’s Corner

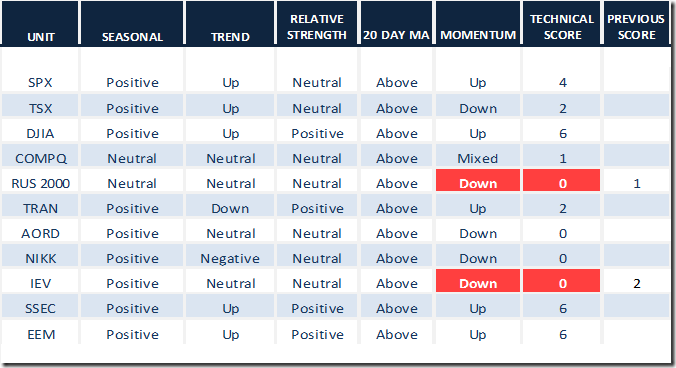

Daily Seasonal/Technical Equity Trends for March 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

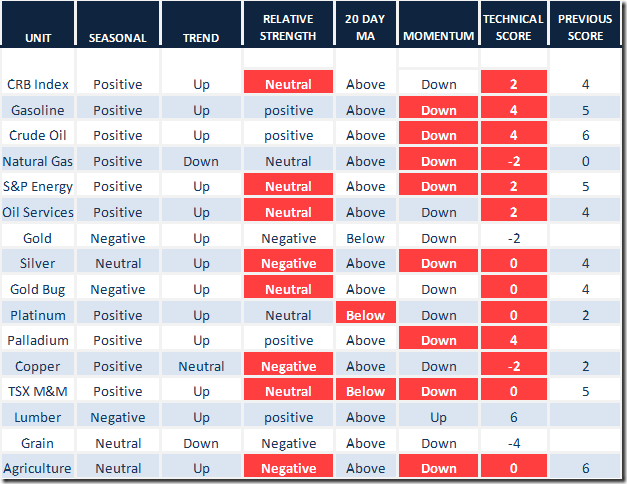

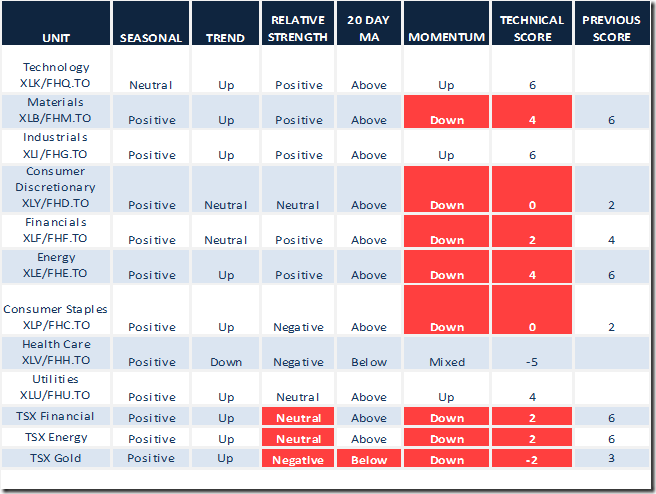

Note the significant reduction in technical score for commodities due to drops in score for Relative Strength and Momentum.

Daily Seasonal/Technical Commodities Trends for March 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Technical scores for sectors also dropped significantly due to drops in score for Relative Strength and Momentum

Daily Seasonal/Technical Sector Trends for March 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Chart

Weakness in commodities and economic sensitive sectors was triggered by strength in the U.S. Dollar Index following comments by an FOMC member implying a sooner and more frequent increase in the Fed Fund Rate in 2016. Momentum indicators for the Index have bottomed/ started to move higher.

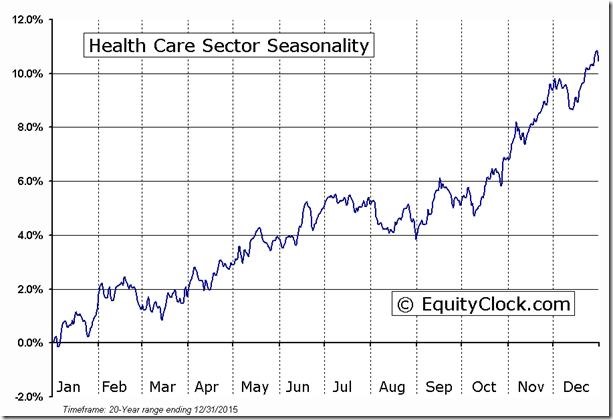

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Accountability Report

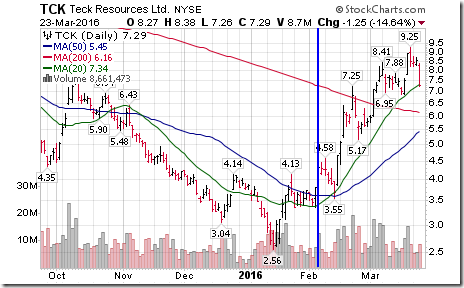

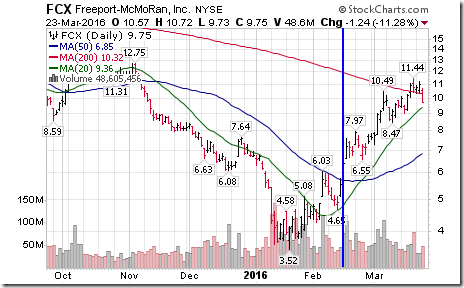

The significant drop in Technical Scores by Commodity and Sector investments has prompted us to support taking trading profits/liquidate at a small loss on related investments previously mentioned favourably in Tech Talk/StockTwits due to their positive seasonal/technical parameters:

S&P TSX Metals & Mining Index ($SPTMN 435.56) originally support in Tech Talk on February 5th at 307.92

Teck Corp (TCK US$7.29) originally supported in a StockTwit on February 5th at US$4.36

BMO Base Metals ETF (ZMT.TO ) originally supported at $4.81 on February 12th on BNN

Freeport McMoran (FCX $9.75) originally supported at $6.18 in a StockTwit on February 17th

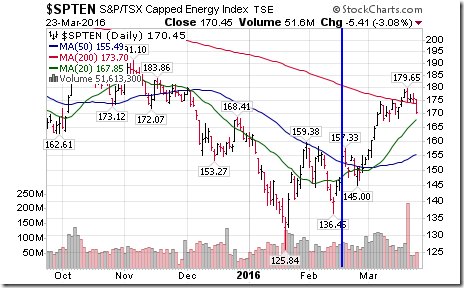

S&P/TSX Energy Index (SPTEN 170.45) originally supported at 154.62 in Tech Talk on February 18th

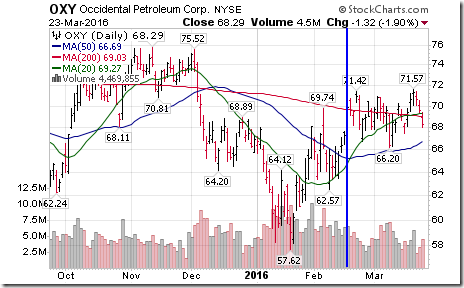

Occidental Petroleum (OXY $68.29) originally supported on February 18th in Tech Talk at $70.63

EOG Resources (EOG $74.34) originally supported on February 19th at $69.71 in a StockTwit.

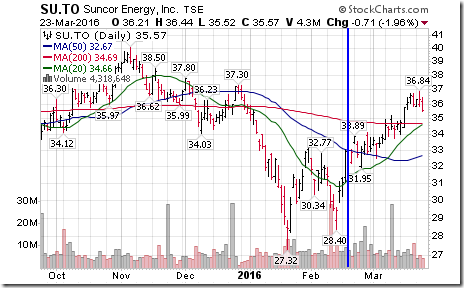

Suncor (SU.TO $35.57) originally supported on February 19th in a StockTwit at $33.00

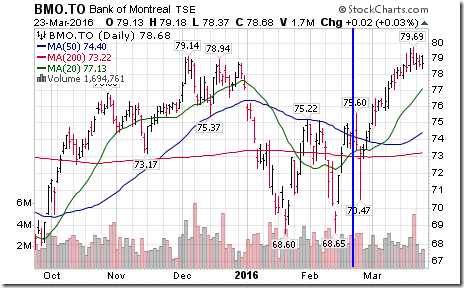

Bank of Montreal (BMO.TO $) originally supported on February 23rd in a StockTwit at $75.17

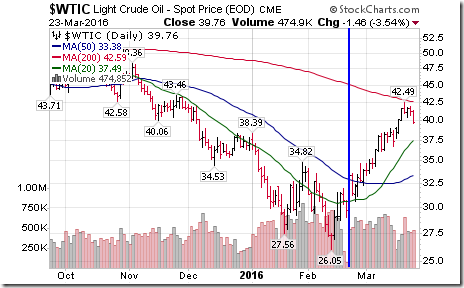

Crude Oil (WTIC US$39.76 ) originally supported at $33.39 in Tech Talk on February 23rd

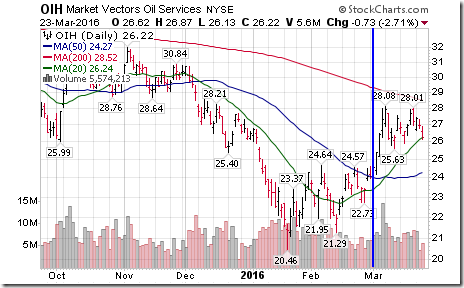

Philadelphia Oil Services Index ($OSX) originally supported at 146.86 in Tech Talk on February 23rd

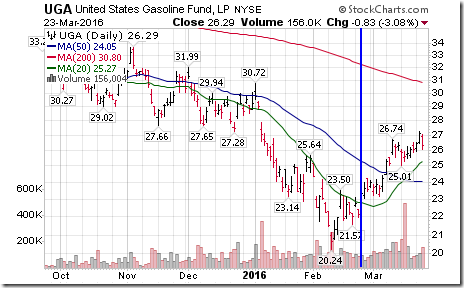

Gasoline ETF (UGA $26.29) originally supported in Tech Talk on February 25th at $23.67

Husky Energy (HSE.TO $15.43) originally supported in a StockTwit on February 29th at $14.15

Market Vectors Oil Services ETF (OIH $) originally supported in a StockTwit on March 2nd at $24.58

Bank of Nova Scotia (BNS.TO $63.27) originally supported in a StockTwit on March 2nd at $57.55

Toronto Dominion Bank (TD.TO $55.54) originally supported in a StockTwit on March 2nd at $53.14

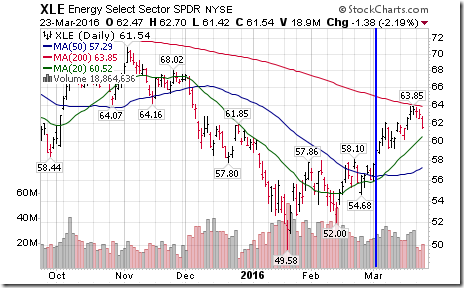

Energy SPDRs (XLE $61.54) originally recommended on March 3rd in a StockTwit at $58.55

Canadian Energy iShares (XEG.TO $10.82) originally supported in a StockTwit on March 3rd at $10.10

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca