by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @EquityClock

S&P 500 Equally Weighted Index outperforming the market suggesting improving breadth

Technical action by S&P 500 stocks to 10:15 AM: Quiet. No S&P 500 stocks broke intermediate support or resistance.

Editor’s Note: After 10:15 AM, 4 S&P 500 stocks broke intermediate resistance: $FFIV, $EOG, $WDC and $NWSA. None broke support.

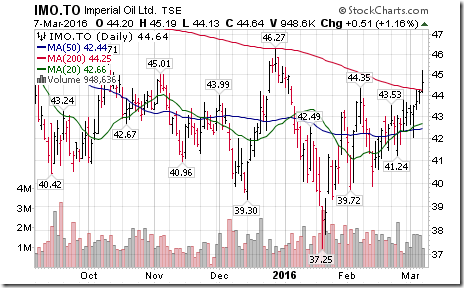

Nice breakout by Imperial Oil $IMO.CA above resistance at $44.35 to complete a base building pattern!

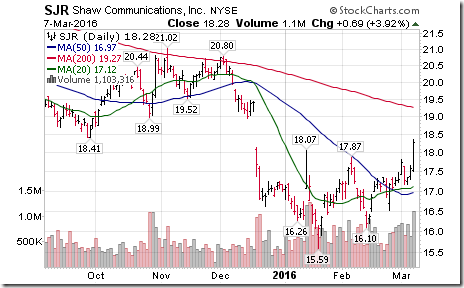

Nice breakout by Shaw Communications $SJR above resistance at US $18.07 to complete a base building pattern!

Momentum stocks lagging this market as breadth improves. $MTUB $FB $AMZN $GOOG $GOOGL

Trader’s Corner

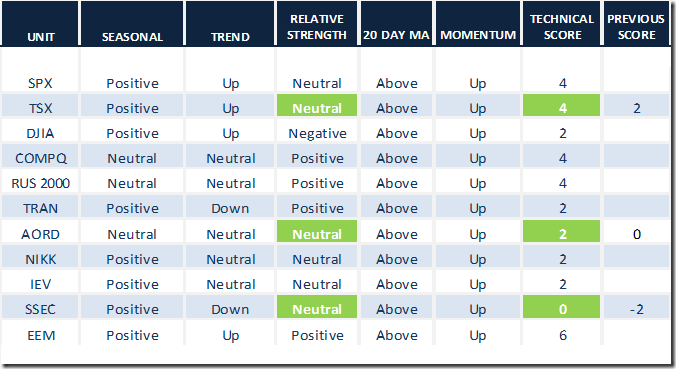

Daily Seasonal/Technical Equity Trends for March 7th 2016

Green: Increase from previous day

Red: Decrease from previous day

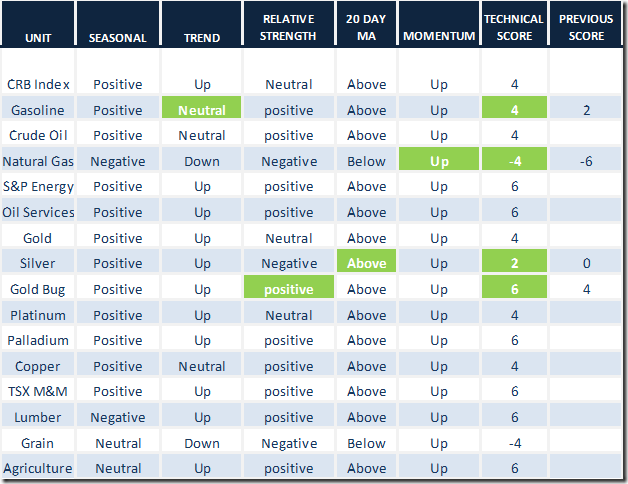

Daily Seasonal/Technical Commodities Trends for March 7th 2016

Green: Increase from previous day

Red: Decrease from previous day

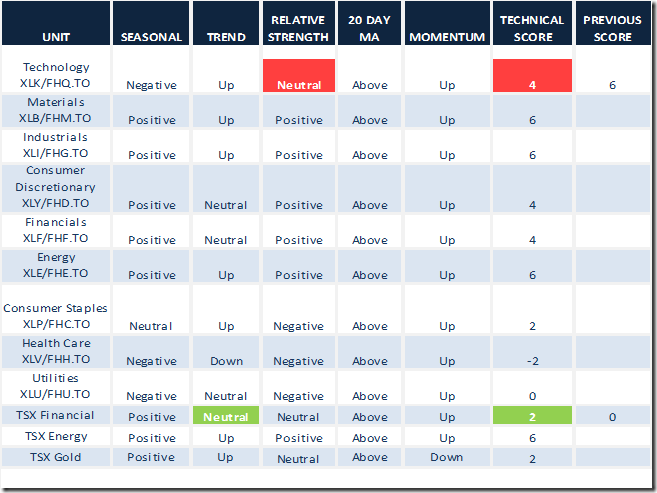

Daily Seasonal/Technical Sector Trends for March 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

Rising commodity prices and related ETFs (e.g. DBC, GSG) are leading equity markets on the upside

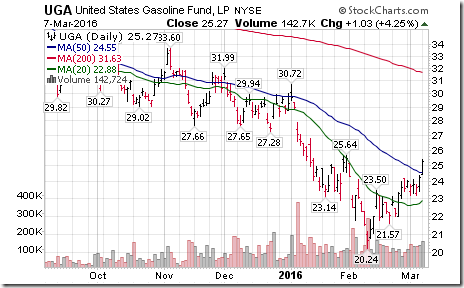

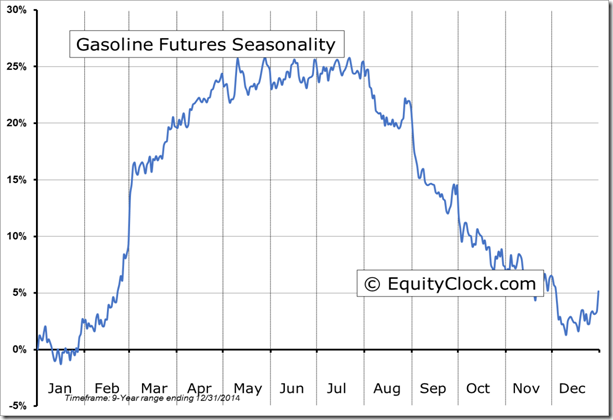

Gasoline and crude oil prices led the commodity sector yesterday. ‘Tis the season for strength!

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca